In the latest filing, Ms. Truong Nguyen Thien Kim reported selling 13.2 million shares of VCI of Vietcap Securities Joint Stock Company. The transaction was made from September 4th to September 11th through matching and/or agreement.

The market during the period of September 4-11 recorded more than 11 million matching transactions of VCI shares (mainly in the September 4 session) at an average price of VND 46,300/share. Estimated at the closing price, Ms. Kim pocketed about VND 600 billion after completing the above transaction.

After the transaction, Ms. Kim still holds more than 9.6 million VCI shares, holding a corresponding 2.18% stake. Ms. Kim is the wife of CEO and Member of the Board of Directors of Vietcap To Hai. Currently, CEO To Hai holds more than 99.1 million VCI shares (22.44% ratio).

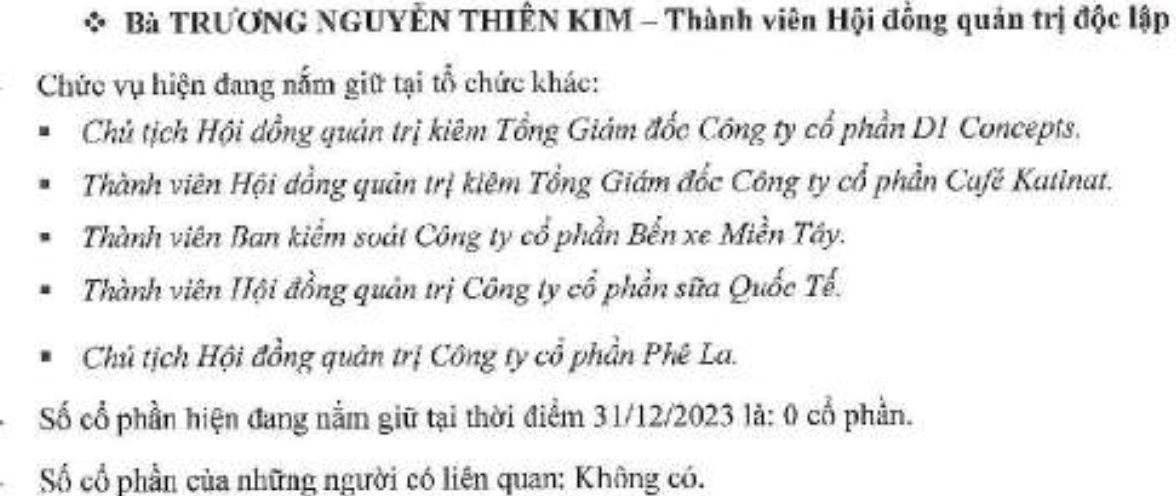

In addition to being known as the wife of the CEO of Vietcap Securities, Ms. Kim also holds multiple positions in several other businesses. According to the 2023 Annual Report of Ben Thanh Trading Services Joint Stock Company (code BTT) – where Ms. Thien Kim holds the position of Independent Member of the Board of Directors, she is currently also Chairman of the Board of Directors and General Director of D1 Concepts Joint Stock Company; Member of the Board of Directors and General Director of Cafe Katinat Joint Stock Company; Member of the Supervisory Board of Western Bus Station Joint Stock Company (code: WCS); Member of the Board of Directors of International Dairy Products Joint Stock Company (code: IDP); Chairman of the Board of Directors of Phê La Joint Stock Company.

Source: 2023 Annual Report of BTT

At the time of their establishment, Ms. Truong Nguyen Thien Kim held a controlling stake in Cafe Katinat Joint Stock Company and Phê La Joint Stock Company. D1 Concepts, on the other hand, is a company that owns many culinary brands such as San Fu Lou, Di Mai, Sorae, CaféDa, and Sens…

Katinat, in particular, is a coffee chain that has recently faced mixed public opinions after announcing that it would “deduct VND 1,000 from each drink sold” to help people in Northern Vietnam recover from the aftermath of Storm No. 3.

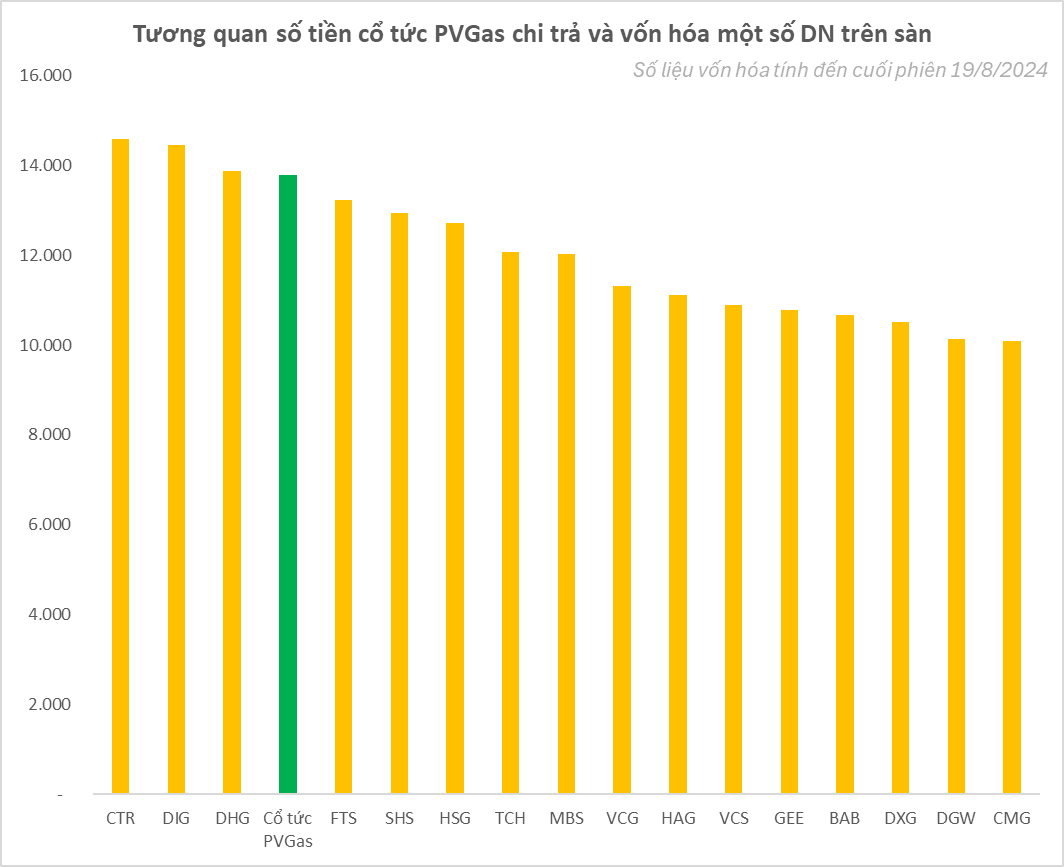

In terms of Vietcap’s business performance, in the first half of 2024, this securities company recorded operating revenue of more than VND 1,700 billion, a sharp increase of 72%. As a result, pre-tax profit reached VND 571 billion, up 170%.

In 2024, Vietcap set a business plan with a revenue target of VND 2,511 billion and a pre-tax profit of VND 700 billion, up 2% and 23%, respectively, compared to the previous year. Thus, after the first half, the company has completed 81% of its profit target.

“Personal Data Standardization: VIETCAP’s Commitment to Empower Investors.”

To ensure compliance with regulatory requirements and seamless transactions when using their products/services, multiple securities companies have requested customers to update/adjust their non-chipped ID cards to the new chipped Citizen Identification Cards.