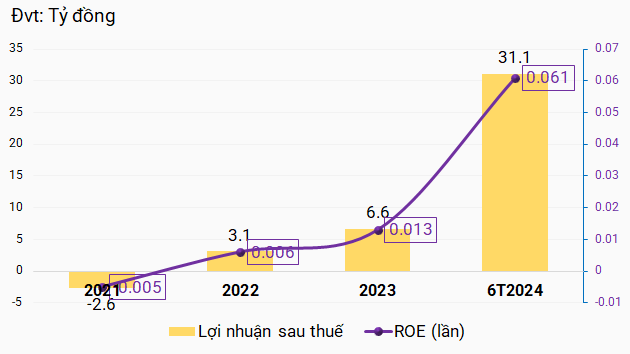

According to the financial report submitted to the Hanoi Stock Exchange (HNX), in the first half of this year, Truong Loc – Binh Thuan Solar Power recorded a post-tax profit of VND 31.1 billion, a six-fold increase compared to the same period last year and more than four times the combined results of the 2021-2023 period. As a result, ROE increased from 0.01 to 0.061 within a year.

|

Profit After Tax of Truong Loc – Binh Thuan Solar Power

|

|

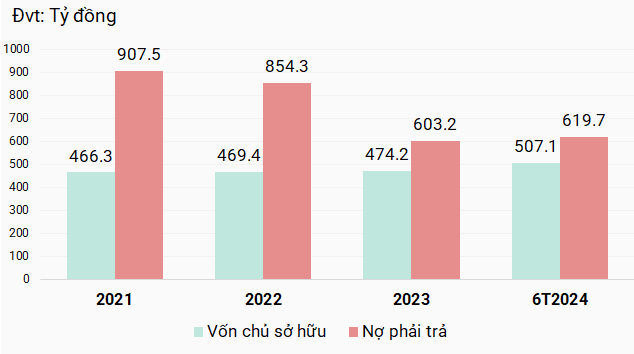

Capital and Liabilities of Truong Loc – Binh Thuan Solar Power

Source: Author’s compilation

|

Source: Author’s compilation

As of June 2024, equity capital stood at VND 507 billion, while liabilities increased slightly to nearly VND 620 billion. The company currently has a single bond issue with the code HL3.BOND.2020, initially issued at a face value of VND 860 billion, with a 15-year term (from December 23, 2020, to December 23, 2035) and an interest rate of 10.7% per annum. The depository organization is Saigon-Hanoi Securities Joint Stock Company (SHS).

In the first half of this year, the outstanding value of the bonds was VND 583.5 billion. According to the plan, the company was scheduled to pay VND 25 billion in principal and VND 34.2 billion in interest on June 24. However, after consulting and obtaining the bondholders’ agreement, the company postponed the principal payment and paid only VND 2.3 billion in interest on June 28. Concurrently, the company extended the bond maturity by two years to December 23, 2037, and modified certain terms related to collateral.

The bonds will be partially repurchased every six months. As per the agreement with the bondholders, the company is not required to repurchase the bonds from June 23, 2024, to December 23, 2027. The repurchase value will gradually increase from VND 5 billion to VND 20 billion and then to VND 55 billion from June 23, 2028, to June 23, 2037.

Truong Loc – Binh Thuan Solar Power, a member of the T&T Group, is the investor of the 50 MWp Hong Lien 3 solar power plant in Hong Lien commune, Ham Thuan Bac district, Binh Thuan province.

The Profitable Flamingo: How the Resort Chain Soared to Success in 2024

Flamingo Holdings has just released its financial report for the first half of 2024, and the results are impressive. The company has seen significant growth in both revenue and profit, surpassing expectations and setting a strong precedent for the remainder of the year. With a strong performance across the board, Flamingo Holdings is poised for continued success and a bright future ahead.