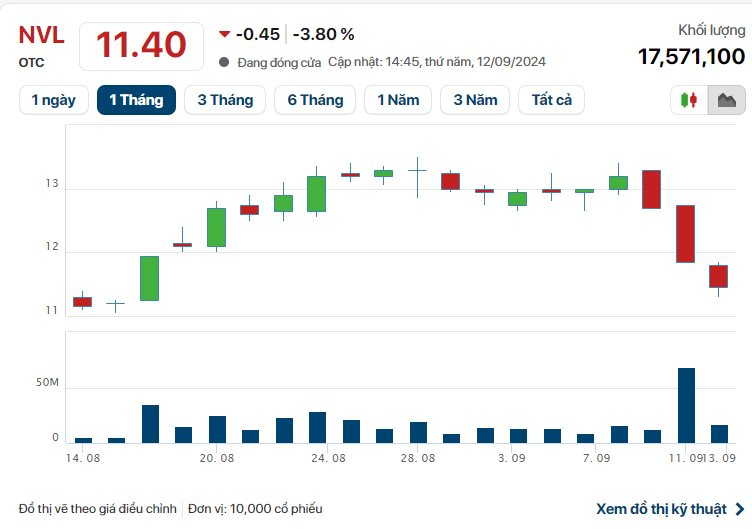

Closing the 12/9 session, NVL stock was at 11,400 VND per share, down 3.8% from the previous session, with a trading volume of over 17.5 million shares – a 3.9-fold decrease compared to the previous trading session.

Notably, this was the third consecutive losing session for this real estate stock, immediately following the news that the Ho Chi Minh City Stock Exchange (HoSE) had added Novaland’s NVL stock and SC5 of Construction Joint Stock Company No. 5 to the list of securities ineligible for margin trading.

The reason for this is that these two companies delayed the publication of their semi-annual 2024 financial statements that had been audited for more than 5 working days from the deadline for disclosing information.

Novaland shares plunge for the third consecutive session after margin cut. (Source: Cafef)

In terms of business performance, in the first half of 2024, Novaland recorded net revenue of over VND 2,246 billion, up 35.5% over the same period. As a result, this real estate giant reported a net profit of over VND 344 billion, a significant improvement compared to the loss of VND 1,094 billion in the same period last year.

Notably, as of June 30, 2024, the company’s inventory was over VND 142,025 billion (equivalent to over USD 5.6 billion), up 2.22% from the beginning of the year. At the same time, it accounted for nearly 60% of the total capital (VND 240,178 billion) of this real estate giant.

Novaland is one of the leading real estate companies in the market today, with a total capital of over VND 240,178 billion. It is currently developing several large-scale projects with an area of 1,000 hectares, such as Aqua City (Dong Nai), Novaworld Phan Thiet (Binh Thuan), and Novaworld Ho Tram (Ba Ria – Vung Tau).

Due to the continuous “plunge” in stock prices, Novaland’s market capitalization is now only over VND 22,231 billion, a significant difference from its book value.

VN-Index breaks losing streak

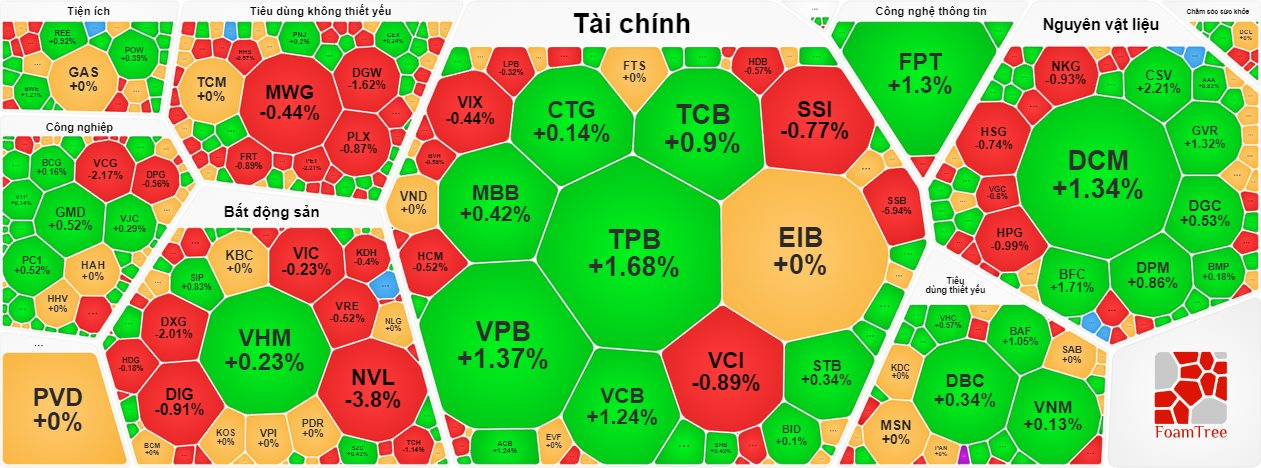

After three consecutive losing sessions, the stock market rebounded today, with the VN-Index gaining over 3 points.

Closing the session on 12/9, the VN-Index increased by 3.08 points to 1,256.35. The HNX-Index rose 0.45 points to 231.9, while the UPCoM-Index climbed 0.4 points to 92.73.

Banking stocks lead market recovery, VN-Index successfully breaks losing streak.

Blue-chip stocks were the main driver of the market’s recovery in today’s session. On the VN30 basket, green dominated the electronic board, pushing the VN30-Index up 3.73 points to 1,297.61.

Stocks in this group that increased by more than 1% included FPT, GVR, ACB, VPB, VIB, VCB, and TPB. Following were stocks that rose less than 1%, such as BID, CTG, MBBSJB, STB, TCB, VCB, and VNM, and VJC.

On the other hand, SSB stock of SeABank continued to plummet, falling 5.95% to VND 15,050 per share, leading the group putting pressure on the VN-Index. This was followed by VN30 basket stocks that fell less than 1%, including HPB, HDB, BVH, SSI, VIC, and VRE.

On the HoSE, DRH stock of DRH Holdings Joint Stock Company continued to attract attention as it extended its sharp decline after HoSE announced its suspension from trading from September 16th.

Closing the session on 12/9, DRH stock was at VND 1,780 per share, down 4.81% from the previous session, with a trading volume of over 3.5 million shares.

On the UPCoM, VNZ stock of VNG Joint Stock Company, a “technology unicorn,” continued to impress with its second consecutive ceiling session.

Closing the session on 12/9, VNZ stock was at VND 409,600 per share, up 14.99% from the previous session, with a trading volume of over 13,000 shares.

Today, market liquidity fell to a record low, with total trading value on the three exchanges reaching nearly VND 12,000 billion. HoSE alone accounted for nearly VND 10,500 billion of this value.

In addition to banking stocks, fertilizer stocks also attracted strong investment today, including DCM +1.34%, DGC +0.53%, DPM +0.86%, and BFC +1.71%…

Foreign investors turned to net sell on the HoSE, offloading MWG shares the most, with a value of nearly VND 50 billion. This was followed by VPB (VND 47.38 billion), VCI (VND 47.12 billion), and HPG (VND 35 billion)…

Aqua City Secures MB Loan of VND 1,100 Billion for Phase 2, NVL Whopper Deal

On September 10th, Novaland Group (Novaland), Military Commercial Joint Stock Bank (MB), Tesla Investment JSC (Tesla), and Green Mark Construction JSC (GMC) signed an agreement to commence the second phase of infrastructure development and continue construction on low-rise residential buildings in the Aqua City urban project.