US Crude Oil Prices Rise Over 2%

Oil prices climbed over 2% as producers assessed the impact on production in the US Gulf of Mexico after Hurricane Francine hit the offshore oil-producing region before weakening to a tropical storm.

Brent crude futures settled up $1.36, or 1.9%, at $71.97 a barrel, while WTI crude futures rose $1.66, or 2.5%, to $68.97 a barrel. Both benchmarks rose more than 2%.

The International Energy Agency (IEA) lowered its 2024 oil demand growth forecast by more than 7% to 900,000 barrels per day (bpd), citing weaker-than-expected demand from China and other regions.

US Natural Gas Prices Surge Nearly 5%

US natural gas prices surged nearly 5% due to lower-than-expected inventory levels in the previous week, while traders assessed the impact on supply after energy companies curtailed output due to Hurricane Francine.

October 2024 natural gas futures on the New York Mercantile Exchange rose 8.7 US cents, or 3.8%, to $2.357 per million British thermal units. In early trading, natural gas prices rose nearly 5%.

Gold Hits Record High, Palladium Highest in Over 2 Months, Platinum Near 2-Month High

Gold prices rose over 1% to a record high as investors anticipated a Federal Reserve rate cut next week following US data indicating a slowing economy.

Spot gold on the LBMA rose 1.7% to $2,554.05 an ounce, while December 2024 gold futures on the New York Mercantile Exchange climbed 1.5% to $2,580.60 an ounce.

The US Labor Department stated that initial state jobless claims rose by 2,000 to a seasonally adjusted 230,000. Meanwhile, US producer prices rose more than expected in August, driven by higher services costs, though the trend remained consistent with slowing inflation.

Palladium prices jumped 4.1% to $1,050 an ounce, its highest since mid-July. Platinum prices rose 3% to $979.62 an ounce, nearing a two-month high.

Copper, Aluminum, and Zinc Prices All Hit Near 2-Week Highs

Copper prices climbed to their highest in nearly two weeks amid signs of improving demand from top metal consumer China and expectations of a Fed rate cut.

Three-month copper on the London Metal Exchange rose 1.4% to $9,215 a ton after touching $9,294.50, its highest since August 30.

Shanghai copper inventories have declined by 36% over the past three months to 215,374 tons, the lowest since March 2024. October 2024 copper futures on the Shanghai exchange rose 1.5% to CNY 73,830 ($10,363.85) a ton.

On the London Metal Exchange, aluminum prices rose 1.8% to $2,412 a ton, its highest since September 3, while zinc climbed 3.2% to $2,858.50, its highest since September 2.

Iron Ore Prices Hit Over 1-Week High, Steel Gains

Iron ore prices on the Dalian Commodity Exchange rose to their highest in over a week, buoyed by improving seasonal demand expectations in China, outweighing concerns about a slowdown in the top consumer’s economy.

January 2025 iron ore futures on the Dalian exchange rose 3.97% to CNY 707 ($99.25) a ton, touching CNY 709 a ton during the session, its highest since September 3.

October 2024 iron ore futures on the Singapore exchange also climbed 1.95% to $94.55 a ton.

On the Shanghai Futures Exchange, hot-rolled coil climbed 3.44%, rebar rose 3.1%, hot-dipped galvanized coil gained 1.87%, and stainless steel added 1.75%.

Rubber Prices in Japan Hit Over 1-Week High

Rubber prices in Japan rose to their highest in over a week, supported by higher oil prices and wet weather conditions across major rubber-producing regions globally.

February 2025 rubber futures on the Osaka Stock Exchange (OSE) climbed JPY 12.3, or 3.49%, to JPY 365 ($2.56) per kg, its highest since September 3.

January 2025 rubber futures on the Shanghai exchange also rose CNY 270, or 1.6%, to CNY 17,045 ($2,393.66) a ton.

