Data from VietstockFinance revealed that NDC stocks witnessed a trading volume matching Mr. Vu Anh Tuan’s transactions on September 11th. The total value of the agreement reached 89.74 billion VND, averaging 159,500 VND per share – a 2% premium to the closing price on September 11th (156,700 VND per share)

Mr. Tuan has no related parties at Nam Duoc and only became a major shareholder on July 10th (over 2 months ago) after purchasing 282,320 NDC shares, increasing his ownership from 4.7% to 9.43%. The transaction value at that time was 35.29 billion VND, averaging 125,000 VND per share.

Excluding the shares bought in July, Mr. Tuan temporarily profited nearly 10 billion VND.

On the stock market, NDC stocks are illiquid, with an average matched volume of only 555 shares per session since the beginning of the year. Starting in late August, NDC stocks surged, pushing the share price from the 125,000 VND range to a year-high of 184,500 VND on September 5th, an increase of nearly 48%.

In the afternoon session on September 16th, the NDC share price remained stagnant at the reference price of 148,000 VND, down nearly 20% from its peak and a 9% decrease since the beginning of the year.

| Price Movement of NDC Shares Since the Beginning of 2024 |

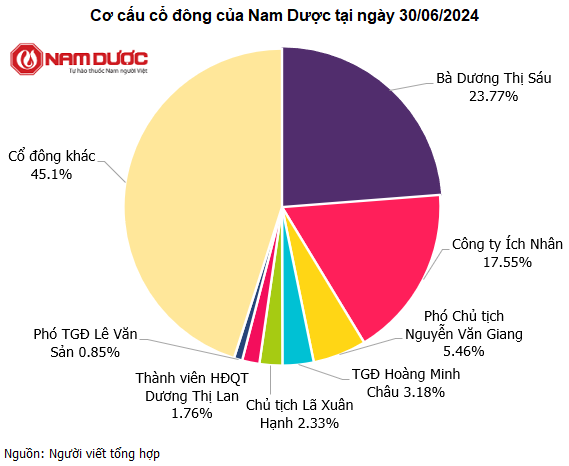

The illiquidity of NDC stocks is largely due to the concentrated ownership structure of the Company. As of June 30, 2024, Ms. Duong Thi Sau was the largest shareholder, owning 23.77% of the capital;

|

Ms. Duong Thi Sau and Duoc Pham Ich Nhan Company are related parties of Mr. Hoang Minh Chau – General Director of Nam Duoc. Mr. Chau also directly owns 3.18% of NDC capital.

Additionally, several Nam Duoc leaders hold a few thousand to a few hundred thousand shares, notably Chairman of the Board of Directors, La Xuan Hanh, with 2.33% capital ownership; Board member Duong Thi Lan with 1.76%, and Board member and Vice General Director Le Van San with 0.85%.

How is Nam Duoc performing?

In terms of business performance, over the last five years (2019-2023), Nam Duoc recorded an average annual revenue of 683 billion VND and an average net profit of 84 billion VND. In 2022, the Company reached its peak in both revenue and profit, earning 907 billion VND in revenue and a net profit of 131 billion VND.

In 2023, revenue slightly decreased by 8% to 830 billion VND, and net profit reached 96 billion VND, a 27% decrease compared to the previous year. The Company attributed this to the impact of the economic situation, reduced demand for pharmaceutical and health care products, and the ineffectiveness of the 2 showroom sales channel (direct retail).

| Financial Results of NDC for the Last 5 Years |

Regarding dividend history, Nam Duoc started paying dividends to shareholders after listing its shares on the UPCoM exchange in 2010, with a ratio ranging from 8-25%. In the last five years (2019-2023), the dividend ratio remained at 25% in cash, except for 2021, when it was 20%.

|

Nam Duoc was established in 2004 with initial chartered capital of 3.5 billion VND by 23 founding shareholders. The company’s initial business focused on agency purchasing, consignment, and trading of pharmaceuticals, cosmetics, and food products… Since 2009, Nam Duoc has specialized in developing herbal medicines, discontinuing the production of synthetic drugs. The company’s well-known product lines, including “Da Day Nam Duoc,” “Dai Trang Nam Duoc,” “Bao Xuan Gold,” and “Siro Ho Cam Ich Nhi,” are widely distributed in the market. After five capital increases, Nam Duoc’s chartered capital has reached nearly 60 billion VND, over 17 times its initial capital. The legal representative is Mr. Hoang Minh Chau, the General Director of the Company. |