Illustration

Oil Prices Slip

Oil prices slipped as U.S. Gulf of Mexico oil production resumed after Hurricane Francine, and data showed a weekly rise in U.S. oil rigs.

Brent crude futures fell 36 cents, or 0.5%, to $71.61 a barrel, while U.S. West Texas Intermediate (WTI) crude futures fell 32 cents, or 0.5%, to $68.65. However, for the week, Brent rose 0.8% and WTI gained 1.4%.

Bob Yager, Mizuho’s energy director in New York, said, “As production and refining in the U.S. Gulf Coast resumed, investors chose to sell off oil contracts at the end of the week.”

The Organization of the Petroleum Exporting Countries (OPEC) and the International Energy Agency (IEA) both lowered their forecasts for oil demand growth this week as the economy of China, the world’s top oil importer, slowed.

U.S. oil inventories rose in the previous week due to increased crude imports and lower exports, while fuel demand weakened, said the Energy Information Administration (EIA).

U.S. Natural Gas Prices Fall

U.S. natural gas prices fell as traders sold off to take profits after prices rose to a two-month high earlier in the session, supported by forecasts of higher demand and lower production in recent days due to Hurricane Francine.

October natural gas futures on the New York Mercantile Exchange fell 5.2 cents, or 2.2%, to $2.305 per mmBtu.

Gold Prices Soar

Gold prices soared, breaking a record high, boosted by expectations that the U.S. Federal Reserve will cut interest rates soon and a weaker U.S. dollar.

Spot gold on the LBMA rose 0.9% to $2,582.04 an ounce. Gold futures for December delivery on the New York Mercantile Exchange rose 1.2% to $2,610.70 an ounce.

Gold prices surged to a new record high and are expected to climb towards $3,000 an ounce, driven by easy monetary policies of major central banks and the intense U.S. presidential election race.

Copper, Aluminum, and Zinc Prices Hit Two-Week Highs

Copper prices hit a two-week high and posted their biggest weekly gain since July, supported by a weaker U.S. dollar and expectations of economic stimulus in top consumer China, which would boost demand.

Three-month copper on the London Metal Exchange rose 0.9% to $9,297.50 a ton after touching $9,314.50, the highest since Aug. 30. Aluminum and zinc also hit two-week highs.

However, copper prices have fallen 16% since the May peak of $11,104, when speculative buying drove prices higher due to concerns about potential shortages in future supply.

The U.S. dollar has come under pressure, making metals priced in the U.S. currency more attractive to buyers holding other currencies, as the Federal Reserve is expected to cut interest rates next week.

Shanghai copper inventories fell 45% in the past three months to 185,520 tons, the lowest since February.

Analysts at Macquarie expected copper prices to average $9,100 a ton this quarter before recovering in the fourth quarter of 2024.

On the London Metal Exchange, aluminum prices rose 2.5% to $2,475 a ton, zinc gained 2% to $2,912.50, while nickel, lead, and tin also climbed.

Iron Ore Prices Fall, Steel Rises

Iron ore prices on the Dalian Commodity Exchange fell but posted weekly gains, supported by China’s new economic stimulus plans and recovering steel demand, despite the slow recovery of the top consumer’s economy.

January 2025 iron ore on the Dalian Commodity Exchange fell 0.29% to CNY 694 ($97.72) a ton. However, for the week, iron ore gained 1.76%.

October 2024 iron ore on the Singapore Exchange also fell 2.17% to $92.70 a ton.

On the Shanghai Futures Exchange, hot-rolled coil climbed 1.06%, rebar gained 1%, galvanized coil added 0.55%, and stainless steel rose 0.04%.

Japanese Rubber Prices Rise for the Week

Japanese rubber prices fell as traders sold off to take profits after recent gains and a stronger yen, but rubber posted a weekly gain due to supply concerns from top producer Thailand.

The rubber contract for February 2025 delivery on the Osaka Stock Exchange fell 6.1 yen, or 1.67%, to 358.9 yen ($2.54) per kg. Rubber prices rose 2.6% for the week.

Meanwhile, January 2025 rubber on the Shanghai Futures Exchange rose 185 yuan, or 1.1%, to 17,025 yuan ($2,397.75) a ton.

October 2024 rubber on the Singapore Exchange fell 0.2% to 184.9 U.S. cents per kg.

Coffee Prices Climb

Robusta coffee prices on the London market hit their highest level in at least 16 years due to weather concerns and tightening supplies.

November robusta coffee on the London market rose 2% to $5,180 a ton after touching $5,190, the highest since at least June 2008.

December arabica coffee on ICE rose 2.4% to $2,554 a lb. For the week, coffee gained 5%.

Sugar Prices Sweeten

October raw sugar on ICE rose 1.7% to 19.39 cents a lb, while October white sugar on the London market climbed 1.8% to $549.60 a ton.

