“VN-Index Recovers: Market Quietly Anticipates Opportunities”

On September 12, the stock market rebounded slightly after three consecutive sessions of decline earlier in the week. At the close, the VN-Index gained 3.08 points to reach 1,256.35, while the HNX-Index also rose by 0.45 points to 231.9.

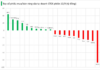

However, the market experienced an extremely dull trading session, with stock prices fluctuating within a narrow range. Liquidity hit a record low, with the three exchanges recording just over VND 11,400 billion, of which the HoSE floor alone accounted for over VND 10,400 billion, a 10% decrease compared to the previous session.

Notably, this lackluster trading pattern has persisted since the beginning of September. Statistics show that the average trading value since the start of the month has been around VND 12,000 billion per session, while the average for August stood at VND 16,500 billion per session.

Money still on the sidelines waiting to enter the stock market

Mr. Nguyen The Minh, Director of Research and Product Development at Yuanta Vietnam Securities Company, opined that as the VN-Index approached the 1,300-point mark, the market faced certain challenges. Foreign investors continued to sell, although the value decreased, maintaining a selling trend.

Additionally, after the September 2 holiday, international stock markets, including the US and China, witnessed declines due to less-than-favorable macroeconomic data. Compounded by the impact of the storm in Vietnam, domestic stock market participants also chose to stay on the sidelines, adopting a wait-and-see approach until clearer opportunities emerge.

“There are reasons to believe that money is still waiting for a chance to flow into the stock market in the near future. Other financial investment channels offer relatively limited appeal, such as low savings interest rates, and a subdued real estate market following the enforcement of three related laws. As for the gold market, its allure has faded after a period of high volatility. Therefore, money flowing into stocks is like “straw waiting for a spark” – a catalyst to ignite it, as emphasized by Mr. Minh.

An investment director at VPS Securities Company suggested that investors are exercising caution amidst a plethora of unclear information, particularly global-related developments, which influence investor sentiment. Nonetheless, this also marks a phase where stocks are reaching their lows. The sectors expected to lead this recovery include banking, securities, steel, and public investment.

The Great Liquidity Conundrum: Are Investors Fed Up with Stocks or Merely Biding Their Time?

SGI Capital anticipates a challenging landscape for liquidity and cash flow in the coming months, with potential risks amplified by volatile global market conditions. The firm believes that navigating this period will require a nuanced approach to managing finances and mitigating risks effectively. With a keen eye on market dynamics, SGI Capital is poised to help clients weather the storm and emerge resilient.

Enterprise Private Bonds: Numerous Proposals to Remove Obstacles and Unblock the Impasse

As new regulations are introduced for privately placed corporate bond transactions, a myriad of solutions has been proposed to ease the process and foster market development.