Carlsberg Vietnam has appointed Andrew Khan as its new CEO, effective September 1, 2024. Mr. Khan is introduced as a leader with strategic vision and experience, particularly in the Asian markets.

With five years at the Carlsberg Group under his belt, Mr. Khan played a pivotal role in driving the growth of premium brands in the company’s key markets. Notably, in 2022, as Vice President of Premium & Beyond Beer, he developed premium brands such as 1664 Blanc, Brooklyn, and Somersby.

The CEO transition comes at a time when the Vietnamese beer market faces challenges alongside intensifying competition. Taking on this new role, the new CEO will be tasked with enhancing the company’s market position, developing human resources, and building a strong team.

Carlsberg also emphasizes that Vietnam is a key market in the company’s global Accelerate SAIL strategy. Carlsberg Vietnam’s vision for the coming period will focus on business development and strengthening the company’s presence and position in the market.

Carlsberg, the first Danish multinational corporation to invest in Vietnam, currently ranks fourth in the Vietnamese beer market, holding an 8% market share after Heineken, Sabeco, and Habeco. In Vietnam, Carlsberg offers a range of products, including Carlsberg, 1664 Blanc, Tuborg, Somersby, and the flagship brand Huda.

Despite the challenges in the Vietnamese beer market, Carlsberg Vietnam has been experiencing solid growth, especially with its premium brands such as 1664 Blanc, Tuborg, Carlsberg, and Somersby, while the domestic brand Huda continues its upward trajectory.

Figure: Market Share by Volume in Asia – Source: Carlsberg

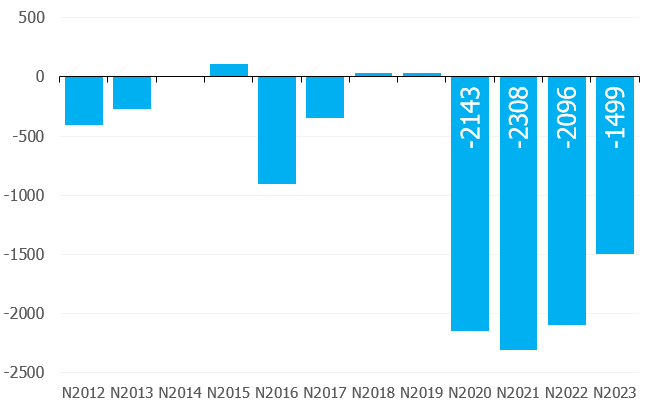

According to Carlsberg’s financial report, the group is the third-largest beer producer in the world by volume, with a revenue of 73.5 billion DKK in 2023, up from the previous year (70.2 billion DKK). Correspondingly, Carlsberg achieved an operating profit of 11.1 billion DKK.

In terms of beer volume, Carlsberg maintained its 2022 performance, reaching 10.1 billion liters in 2023. Notably, while the European market experienced a decline, Asia went against the grain, increasing by 5.1%, from 4.2 billion liters in 2022 to 4.41 billion liters in 2023.

“Asia delivered a series of solid results despite an increasingly challenging macroeconomic environment. Volume growth was driven by positive developments in markets such as China, Vietnam, and India,” the company report stated.

Carlsberg’s volume growth in Vietnam was primarily driven by its premium beer brands, particularly 1664 Blanc and Tuborg. Due to strong performance in the Chinese and Vietnamese markets, Tuborg’s volume in Asia increased by 7% in 2023.

“Vietnam is one of the largest beer markets in the world. We believe that Vietnam continues to hold opportunities for the company to expand its business,” Carlsberg stated.

The Dominant “Four Kings” Ruling the Vietnamese Beer Market: How Heineken, Sabeco, Carlsberg Earn Billions of USD Thanks to Vietnamese Drinking Culture?

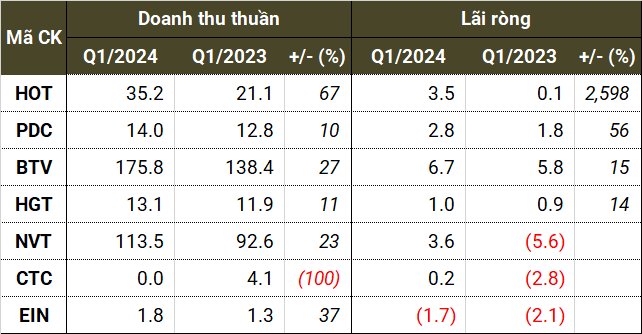

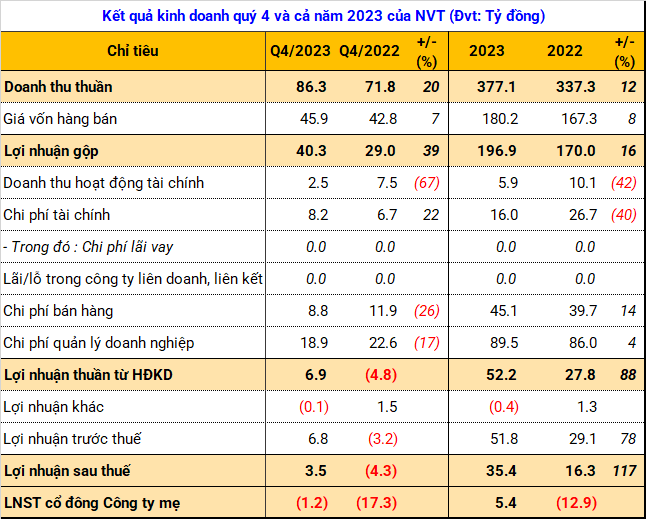

With a year-round warm climate, a large population, high income, and a distinctive drinking culture, the Southern region accounts for over half of Vietnam’s total beer consumption. With the main market in the South, Sabeco generated over $1 billion in beer sales in 2023, a 12% decrease compared to the previous year.