Attracting $550 Million in FDI

According to a report by the General Statistics Office of Vietnam, as of August 31, the total registered foreign direct investment (FDI) into Vietnam reached $20.52 billion, an increase of over 8% compared to the same period last year.

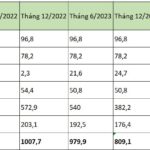

There were 2,247 newly licensed projects with a total registered capital of nearly $12 billion, up 8.5% in the number of projects and up 27% in registered capital year-on-year. Notably, the real estate business sector attracted $2.4 billion, a 5.1-fold increase compared to the same period last year, accounting for nearly 20% of the total newly registered capital.

When taking into account both new and additional registered capital, the FDI registered for the real estate business sector reached $2.55 billion, a 3.7-fold increase year-on-year, accounting for nearly 14.4% of the total newly registered and additional capital.

In terms of foreign investors’ capital contribution and share purchases, the real estate business sector attracted nearly $812 million, accounting for 29% of the total.

The Most Benefited Segment

According to Savills, Vietnam currently has 33,000 hectares of industrial land for lease, with an occupancy rate of 80% and high demand, especially in the Southern region. The current development trend is leaning towards built-ready warehouses and factories, which are attracting significant interest from investors. The occupancy rate for this type of real estate is also at 80% nationwide. The average rental price stands at $5.4/sqm/month, mainly driven by the Southern market.

Industrial real estate attracts investors and foreign capital.

Mr. Jack Nguyen, CEO of InCorp Vietnam, shared that FDI mainly flows into manufacturing industries, real estate, and energy. Singapore, Japan, and Hong Kong (China) remain the largest investors.

“We are receiving consulting requests from Chinese companies, especially in the Northern region market. Many Chinese manufacturers are moving to Vietnam to establish their supply chains. The trend of building large-scale industrial parks on the outskirts of cities promises to create a new wave of investment,” said Mr. Jack.

Additionally, while domestic spending has slowed down this year, the retail real estate market remains robust due to limited space availability. This irony creates challenges for retailers looking to expand, while also driving up rental prices in central areas in the future.

The office and residential segments are also experiencing strong demand, bolstered by a stable economy and expanding companies. Office rental prices are forecasted to remain stable due to new supply and a focus on sustainability.

A recently published study by Savills Impacts affirms that Ho Chi Minh City and Hanoi are among the fastest-growing cities globally due to factors such as demographics, urbanization, economic growth, and the expansion of the middle class. Remittances to Ho Chi Minh City have reached a record high in the last decade, with an estimated 20% invested in real estate, further supporting the recovery of the housing market.

“Korean Conglomerate Invests $200 Million in Wind Power Equipment Manufacturing in Long An”

South Korea’s CW Wind Corp has signed a memorandum of understanding (MOU) to lease land in Can Duoc District, Long An Province. The company plans to develop a large-scale wind power equipment manufacturing facility with an estimated investment of $200 million.