The ex-dividend date is September 27, and the payment date is October 15, 2024.

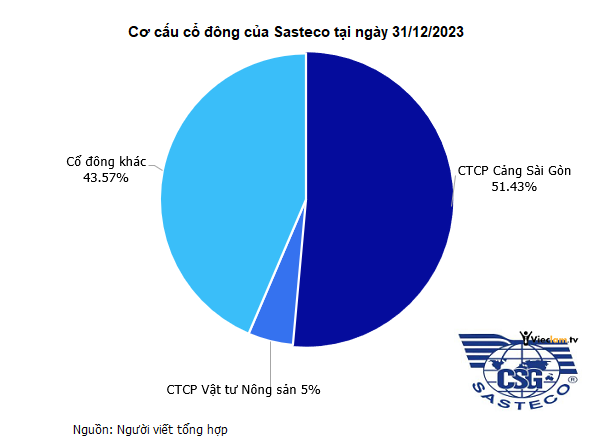

Currently, the Vietnam Maritime Corporation (VIMC, UPCoM: MVN) indirectly owns Sasteco through its subsidiary, Saigon Port Joint Stock Company (UPCoM: SGP). Specifically, SGP owns 51.43% of Sasteco, expecting to receive VND 14.4 billion in dividends in the upcoming payout. Following that, Agricultural Supplies Joint Stock Company holds 5% of the capital and will receive nearly VND 1.4 billion.

|

The Chairman of Agricultural Supplies Company is Mr. Nguyen Tien Dung – Member of the Board of Directors of Sasteco. In addition, Mr. Dung also holds several leadership positions in other businesses, including Chairman of SITC – Dinh Vu Logistics Company Limited and Vice Chairman of Dinh Vu Port Development Joint Stock Company (HOSE: DVP) and Haiphong Port Technical Services Joint Stock Company.

|

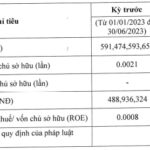

Regarding the dividend history, Sasteco started paying dividends to shareholders when it was listed on UPCoM in 2016, with a rate of 12% in cash. There was no dividend payment in 2017. In the period 2018-2019, the Company maintained a dividend of VND 1,000/share and reduced it to VND 800/share for the next three years, from 2020 to 2022.

In terms of business performance, in the last four years (2020-2023), Sasteco’s average annual net profit was meager, at only VND 3.5 billion, far below the record profit of VND 21 billion in 2017. This was due to the volume of goods handled in the Company’s operating areas not increasing as expected due to the prolonged economic crisis.

However, Sasteco decided to distribute its entire accumulated undistributed post-tax profit as of December 31, 2023, as dividends to shareholders, amounting to nearly VND 28 billion. The payout ratio is 70.65% in cash, the highest ever.

| Sasteco’s net profit in the last 10 years |

In the stock market, SAC shares have been on a remarkable upward trend since mid-May 2024, with the market price surging from the VND 11,000/share region to a historical peak of VND 31,700/share (session on June 21), equivalent to more than 2.8 times. Subsequently, SAC shares underwent a correction and are currently trading around VND 29,400 (session morning of September 16), down over 7% from its peak but still more than 3.2 times higher than at the beginning of the year.

| Price movement of SAC shares since the beginning of 2024 |

|

Sasteco, formerly known as Saigon Port Loading and Unloading and Services Enterprise, was established in 2008 with a charter capital of VND 40.5 billion as a subsidiary of Saigon Port Joint Stock Company. Its main business lines include cargo handling and packaging, warehousing and freight forwarding services, leasing of machinery and equipment, and marine vessel supply and transportation. The legal representative is Mr. Phan Le Dung – General Director of Sasteco. |

The Ultimate Guide to This Week’s Dividend Payouts: A Top Bank Prepares to Release a Generous 50% Cash Dividend

This week, a total of 25 businesses will be distributing cash dividends, with rates ranging from a substantial 50% to a more modest 1%.