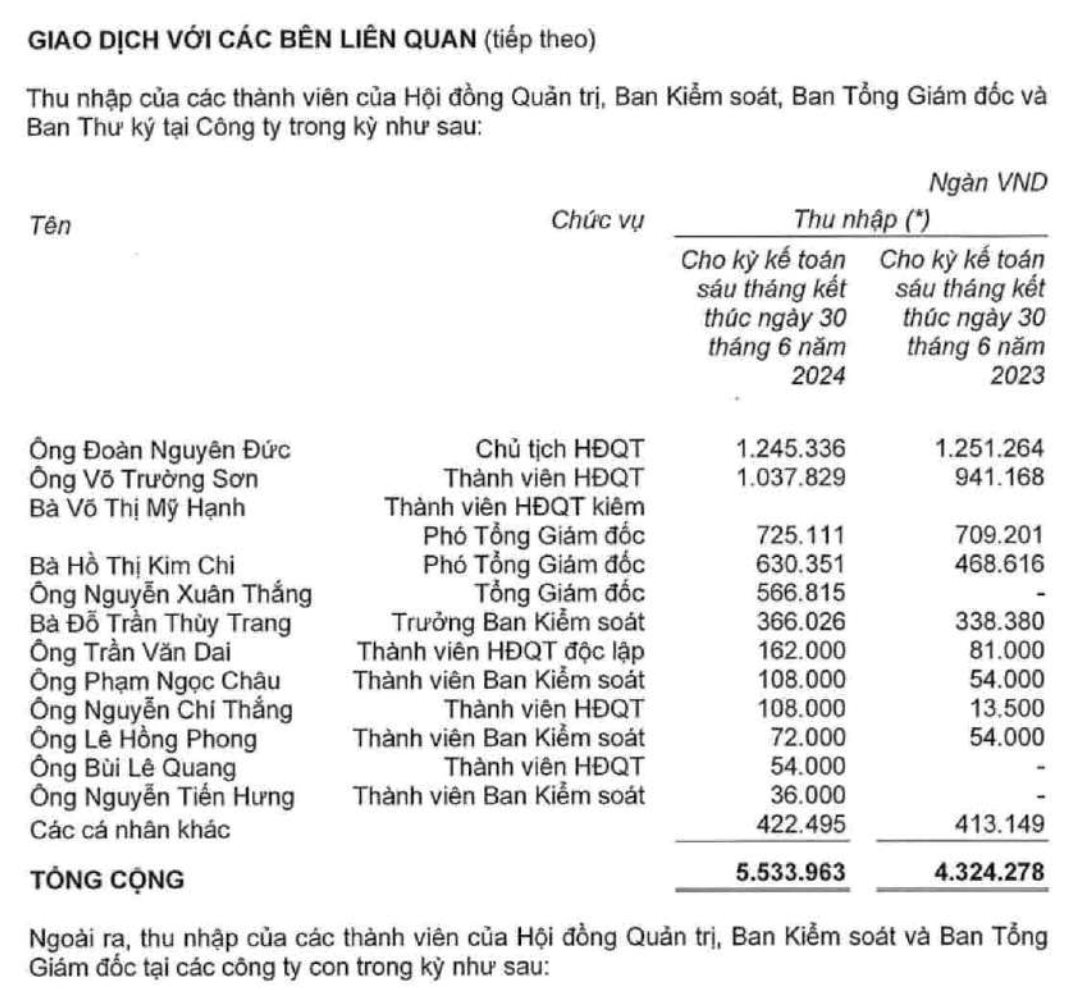

As per the audited consolidated financial statements for the first six months of 2024 of Hoang Anh Gia Lai Joint Stock Company (HAGL), the income of the Chairman of the Board of Directors, Mr. Doan Nguyen Duc (known as “Bầu Đức”), was reported to be over 1.2 billion VND for the period. This equates to a monthly income of 200 million VND for Bầu Đức. In fact, Bầu Đức’s income has consistently been around 200 million VND per month for the past several years.

The second-highest income earner in the company is Mr. Vo Truong Son, a member of the Board of Directors, with an income of over 1 billion VND. This equates to a monthly income of 166 million VND for Mr. Son.

