The VN-Index formed a new deep bottom in the afternoon session at 1:50 pm, with prices touching a better support region before rebounding. However, the volume of money pushing prices up was also very small, mainly from a few large-cap stocks supporting the index, so the breadth remained almost unchanged and liquidity was also very poor.

At the bottom, the VN-Index fell more than 7 points and narrowed to a 4.64-point (-0.37%) loss by the end of the session. The breadth at the bottom was recorded as 172 gainers/202 losers, but at the close, it was 163 gainers/210 losers, despite the better index level. This was the effect of propping up the large-cap stocks, while the majority of stocks saw little change.

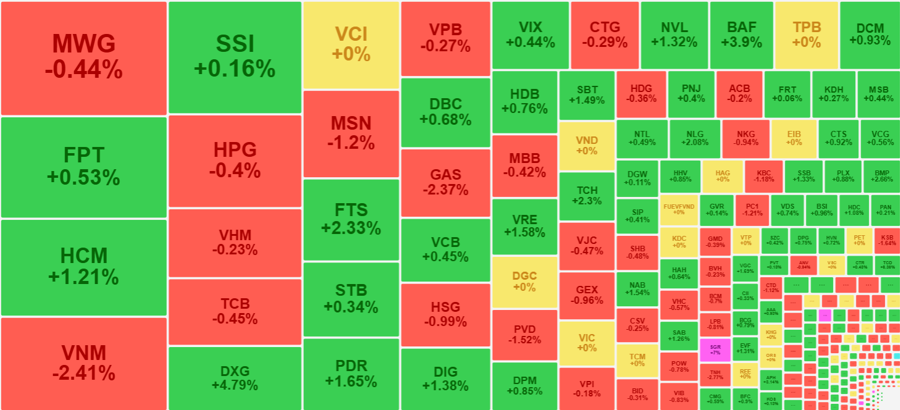

VCB, VRE, CTG, and VIC were the large-cap stocks that edged higher in the last 30 minutes of continuous matching. However, the improvement was very slight, with VCB closing up 0.45% from the reference price and gaining about 0.3% in the last 30 minutes. CTG gained about 0.43% from 2 pm onwards but still closed down 0.29% from the reference price. VIC improved by about 0.59%, returning to the reference price at the end of the day… Overall, there was no clear consensus among large-cap stocks, and the recovery margin was small. This only helped the VN-Index to gain back a few points from the intraday low.

Apart from the rebound led by these large-cap stocks, the market was not much different from the morning session. The price drop and new bottom in the first half of the afternoon session only helped improve liquidity as sellers lowered prices to an area with more buy orders. The HoSE floor saw a trading volume increase of about 37% in the afternoon compared to the morning session, reaching nearly VND 5,297 billion. Including HNX, the matched trading volume in the afternoon increased by 35.8%, reaching VND 5,649 billion.

This is still a very small trading volume, not enough to break the stagnant state of the market. The market is not lacking in money, but there is no incentive to trade. Investors may be willing to buy on dips, but that’s about it. Moreover, there is no new supportive information. The FED will meet on interest rates on September 17-18 (US time), and the information will only appear before the session on the last day of the week, September 19. Derivatives will also expire in this session. Therefore, it is unlikely that the stagnant state with low liquidity will change in the coming sessions.

Of course, with a better breadth than in the morning (125 gainers/207 losers), there were still some stocks that went against the trend. The situation did not change much, and the group of gainers saw very few stocks with strong trading volume. Out of a total of 55 stocks that closed up more than 1%, 7 stocks had a liquidity of over VND 100 billion, all of which were mid-cap stocks: HCM up 1.21% matched 405 billion; DXG up 4.79% matched 218.9 billion; FTS up 2.33% matched 200.3 billion; PDR up 1.65% with 178.8 billion; DIG up 1.38% with 144.5 billion; NVL up 1.32% with 118.4 billion; BAF up 3.9% with 111.4 billion.

In the context of the overall weak market liquidity, the above stocks attracting a liquidity of hundreds of billions is an impressive move. However, this is only a small part, as the majority of stocks traded weakly with poor liquidity. Today, HoSE had 28 stocks with liquidity above VND 100 billion, including 15 gainers, 13 losers, and only 7 gainers of more than 1%, as mentioned above.

Of course, the effect of low liquidity also has a positive side, which is that the decline in stock prices is also limited. The only three stocks that fell more than 1% with the highest liquidity were VNM down 2.41% matched 393.2 billion; MSN down 1.2% with 213.5 billion; GAS down 2.37% with 156.3 billion. The remaining 6 stocks with a matched volume of over VND 10 billion were PVD down 1.52%, KBC down 1.18%, PC1 down 1.21%, TNH down 2.77%, KSB down 1.64%, and CTD down 1.12%.

In the afternoon, the VN-Index fell to its intraday low of 1,248.78 points, marking the second test of the 1,250-point level for the day. The recovery rhythm that appeared at the end of the day brought the index back above this threshold, continuing to send positive signals. Trading around this psychologically important level, which saw a sharp drop in liquidity, indicated that investors holding stocks were expecting a bottom to be formed.