BB Sunrise Power JSC has recently disclosed its periodic financial report for the first half of 2024 to the Hanoi Stock Exchange (HNX).

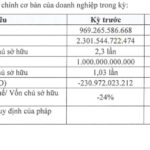

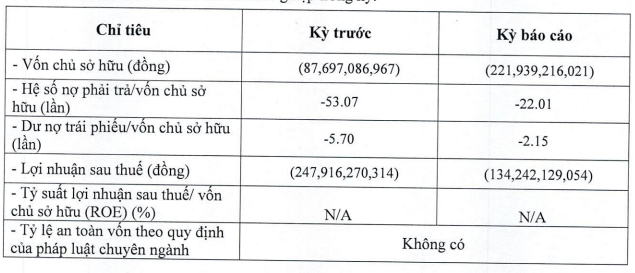

According to the report, BB Sunrise Power reported a post-tax loss of over VND 134 billion, a significant improvement from the loss of VND 248 billion in the same period last year. Due to the continued losses, the company’s equity at the end of Q2/2024 was negative VND 222 billion.

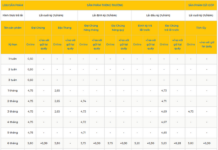

The debt-to-equity ratio stood at a negative 22.01 times, with total liabilities amounting to VND 4,885 billion, including VND 477 billion in bond debt.

Source: HNX

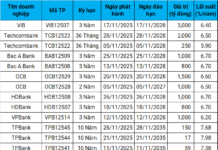

The entire bond debt mentioned above pertains to the BBSP.H.20.23.001 bond code, with a value of VND 500 billion, issued on December 22, 2020, and a three-year term.

In May 2024, BB Sunrise Power received approval from bondholders to extend the term of the BBSP.H.20.23.001 bond from three years to five years. As a result, the maturity date was adjusted from December 22, 2023, to December 22, 2025.

Consequently, the interest rate for this bond was also changed to 8% per annum, effective from March 22, 2023, to December 22, 2025.

The bond issuance was advised and registered for custody at Tan Viet Securities Joint Stock Company – TVSI. The asset security management organization is Vietnam Foreign Trade Joint Stock Bank – Vietcombank. The auditing organization is Vietnam Auditing and Appraisal Joint Stock Company – AVA.

According to the disclosure on HNX, so far in 2024, BB Sunrise Power has repurchased this bond three times ahead of schedule. Specifically, on July 5, the company repurchased nearly VND 23 billion, on August 1, VND 10 million, and on September 4, VND 20 million.

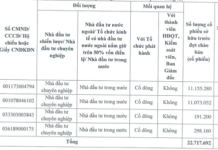

Established in 2019 with a charter capital of VND 500 billion, BB Sunrise Power is a member of the BB Group ecosystem, chaired by Vu Quang Bao.

The company’s shareholder structure comprises BB Power Holdings JSC holding 90%, and Pham Van Toan and Dang Thanh Binh, each owning 5%. Its main business focuses on investing in energy projects, power transmission, and distribution.

Tran Huy Hoang serves as the General Director of both BB Sunrise Power and BB Power Holdings.

BB Sunrise Power has undertaken several projects, including a hydroelectric project in Kom Tum, a solar power project in Ninh Thuan, a wind power project in Ninh Thuan, a hydroelectric project in Ha Giang, and a wind power project in Gia Lai.

Besides his role as a founding shareholder and Chairman of the Board of Directors at BB Group, Vu Quang Bao is also a major shareholder and CEO of Bitexco Group Joint Stock Company, alongside his brother, Vu Quang Hoi, who is the Chairman of Bitexco Group.

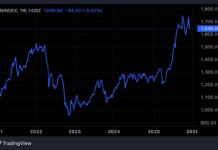

Previously, BB Sunrise Power’s parent company, BB Power Holdings, also reported a loss of nearly VND 185 billion in the first half of 2024. For the period from 2021 to the first half of 2024, the company incurred a total loss of over VND 1,156 billion.

As of June 30, 2024, the company’s equity stood at nearly VND 1,890 billion, a 22% decrease compared to the same period last year. The debt-to-equity ratio improved from 4.73 to 3.68 times, with total liabilities exceeding VND 6,954 billion. Of this, bond debt accounted for more than VND 310 billion.

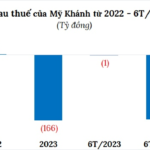

“A Troubling Loss for My Khanh Development Investment: $164 Million in Tax Losses”

Investment and Development Company My Khanh suffered a loss of 164 billion VND in the first half of 2024, compared to a loss of 1 billion VND in the same period last year. Notably, its debt soared to 2,590 billion VND, an alarming 36 times its equity.