Saigon Capital Joint Stock Company has recently submitted a periodic financial report for the first half of 2024 to the Hanoi Stock Exchange (HNX).

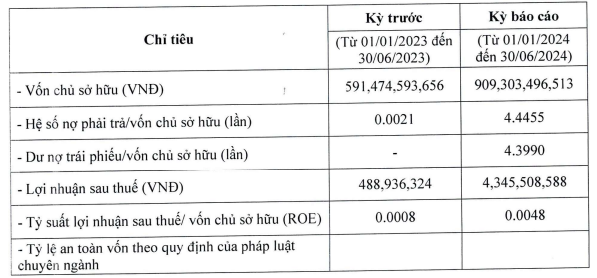

According to the report, Saigon Capital posted a net profit of 4.3 billion VND in the first half of this year, nine times higher than the same period last year.

As of the end of June 2024, the company’s equity stood at over 909 billion VND, a 54% increase compared to the previous year. The debt-to-equity ratio increased significantly to 4.4455, equivalent to a total debt of 4,042 billion VND, mostly in bond debt.

Source: HNX

In the first half of 2024, Saigon Capital repaid over 250 billion VND in bond interest. According to the HNX announcement, Saigon Capital has four bond issues currently in circulation, each valued at 1,000 billion VND, with a five-year maturity and a fixed interest rate of 12.5%/year. These bonds were issued between September and December 2023.

The specific bond codes are: SGGCH2328001, maturing from 29/09/2023 to 29/09/2028; SGGCH2328002, maturing from 05/10/2023 to 05/10/2028; SGGCH2328003, maturing from 08/11/2023 to 08/11/2028; and SGGCH2328004, maturing from 04/12/2023 to 04/12/2028. This indicates that Saigon Capital successfully raised 4,000 billion VND through bond issuances within a four-month period in 2023.

The collateral for these bond issuances includes all rights and interests arising from a business cooperation contract between Saigon Capital and Viet Nam Hiép Phong Co., Ltd., as well as all balances and rights to assets arising from dedicated collection accounts for bond issuances and loan agreements with HDBank. These assets serve as collateral for the company’s borrowings from the bank.

The aforementioned bond issuances by Saigon Capital aim to raise capital for the Our City urban area project in Hai Thanh ward, Duong Kinh district, Hai Phong city. This project is developed by Viet Nam Hiép Phong Co., Ltd. (a subsidiary of Hong Kong-based Hiép Phong Group) under a business cooperation contract signed in September 2023 between the two companies.

The Our City urban area spans over 43 hectares and was initiated by Viet Nam Hiép Phong Co., Ltd. in 2008. According to the master plan, the total construction area of the project is 680,871 square meters, comprising six zones. Five of these zones are dedicated to ecological housing, featuring detached and semi-detached villas, while the sixth zone is allocated for a large-scale commercial complex.

The project encompasses 2,001 apartments and has a total investment of 10,548 billion VND. Although the project was scheduled to be completed within five years from its commencement in 2008, only a portion of it, covering nearly 8 hectares of land, has been constructed so far.

Regarding the issuer, Saigon Capital was established on August 12, 2019, with an initial charter capital of 590 billion VND. The founding shareholders included Mr. Huynh Thanh Hai, holding 98% of the capital, and Mr. Lam Tuan Vinh and Mr. Cao Phu Huu, each holding 1%.

Initially, the company operated primarily in the field of management consulting (excluding financial and accounting consulting), with its head office located at 22 Ly Tu Trong, Ben Nghe ward, District 1, Ho Chi Minh City. Mr. Huynh Thanh Hai served as the Director and legal representative.

In December 2020, Saigon Capital shifted its main business line to debt brokerage, debt consulting, and debt trading activities.

Since October 2023, Mr. Nguyen Trong Tuan (born in 1978) has been appointed as the Director and legal representative of the company.

Notably, in April 2024, the company increased its charter capital to 903 billion VND. In June 2024, Saigon Capital relocated its head office to 51 Hoang Dieu, Ward 10, Phu Nhuan District, Ho Chi Minh City. At present, the company has five employees.

Despite being in the market for five years, there is limited information available about real estate projects invested and developed by Saigon Capital.