Ending this trading week, on September 14, the price of Robusta coffee on the London (UK) exchange experienced a shocking surge of 190 USD/ton, pushing November-delivery Robusta to 5,267 USD/ton, with the intra-day high reaching 5,281, an increase of 204 USD/ton.

At the beginning of the week (September 9), November-delivery Robusta coffee was priced at 4,770 USD/ton. Thus, within just one week, the price of coffee, with Vietnam being the world’s top supplier, skyrocketed by nearly 500 USD/ton.

For January 2025 delivery, Robusta coffee prices also approached the 5,000 USD/ton mark, settling at 4,998 USD/ton, reflecting a substantial increase of 443 USD/ton.

While global coffee prices have been consistently hitting new highs, domestic coffee prices in Vietnam have been lagging, with a more modest increase of only 5,500 – 6,000 VND/kg for the week, reaching approximately 124,000 VND/kg, which is still 10,000 VND/kg shy of the peak observed in April.

Forecast for the 2024-2025 coffee crop remains optimistic with expectations of sustained high prices

Explaining the sharp rise in global coffee prices, Mr. Nguyen Ngoc Luan, CEO of Global Trade Link Co., Ltd. (Ho Chi Minh City), attributed it to the year-end period when coffee consumption demand typically increases while raw materials remain scarce, driving up prices.

Regarding the discrepancy between domestic and global price movements, Mr. Luan suggested that domestic prices had already increased earlier and stabilized. Taking into account exchange rates, domestic and global coffee prices are currently on par.

“Back in April, domestic coffee prices surged beyond reasonable levels due to the involvement of speculators,” Mr. Luan observed.

Predicting the price trajectory for the upcoming harvest season starting in October, Mr. Luan anticipated prices to hover around 120,000 – 130,000 VND/kg and unlikely to decline. This price range is also what processing enterprises are considering for their output contracts.

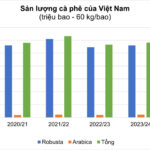

According to the Vietnam Coffee – Cocoa Association (VICOFA), in the first eight months of 2024, Vietnam exported approximately 1.05 million tons of coffee, generating nearly USD 4.04 billion in revenue. This represents a 12.5% decrease in volume but a significant 36.4% increase in value compared to the same period last year.

Coffee Imports on the Rise

On the other hand, during the same period, Vietnam imported approximately 97,858 tons of coffee, valued at nearly USD 371.3 million, indicating a substantial increase of about 41.7% in volume and over 104% in value year-over-year. Among these imports, live coffee beans accounted for roughly 83,334 tons, with a value of approximately USD 299.45 million, translating to an average unit price of 3,600 USD/ton.

This phenomenon can be attributed to the high prices of Vietnamese coffee, prompting local coffee processing plants to seek more affordable sources and some export enterprises to turn to imports to fulfill their commitments to partners.

The World’s Second Largest Coffee Exporter and Top Producer of Robusta Beans: Unraveling the Challenges Faced by Vietnam’s Coffee Industry

The Vietnamese coffee market is at a pivotal moment. With rising prices and declining production, the industry faces a unique set of challenges and opportunities. This dynamic situation demands a fresh perspective and a strategic approach to navigate the changing landscape.