November 2024 butadiene rubber futures on the Shanghai exchange gained CNY 390, or 2.6%, to CNY 15,375 ($2,159.14) a ton. October 2024 rubber futures on the Singapore exchange rose 1.7% to 185.2 US cents per kg.

Coffee Prices Rise in Vietnam, Indonesia, London, and New York

Coffee prices in Vietnam edged higher as the coffee crop in the Central Highlands region was unaffected by Typhoon Yagi, while trading was expected to remain subdued until the new harvest begins next month.

Vietnamese robusta coffee beans for export (2,5% black and broken) were offered at a premium of $50 a ton to the November 2024 contract on the London exchange and at a discount of $30-$50 a ton to the January 2025 contract. Local coffee bean prices rose to VND 121,000-121,500 ($4.93-$4.95) per kg, up from VND 119,000-120,500 a week earlier.

Vietnam’s coffee exports in the first eight months of 2024 reached 1.056 million tons, down 12.1% from the same period last year.

In Indonesia, robusta coffee beans (80 defects) were offered at a premium of $280 a ton to the November 2024 contract on the London exchange, up from a premium of $220 a ton to the September-October 2024 contracts a week earlier.

November 2024 robusta coffee futures on the London exchange rose $69, or 1.4%, to $5,077 a ton, heading towards its peak of $5,180 a ton hit on August 30.

December 2024 arabica coffee futures on the New York exchange climbed 1.1% to $2,494 a pound.

Sugar Prices Extend Gains

October 2024 raw sugar futures on ICE rose 0.34 US cent, or 1.8%, to 19.07 US cents per lb.

October 2024 white sugar futures on the London exchange gained 2.1% to $540.10 a ton.

Corn and Soybean Prices Climb, Wheat Falls

Corn prices on the Chicago Board of Trade rebounded from near two-week lows after the US Department of Agriculture (USDA) raised its estimate of US corn production.

December 2024 corn futures on the Chicago Board of Trade rose 1-1/4 US cents to $4.06 a bushel after dipping to $3.97, its lowest since August 30. December 2024 wheat futures fell 3/4 US cent to $5.78-1/2 a bushel, while November 2024 soybean futures climbed 10-1/4 US cents to $10.1-3/4 a bushel.

Thai Rice Prices Hit Over 1-Year Low, Indian Rice at 8-Month Low, Vietnamese Rice Softens

Thai rice prices fell to their lowest in over a year as a bidder had to cut prices in a recent tender held by Indonesia, while Indian rice export prices dropped to an eight-month low.

In India, a key rice exporter, the 5% broken rice variety was quoted at $528-$534 per ton, its lowest since mid-January, down from $535-$540 the previous week.

For the 5% broken variety, Vietnamese rice was quoted at $567 a ton, down from $575 the previous week.

Thai 5% broken rice prices fell to $550-$565 a ton, its lowest since July 20, 2023, from $585 the previous week.

Palm Oil Prices Hit 3-Week Low

Palm oil prices in Malaysia dropped to a three-week low as top buyer India was expected to raise import taxes, and soybean oil and palm oil futures on the Dalian exchange weakened.

November 2024 palm oil futures on the Bursa Malaysia exchange fell 53 ringgit, or 1.36%, to 3,848 ringgit ($888.07) a ton.

