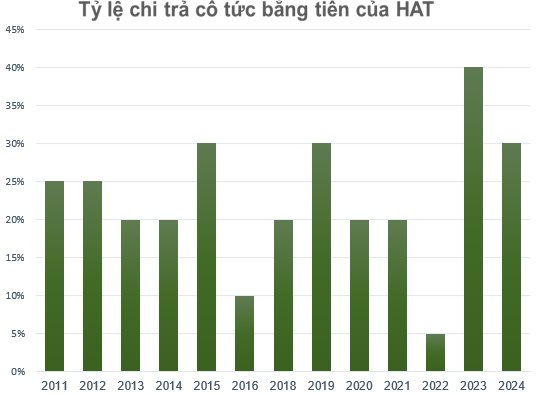

Habeco Trading (HAT) has recently announced that it will finalize its shareholder list on September 23 to pay a 30% cash dividend for 2023, equivalent to VND 3,000 per share.

With over 3.1 million shares in circulation, the company will distribute approximately VND 9.3 billion in dividends. The payment is expected to be made on October 23, 2024.

Its parent company, Hanoi Beer, Alcohol, and Beverage Joint-Stock Corporation (Habeco, ticker: BHN), which holds 60% of the capital, is expected to receive approximately VND 6.6 billion in dividends.

Since its listing in 2010, Habeco Trading has consistently paid cash dividends to its shareholders. In 2023, the company even distributed a 40% cash dividend. For 2024, the Annual General Meeting approved a 30% cash dividend payout.

Established in 2006, Habeco Trading is responsible for distributing Hanoi Draught Beer products for the Hanoi Beer, Alcohol, and Beverage Joint-Stock Corporation.

Despite anticipating challenges in the beer industry due to subdued consumer demand and government policies restricting alcohol consumption, Habeco Trading remains optimistic about its performance in the first half of 2024.

For the six months ended June 30, 2024, Habeco Trading reported VND 646 billion in net revenue and VND 12.7 billion in after-tax profit, representing a 13% and 7% increase, respectively, compared to the same period last year. The company has achieved nearly 48% of its full-year revenue target (VND 1,351 billion) and 68% of its full-year profit target (VND 18.7 billion).

To ensure growth in consumption, the company plans to purchase an additional 50,000 2-liter keg shells in Q4 2024 to support its sales efforts.

Additionally, HAT intends to strengthen its market presence and sales network by focusing on consolidating and expanding its depth in Hanoi’s inner city while also reaching out to the outskirts and neighboring provinces to create a protective market belt for Hanoi.

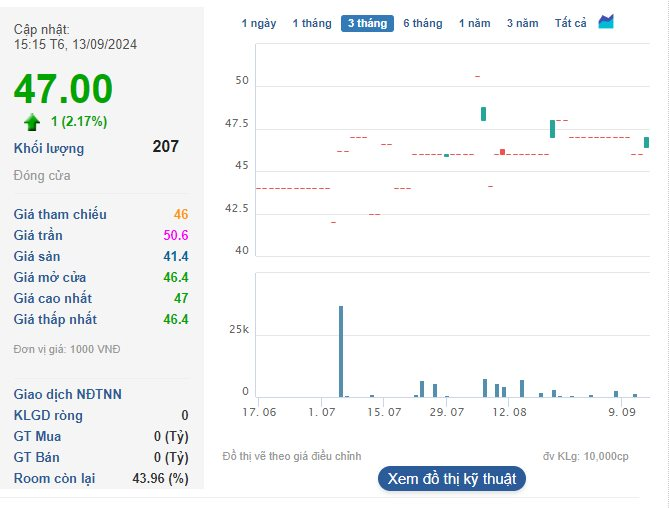

In the stock market, HAT’s share price currently stands at VND 47,000 per share, reflecting a 10% increase since the beginning of the year. The stock often experiences low liquidity, with only a few hundred to a thousand shares traded per session, and some sessions witness no trading activity at all.

“Playing” High-Dividend Micro-Cap Stocks

Many organizations and individuals hold a modest number of shares in companies with a small capital base and market capitalization, but these shares offer an impressive dividend yield of 20% to 50%.