Illustrative image

Vietnam holds an advantage in agricultural produce with a range of export commodities bringing in billions of USD. Notably, the country boasts a particular spice that accounts for 60% of the world’s export volume: peppercorn. Statistics show that there are currently 100,000 pepper farmers, 200 exporting businesses, and 35 pepper processing factories in Vietnam.

According to the Vietnam Pepper Association (VPA), the estimated pepper output for 2024 in Vietnam is expected to reach approximately 170,000 tons, a 10% decrease compared to the previous year. This is also the lowest level in the past five years. Therefore, besides domestic supply, the country has been importing from other providers to maintain its export status.

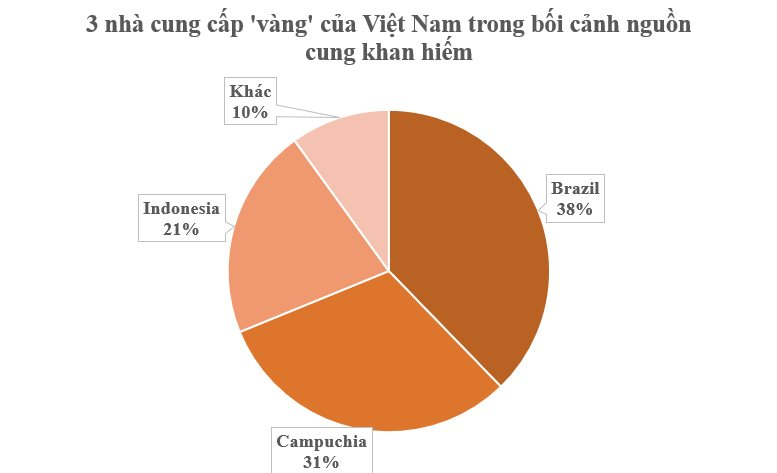

As per VPA’s statistics, Vietnam imported 1,491 tons of pepper in August, equivalent to over $8.2 million, a 20% decrease in volume compared to the previous month. Brazil was the largest pepper supplier to Vietnam in August, with 736 tons, a surge of 808.6% from the previous month, followed by Indonesia and Cambodia.

In the first eight months of the year, Vietnam imported 21,348 tons of pepper, with a value of over $88 million, a 12.3% increase compared to the previous year. The main supplier was Brazil, with 8,058 tons, a decrease of 30.5%. Notably, imports from Cambodia surged by 96.1% to 6,635 tons compared to the same period last year. Indonesia was the third-largest market, with 4,530 tons, a 95% increase.

In terms of import varieties, Vietnam imported 18,657 tons of black pepper and 2,691 tons of white pepper. Leading importing enterprises included Olam Vietnam with 7,496 tons, Tran Chau with 2,756 tons, and KSS Vietnam with 1,235 tons.

Peppercorns hold a significant proportion in the global spice basket and play an essential role in culinary cultures. Notably, pepper products are increasingly used in pharmaceuticals, cosmetics, and healthcare. The pepper market is valued at $5.43 billion, and it is forecasted to grow by over 20% on average during 2024-2032. In 2023, Vietnam exported 264,094 tons of various peppercorns, earning $906.5 million. Compared to 2022, the export volume in 2023 increased by 13.8%, but the value decreased by 8% due to lower export prices.

Experts predict a global peppercorn supply shortage of nearly 100,000 tons. In the near future, with scarce supply and increased imports from countries like China, the market will experience significant shifts. Notably, in May, Vietnam’s peppercorn exports to China reached 3,137 tons, a surge of 4.8 times compared to the previous month, the highest level in the past 11 months.

According to the Import-Export Department of the Ministry of Industry and Trade, pepper prices in producing countries will likely remain high due to increased demand, while supply from Indonesia, Brazil, Malaysia, and Cambodia cannot compensate for the reduced exports from Vietnam. Currently, global consumers are willing to pay a premium for high-quality pepper.