Spot gold prices ended the week at $2,582.04 per ounce, while December 2024 gold futures peaked at $2,610.70 per ounce.

Bullish gold speculators locked in gold bars at record highs. The $3,000 target is coming into view as major central banks ease their monetary policies and the US presidential election heats up.

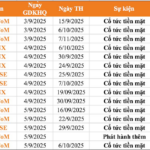

Gold prices this week.

The stars seem to align for gold and silver speculators as the European Central Bank (ECB) cut interest rates last week, and the Fed is likely to follow suit next week. FedWatch tool by CME indicates a 57% market expectation of a 25-basis-point cut and a 43% chance of a 50-basis-point reduction in this meeting. This would be the Fed’s first rate cut since 2020.

“The market still expects the Fed to cut rates by about 100 basis points by the end of this year, which means rates would have to be cut by 50 basis points at one of the two remaining meetings after September,” Commerzbank analysts said, adding, “Therefore, the fact that rates are expected to be cut sharply in the coming months could be why gold prices are rising.”

The US dollar fell to its lowest level this year against the Japanese yen on Friday, further boosting interest in gold bars.

The World Gold Council said last week that gold exchange-traded funds had seen inflows for the fourth consecutive month in August. Holdings in the world’s largest gold-backed ETF, SPDR Gold Trust GLD, hit their highest since early January on Thursday (Sep 12).

The latest Kitco News survey showed that both industry experts and retail investors remain optimistic about gold’s potential to continue rising, but they are more cautious than in recent weeks. Technically, the Relative Strength Index (RSI) is currently at 69, indicating that gold prices are approaching the “overbought” zone.

Marc Chandler, Chief Executive Officer of Bannockburn Global Forex, sees upside potential but also believes the rally has gone a bit too far, too soon.

“Gold is hitting new record highs, seemingly supported by US rate cuts and a weaker dollar,” he said. “After cooling off, there’s new speculation that the Fed will cut by 50 basis points in the first cut. Even if the Fed cuts by 25 basis points next week, it could still be a dovish cut if Chair Powell doesn’t push back against expectations of one and possibly two half-point cuts in the last two meetings of the year.”

Mr. Chandler added that with gold prices in uncharted territory, resistance levels don’t mean much.

Mark Leibovit, publisher of VR Metals/Resource Letter, expects gold prices to rise in the coming days but believes the peak will coincide with the Fed meeting. “Looking for a peak trade next week,” he said.

“Prices will go up for a few reasons,” said Darin Newsom, a senior analyst at Barchart.com. “First, Newton’s First Law of Motion applied to markets tells us that ‘an object in motion will stay in motion unless acted upon by an external force,’ with that external force usually being non-commercial activity (funds, investment, etc.),” he said. “As of Friday morning, investment money continues to flow into gold.”

“Second, to quote Willy Wonka (of Chocolate Factory fame), ‘So much time and so little to do! Wait a minute, strike that, reverse it!’. For this discussion, replace ‘so little time’ with ‘so much buying.’ Replace ‘wonka’ with ‘investor.'”

Adam Button, head of currency strategy at Forexlive.com, also sees prices rising next week. “There’s no reason to fight this rally,” he said. “A 25-basis-point cut from the Fed could lead to some reflexive selling, but there will be buyers down at the $2,500 level.”

Daniel Pavilonis, a senior commodities broker at RJO Futures, thinks gold prices are a bit overbought in the short term, even though gold still has significant momentum through year-end. “I think prices will start to level off a bit,” he said. “That’s what the market is looking for, but we’re so far away from the moving averages, I think we’ll start to come back to realistic trend ranges.”

Pavilonis predicts gold will dip ahead of the rate decision. “I think you’ll see some profit-taking,” he said. “I think it will be within the range that you’ve seen in the last few weeks, maybe somewhere around there, and then wait and see what the Fed does.”

“I think the perfect scenario is the Fed cuts [25 basis points],” he added. “I think if they start cutting at half a point, the market will wonder, ‘Are rates being cut because we’re starting to see deflation?’ I think half a point right now is a little bit scary. We’ve got some big economic issues, and gold trading at $2,600 is pretty high.”

Pavilonis said the other main driver of gold’s recent rally is the US election and the potential for political unrest.

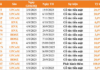

This week, 13 analysts participated in the Kitco News gold survey, and while the results showed they remain fundamentally bullish, many expressed concern that gold could move in either direction, depending on the Fed’s rate decision.

Eight Wall Street analysts, or 62%, expected gold prices to rise next week, while three analysts, or 23%, predicted gold would fall, and two analysts, or 15%, saw a sideways market.

Meanwhile, 189 Main Street investors completed the online survey. A total of 107 voters, or 57%, looked for gold to climb in the next week, while 47, or 25%, expected lower prices, and the remaining 35 voters, or 18%, were neutral.

Kitco News survey results on gold price outlook for next week.

References: Kitco, Reuters

The Golden Opportunity: Unveiling the Power of Words in the Digital Age

The global gold price continues to soar above $2,500 per ounce, pushing domestic gold ring prices to record highs.