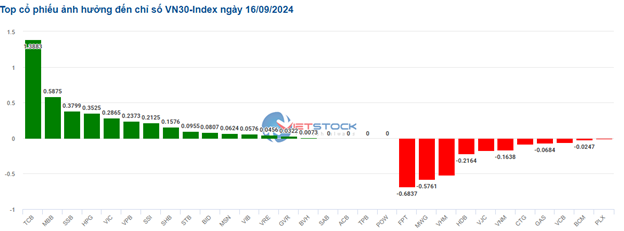

Most of the stock codes in the VN30 basket surged, with notable performances from TCB, MBB, SSB, and HPG, contributing 1.39 points, 0.59 points, 0.38 points, and 0.35 points to the VN30 index, respectively. On the flip side, FPT, MWG, VHM, and HDB faced selling pressure, dragging the index down by nearly 2 points.

Source: VietstockFinance

|

The materials sector witnessed a positive start, with fertilizer stocks leading the way. The three giants in this industry, DPM, DCM, and BFC, rose by 2.25%, 1.18%, and 2.11%, respectively. Additionally, chemical stocks such as DGC (+0.7%) and steel stocks like HPG (+0.4%) and NKG (+0.48%) also contributed to the sector’s gains.

From a technical perspective, DPM has been trading sideways in the long term, but on September 16, 2024, its share price surged, forming a Rising Window candlestick pattern with increased volume. This indicates a potential break above the 20-day average and reflects a positive investor sentiment.

Moreover, DPM’s price is testing the neckline of an Inverse Head and Shoulders pattern. If the recovery scenario plays out, the price target is expected to be in the range of 41,500-42,500. The MACD indicator also supports this positive outlook, as the signal line has crossed above the MACD line, suggesting a buy signal.

Source: https://stockchart.vietstock.vn/

|

The financial sector also contributed to the market’s upward momentum, although stock performances were mixed. SSI, TCB, MBB, and NAB rose by 0.62%, 1.35%, 0.84%, and 3.94%, respectively, while SHB, TPB, VPB, and VND remained unchanged, and HDB, MSB, and CTG faced selling pressure.

In contrast, the telecommunications sector exhibited a contrasting performance, with selling pressure concentrated on VGI (-0.64%), VNZ (-7.16%), LBE (-9.09%), and FOX (-0.89%).

As of the opening, buyers maintained their dominance. There were 359 advancing stocks against 212 declining stocks.

Open: Mixed Sentiments Persist

On September 16, at 9:30 am, the VN-Index hovered around the reference level at 1,250 points. There were 10 stocks that hit the ceiling price, 225 rising stocks, 1,219 stocks standing at the reference price, 145 declining stocks, and 7 stocks falling to the floor price.

At the Government’s Regular Meeting on September 15, the Minister of Planning and Investment, Nguyen Chi Dung, reported that Typhoon No. 3 (Yagi) and its aftermath affected 26 northern provinces and Thanh Hoa province, which account for over 41% of the country’s GDP and 40% of its population.

According to the Ministry, the typhoon caused losses of VND 40 trillion in assets for the people and the State. Additionally, approximately 257,000 houses, 1,300 schools, and numerous infrastructure works were damaged or collapsed, and there were 305 dyke incidents, mainly on major dykes.

As of 9:30 am, the materials sector led the gains, with DPM (+1.55%), DCM (+1.18%), HPG (+1%), NKG (+0.95%), HSG (+0.75%), and CSV (+0.13%) all trading in positive territory.

The industrial sector also displayed strength, with most stocks in this group recording gains. Specifically, PC1 rose by 0.87%, VCG by 1.1%, BCG by 0.94%, DGT by 3.03%, and NHH by 1.41%.

The Pearl of Vietnam Shines Again: Quang Ninh Launches a 3-Day Clean-Up Campaign for Ha Long Bay

The latest update from the Ha Long Bay Management Board in Quang Ninh Province confirms that tourist spots in Ha Long Bay have resumed normal operations and are ready to welcome visitors once again.