TNH Joint Stock Hospital Group Corporation (code: TNH) announced that it will offer more than 15.2 million shares to the public with a par value of 10,000 VND per share, at a ratio of 13.8%.

The record date for shareholders to receive the rights to buy shares is September 18, and the transfer period for the share purchase rights is from September 24 to October 7. The registration and payment period for the share purchase is from September 24 to October 14, 2024.

This capital-raising plan was approved at the 2023 Annual General Meeting of Shareholders of TNH. If the issuance is successful, TNH’s charter capital will increase from 1,102 billion VND to 1,254 billion VND.

Out of the expected proceeds of 152 billion VND, the Company will allocate 20 billion VND to repay loans to credit institutions, 40 billion VND to supplement working capital (payment for goods, drugs, chemicals, and salary payments), and the remaining 92 billion VND to repay debts to the Company’s leaders, including: Mr. Hoang Tuyen, Chairman of the Board of Directors (35.6 billion VND); Mr. Nguyen Van Thuy, Member of the Board of Directors and Vice President (35 billion VND); Mr. Le Xuan Tan, General Director and Vice Chairman (11.4 billion VND); and Mr. Nguyen Xuan Don, former Member of the Board of Directors (10 billion VND).

Yen Binh Thai Nguyen General Hospital is a branch of TNH Hospital System

Previously, TNH had borrowed 92 billion VND from its leaders for a term of 12 months starting from August 2022, with an interest rate of 5.45% per annum, to repay bonds issued in 2020. The Company has extended this debt three times, with the latest extension being until March 31, 2025, to await the completion of the procedures for the issuance of shares and arrangement of capital sources to repay the debt according to the signed contract.

In another development, TNH has received a tax penalty decision from the Tax Department of Thai Nguyen city for a late tax declaration submission, with a fine of 3.5 million VND for a delay of between 1 and 30 days.

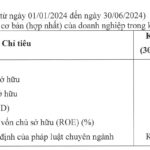

In terms of business results, in the first half of 2024, TNH recorded net revenue of nearly 222.5 billion VND, a decrease of more than 3% compared to the same period last year. Cost of goods sold increased by 11.25% to 142 billion VND, resulting in a gross profit decrease of nearly 21% to about 81 billion VND. Accordingly, net profit after tax decreased by 14% to over 53 billion VND.

For the full year 2024, TNH sets a target of 540 billion VND in revenue and 155 billion VND in net profit. After the first half, the Company has achieved 41% of the revenue target and 35% of the profit target.

PV