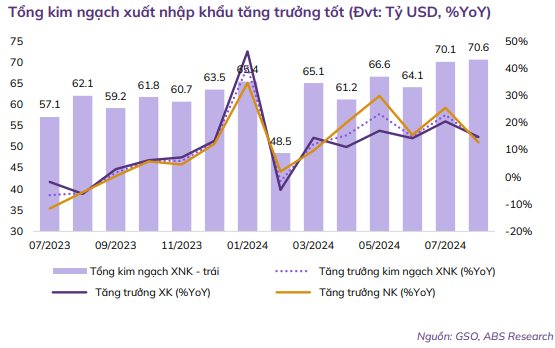

In their latest report, An Binh Securities (ABS) assessed that Vietnam’s macroeconomic situation in August continued its positive trend. With a PMI of 52.4 for the fourth consecutive month, the manufacturing sector displayed an impressive growth rate. Foreign trade and FDI investment remained robust while the VND/USD exchange rate eased, relieving pressure on the Vietnamese currency.

As we move into September, ABS highlights two crucial macroeconomic factors that will impact the market. Firstly, Super Typhoon Yagi’s landfall in Vietnam has resulted in significant losses of life and property. Individuals and businesses will require time and resources to recover and resume normal economic activities. Inflationary pressures may also rise due to supply disruptions for essential and non-essential goods, while demand in related sectors such as construction materials may be affected.

The second critical macroeconomic factor is the anticipated shift in the Fed’s monetary policy, with a potential interest rate cut of 0.25% expected at the FOMC meeting on September 18th. This provides the State Bank of Vietnam (SBV) with additional flexibility in conducting its monetary policy. The SBV has been implementing various solutions to boost credit growth and support the economy. As of September 7th, credit outstanding has increased by 7.15% compared to the beginning of the year. Increased credit enhances the liquidity of the economy and the stock market.

In terms of policy expectations, the 8th session of the 15th National Assembly, which commences on October 21st, 2024, will consider and pass 11 draft laws and provide opinions on 12 others, including important laws such as the Value-Added Tax Law, the Electricity Law, and the Enterprise Income Tax Law. Additionally, measures to upgrade the market, such as the issuance of circulars related to foreign institutional investors’ ability to purchase securities without immediate full payment, may be promulgated and implemented in the fourth quarter. ABS believes that this could attract more foreign capital into Vietnam.

The Market Requires Further Accumulation; the Scenario of VN-Index Falling to a New Low Should be Considered

Turning to the stock market, the benchmark index has attempted to break through the resistance level of 1,300 points but has not yet succeeded. Subsequently, it has tested and formed two bottoms at the price range of 1,165 and 1,185 points. ABS Research constructs two market scenarios for September.

In the positive scenario, the VN-Index continues to trade sideways with a narrowing range, fluctuating between 1,250 – 1,269 points and 1,284 +/- points. Subsequently, for the index to confirm an upward trend, it needs to surpass the range of 1,305 – 1,316 points, targeting the higher range of 1,340 – 1,395 points. Investors can then consider adding medium-term buy positions and further increase their exposure when the market confirms its upward trajectory.

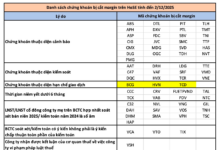

According to ABS, investors should prioritize stocks of leading companies with stable production and business operations, consistent cash flow from core activities, and focus on sectors such as banking, securities, real estate, industrial park real estate, public investment, galvanizing, fertilizers, retail, and textiles.

Preparing for the Super Typhoon: Emphasizing Rescue and Relief Operations

Tropical Storm No. 3 is considered the strongest storm in the South China Sea in the past decade. By the morning of September 5, 2024, the storm had intensified to a Category 15, with gusts exceeding Category 17. In the afternoon of September 5, the storm’s intensity is expected to increase further, reaching Category 16 and becoming the most powerful superstorm globally this year.

The Impact of a Weaker Currency: Exploring the Benefits for the Economy

Since the beginning of the third quarter, the pressure on exchange rates has eased. The appreciation of the VND against the USD has provided much-needed relief to various business sectors and is expected to alleviate the pressure on rising interest rates. This could potentially stimulate consumer demand and boost the economy.

Free-floating USD “loses heat,” continues to plummet.

Today (13/3), the USD exchange rate continues to plummet. Over the course of two sessions, the free USD exchange rate decreased by 180 dong for buying and 150 dong for selling, hovering around 25,320-25,550 dong/USD. Meanwhile, the USD exchange rate at banks tends to rise.