Global gold prices surged during Thursday’s trading session (September 12), setting an all-time high record, as US inflation data increased the likelihood of a significant Federal Reserve rate cut next week. The European Central Bank’s (ECB) rate cut also boosted the precious metal’s prices.

At the close of the New York market, spot gold rose by $47.8/oz compared to the previous session’s close, equivalent to a 1.9% increase, reaching $2,559.3/oz.

As of 8 a.m. Vietnamese time on September 13, spot gold prices climbed by $7.6/oz compared to the US close, equivalent to a 0.3% increase, settling at $2,566.9/oz. Converted at Vietcombank’s selling exchange rate, this price is equivalent to about VND 76.5 million/troy ounce, a VND 1.7 million/troy ounce increase compared to the previous day.

The catalyst for gold’s breakthrough after a period of fluctuation around the $2,500/oz mark was the shift towards a more accommodative monetary policy stance by central banks worldwide.

The Producer Price Index (PPI) report released by the US Department of Labor on Thursday indicated a 0.2% increase in wholesale prices in August compared to the previous month, in line with analysts’ forecasts. On Wednesday, the US Department of Labor also released the Consumer Price Index (CPI) report, which showed a slight increase in core inflation but a decrease in overall inflation for August to its lowest level since February 2021.

Weekly data from the US Department of Labor also showed a slight rise in the number of people filing for initial jobless claims in the week ending September 7, reaching 230,000.

These figures suggest that inflation in the US continues to ease, and the economy is weakening, paving the way for the Fed to cut rates next week.

The market is betting on a 100% chance of a Fed rate cut during the September 17-18 meeting. The probability of a 0.5 percentage point reduction has increased to 43% from below 30% the previous day, while the likelihood of a 0.25 percentage point cut has decreased to 57%, according to data updated this morning from the FedWatch Tool of the CME exchange.

“We’re heading towards a lower interest rate environment, so gold is becoming much more attractive… I think we could see several consecutive rate cuts, rather than a large cut with a few reductions,” said Alex Ebkarian, COO of Allegiance Gold, to Reuters.

In a move that was in line with expectations, the European Central Bank (ECB) lowered its key interest rate by 0.25 percentage points to 3.5% on September 12. A lower-interest-rate environment, not just in the US but globally, benefits gold prices as it is a non-interest-bearing asset.

The sharp decline in the US dollar also fueled gold’s rally to new record highs. The Dollar Index closed Thursday’s session at 101.37, down from 101.83 in the previous session.

“The US job market is continuing to weaken, and if this trend persists, the Fed will cut rates for an extended period,” said Phillip Streible, chief strategist at Blue Line Futures, in an interview with Reuters.

According to Jim Wyckoff, a technical analyst at Kitco News, the short-term technical advantage continues to favor gold bulls targeting December delivery. Their next objective is to firmly establish gold prices above the $2,600/oz level. Conversely, the bears are aiming to push prices below the $2,500/oz mark.

The first resistance level for December gold is $2,583.6/oz, followed by $2,600/oz. The first support level is $2,550/oz, followed by $2,538.7/oz.

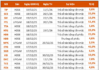

On Thursday, gold futures prices for December delivery on the COMEX exchange settled at $2,580.6/oz, marking the 33rd time that gold futures have reached a record high this year, reflecting a daily increase of $38.2/oz or 1.5%.

“Post-Flood: Curbing Price Hikes, Combating Inflation”

Inflation has eased and market prices have stabilized. However, according to experts, the unpredictable nature of floods and their potential impact need to be considered in the coming months. If the production and business activities in the areas affected by the third storm can be quickly restored, and supply-demand connections are re-established, leading to stable prices, inflation can be kept under control and this year’s GDP growth target can be achieved, or even exceeded.

The Ultimate Guide to Predicting Gold Prices: An Expert’s Surprising Forecast for the Year-End

The experts predict that gold prices will continue to soar to new heights, with the potential for domestic gold prices to reach the staggering threshold of 90 million VND per tael.