The morning session ended with lackluster market liquidity as the VN-Index matched over 204 million units, equivalent to a value of 4.7 trillion VND. The HNX-Index recorded a meager volume of more than 18 million units, with a value of 286 billion VND.

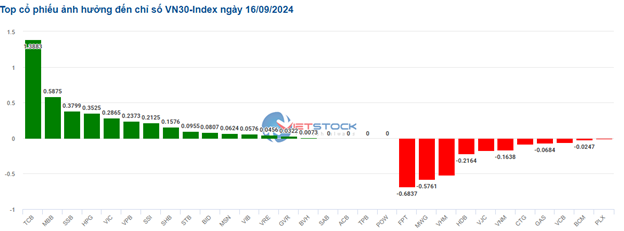

In terms of impact, VHM, CTG, and GAS are exerting the most negative pressure, taking away more than 1.6 points from the VN-Index. On the other hand, a group of bank stocks, including TCB, SSB, and NAB, are providing a boost to the index, contributing over 1 point.

Sectors are witnessing a mixed performance. On the upside, the materials sector is the brightest spot in the market at the moment. Chemical stocks maintained their gains until the end of the morning session, up 0.21%. Shares that rose over 1% include BMP (+2.59%), APH (+3.69%), DPM (+1.27%), and AAA (+1.13%). However, due to their small market capitalization, they have not significantly boosted overall demand.

In contrast, the telecommunications sector is currently at the bottom with a decline of 1.25%, mainly dragged down by stocks such as VNZ, which fell more than 7%, STC down over 5%, and EBS, which plunged nearly 10%. Stocks like FOX, FOC, and TTN recorded declines of over 1%. The majority of the remaining stocks showed only slight fluctuations around the reference price.

10:35 a.m.: Leaning towards the upside

Investor caution persists, keeping the major indexes range-bound, but with a slight advantage to the bulls. The VN-Index edged up 1.46 points, hovering around 1,253. The HNX-Index rose 0.2 points, trading at around 232.

Most stocks in the VN30 basket advanced. Notably, TCB, MBB, SSB, and HPG contributed 1.39 points, 0.59 points, 0.38 points, and 0.35 points to the VN30 index, respectively. On the flip side, FPT, MWG, VHM, and HDB faced selling pressure, dragging the index down by nearly 2 points.

Source: VietstockFinance

|

Materials stocks sported a positive tone from the get-go. In the fertilizer subgroup, the three giants DPM rose 2.25%, DCM climbed 1.18%, and BFC gained 2.11%… Additionally, the chemicals subgroup saw gains in DGC, up 0.7%, while the steel subgroup had HPG advancing 0.4% and NKG up 0.48%.

From a technical perspective, DPM remains in a long-term sideways trend, and during the morning session of September 16, 2024, the stock witnessed a strong surge, forming a Rising Window candlestick pattern with rising volume, indicating investors’ optimism. It is expected to surpass the 20-day average.

Moreover, DPM is testing the neckline of an Inverse Head and Shoulders pattern. If the recovery scenario plays out in the coming sessions, the price target is projected to be in the range of 41,500-42,500. Additionally, the MACD indicator has issued a buy signal as the signal line crossed above the MACD line, reflecting the prevailing positive outlook.

Source: https://stockchart.vietstock.vn/

|

Following materials, the financial sector also contributed to the market’s upward momentum, although performance within the sector remained mixed. Specifically, on the upside, we saw SSI climbing 0.62%, TCB up 1.35%, MBB advancing 0.84%, and NAB surging 3.94%… Meanwhile, SHB, TPB, VPB, and VND were unchanged, and some stocks continued to face selling pressure, including HDB, down 0.57%, MSB, falling 0.44%, and CTG, declining 0.29%…

In contrast, the telecommunications sector exhibited a divergent trend, with selling pressure concentrated in VGI, down 0.64%, VNZ, falling 7.16%, LBE, plunging 9.09%, and FOX, slipping 0.89%…

Compared to the opening, buyers maintained a slight edge. There were 359 gainers and 212 decliners.

Market Open: Caution Lingers

As of 9:30 a.m. on September 16, the VN-Index hovered around the reference level at 1,250 points, with 10 stocks hitting the ceiling price, 225 rising, 1,219 unchanged, 145 falling, and 7 hitting the floor price.

At the Government Standing Committee meeting on September 15, Minister of Planning and Investment Nguyen Chi Dung reported that Typhoon No. 3 (Yagi) and its aftermath affected 26 northern provinces and Thanh Hoa province. These regions account for over 41% of the country’s GDP and 40% of its population.

According to the Ministry, Typhoon Yagi caused approximately 40,000 billion VND in damage to people’s and state property. Additionally, the Ministry of Planning and Investment reported that around 257,000 houses, 1,300 schools, and numerous infrastructure works were damaged or collapsed, and there were 305 dyke incidents, mainly involving major dikes.

As of 9:30 a.m., the materials sector led the way with a strong showing from the get-go. Notable performers included DPM, up 1.55%, DCM, climbing 1.18%, HPG, advancing 1%, NKG, rising 0.95%, HSG, up 0.75%, and CSV, gaining 0.13%,…

Next was the industrial sector, with most stocks in the group trading in positive territory. Specifically, PC1 rose 0.87%, VCG climbed 1.1%, BCG advanced 0.94%, DGT surged 3.03%, and NHH increased 1.41%,…

The Stock Market ‘Anticipates’ Next Week’s Key Event

The market experienced a rather dull trading week, with the last two sessions seeing the lowest liquidity since April 2023. Investor sentiment seems to be heavily impacted by the aftermath of the third storm, which disrupted the business operations of a significant number of enterprises. The market is also awaiting the response of the State Bank of Vietnam following the interest rate cut by the Federal Reserve.

The Stock Market Plunge: NVL, DRH, NRC, and VNZ Take Center Stage as the Market Sheds Over 22 Points

The stock market witnessed a downward trend last week, with the VN-Index shedding over 22 points. Novaland (NVL), DRH Holdings (DRH), and Danh Khoi (NRC) stocks, along with tech “unicorn” VNG (VNZ), saw a surge in trading. Meanwhile, a company’s announcement of a 70% cash dividend caused its stock to soar towards its historical peak.