Wheat Prices Reach 12-Week High, Corn Climbs, Soybeans Slip

Wheat prices on the Chicago Board of Trade rose to a 12-week high as the conflict between Russia and Ukraine intensified, raising concerns about exports from the Black Sea region.

Chicago Board of Trade December wheat rose 16-1/4 cents to $5.94-3/4 a bushel, the highest since mid-June. Wheat gained 4.9% for the week. December corn added 7-1/4 cents to $4.13-1/4 a bushel, while November soybeans fell 4-1/2 cents to $10.06-1/4 a bushel.

Palm Oil Prices Hit Three-Week Low

Malaysian palm oil prices fell for the second consecutive session to a three-week low due to a stronger ringgit and weaker demand, overshadowing concerns about sunflower oil supplies from the Black Sea region.

November palm oil on the Bursa Malaysia Exchange fell 39 ringgit, or 1%, to 3,813 ringgit ($887.16) a ton. Palm oil lost 2.2% for the week.

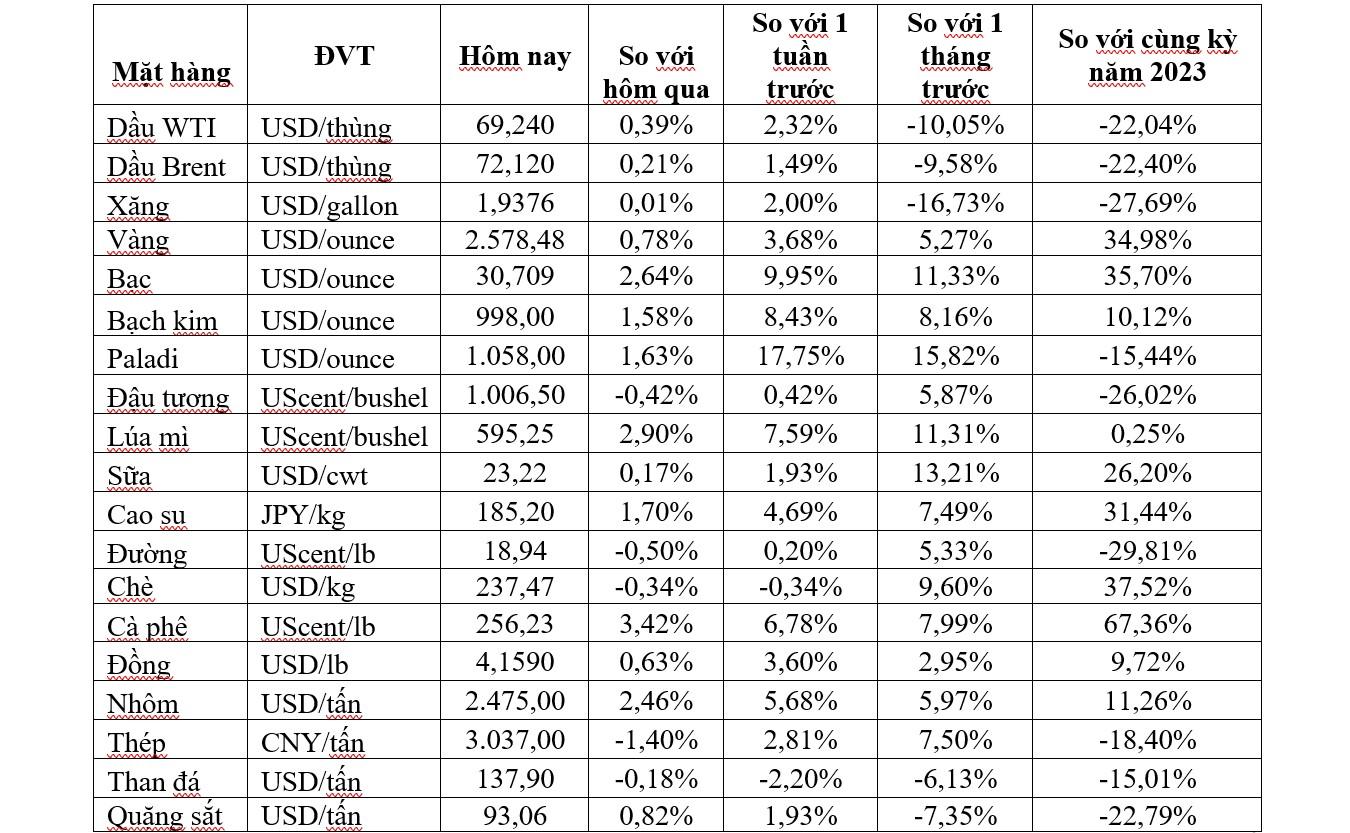

Key Commodity Prices on Sept. 14

The Cautious Analyst After Gold Surges to New Highs

The price of gold surged on Friday, breaking all previous records, as markets were buoyed by optimism that the Federal Reserve would cut interest rates. This move is expected to stimulate gold investments as the US dollar weakens.