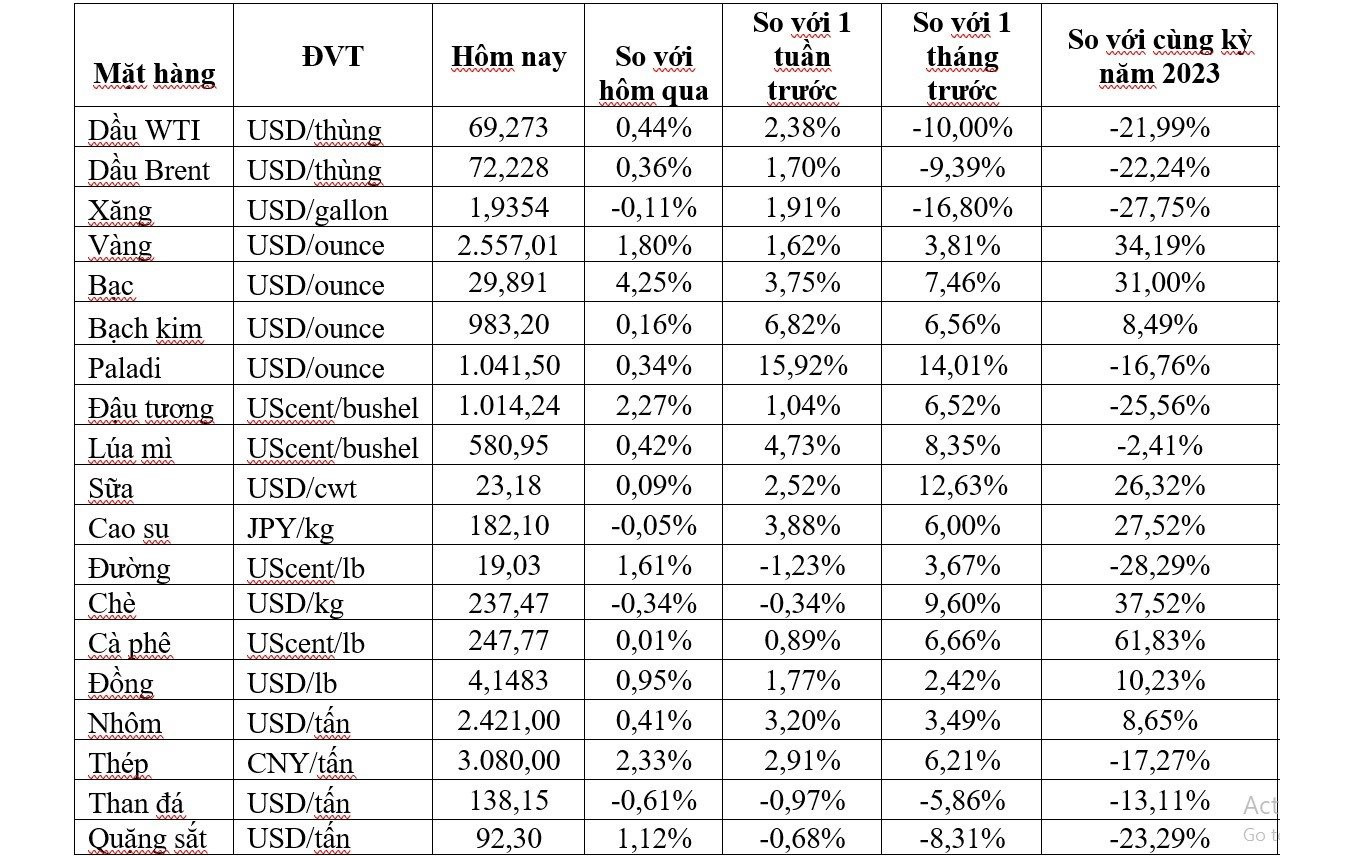

Prices of Some Key Commodities on the Morning of September 13

The Energy and Commodity Markets Surge: US Crude Oil Climbs Over $2 a Barrel, Robusta Coffee at a Near 16-Year High

As of the market close on September 11th, crude oil prices surged by over $2 a barrel, with natural gas, nickel, copper, steel, and sugar also seeing notable gains. Robusta coffee prices hit a near 16-year high, while gold and rubber prices retreated.

Gold Bar Buying Service: SJC Gold Bars at an Unbeatable Price of 79.5 Million VND per Tael

As of today, larger enterprises are purchasing gold bullion at a fixed rate of 78.05 million VND per tael, whereas mid-range gold retailers are offering to buy gold at a rate that is 1 million VND higher per tael.