Image: HAGL Financial Statements

The auditors continue to emphasize the “existence of a material uncertainty that may cast significant doubt about the Group’s ability to continue as a going concern.” According to Ernst & Young Vietnam, the accumulated loss of 957 billion VND as of June 30, 2024, along with the company’s short-term debt exceeding its short-term assets by more than 350 billion VND, are issues of concern. Additionally, HAGL is in breach of certain commitments related to bond contracts and has not repaid the principal and interest of bond loans that have become due. As of June 30, the company has not repaid more than 789 billion VND in principal, 7.7 billion VND in interest, and approximately 3,277 billion VND in bond interest due, as it has not received repayment from HNG.

In response to the issues highlighted by the auditors, HAGL stated that it has prepared a 12-month business plan. This plan includes expected cash flows from the partial disposal of financial investments, asset disposals, recovery of loans from partners, bank borrowings, and cash flows from ongoing projects. HAGL expects these measures to enable the company to repay its maturing debts and continue its operations for the next 12 months.

“The pig and banana businesses continue to generate significant cash flows in 2024,”

the company stated.

According to the report, the company’s net revenue decreased by 12.2% compared to the same period last year, reaching 2,762 billion VND. However, net profit increased by nearly 30%, surpassing 500 billion VND, with a gross profit margin improving from 20% to 35.5%.

Fruit, the company’s main source of revenue, contributed more than 2,000 billion VND, accounting for 72.5% of total revenue, an increase of 57% compared to the previous year. Meanwhile, the pig farming segment brought in more than 611 billion VND, a decrease of 39% compared to 2023.

HAGL attributed the increase in profit to the rise in fruit revenue. Despite a decrease in sales volume in the pig farming segment, the company still made a profit due to higher pig prices.

This year, HAGL aims to achieve a revenue of 7,750 billion VND, an increase of 20.3% compared to the previous year, but expects net profit to decrease by 25.9% to 1,320 billion VND. With a net profit of over 500 billion VND in the first half of the year, the company has achieved 37.9% of its annual profit plan.

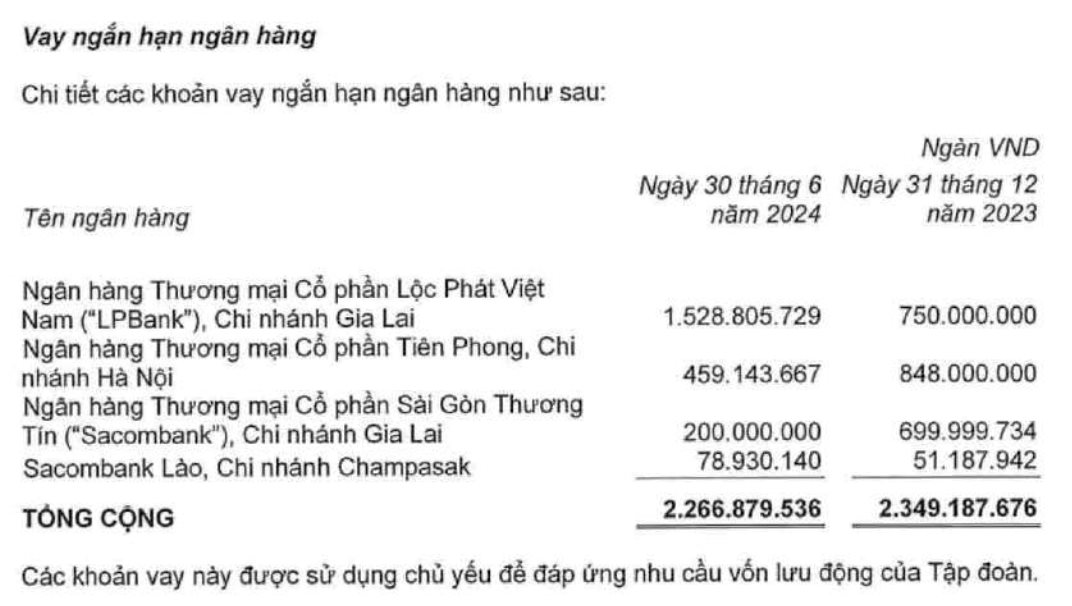

In the first half of this year, Loc Phat Commercial Joint Stock Bank (LPBank) provided additional loans of 779 billion VND to HAGL. As of June 30, the outstanding balance of loans from this bank was 1,529 billion VND, accounting for 67% of the company’s total short-term bank borrowings.

Of this, 779 billion VND borrowed from LPBank was secured by 90 million HAG shares owned by Bầu Đức. The repayment period is from June 22 to December 9, 2024. The remaining loan amount is secured by land use rights and assets attached to the land with a total area of 957 hectares (7 land-use rights certificates) owned by the Gia Lai Livestock Company. The repayment date for this loan was June 16.