As soon as the negative impacts from the downturn in global stocks faded, the domestic stock market was hit last week by the “flood” of Storm Yagi (Storm No. 3). After a strong reaction at the beginning of the week, along with the flood reaching its peak and the water receding, the stock market also had three more balanced sessions…

The highlight of this balance is that liquidity fell very significantly, especially in the last two days, with the HoSE and HXN matching value reaching an average of 9,800 billion VND/session. As the VN-Index and stock prices did not fall further in this very small liquidity, experts said that this was a signal of a significant reduction in selling pressure, especially when the market was in a correction phase.

After initially reacting quite negatively to the flood situation, the market has become calmer. The consequences of Storm No. 3 are quite severe, affecting people’s lives as well as production and business. However, according to experts, the impact is quite localized and has not yet affected key sectors and areas. The impacts on food prices, inflation, transportation logistics, industrial production, agriculture… may be reflected in the macro data of September or early Q4, but are still assessed to be short-term and do not affect the 2024 growth prospect.

Experts also said that the Government will soon have many solutions to overcome the consequences of the storm and flood to ensure people’s lives and production and business. This will quickly restore operations, reduce the burden on businesses, and maintain growth momentum. Among them, credit measures are expected to have a positive impact on the stock market.

Nguyen Hoang – VnEconomy

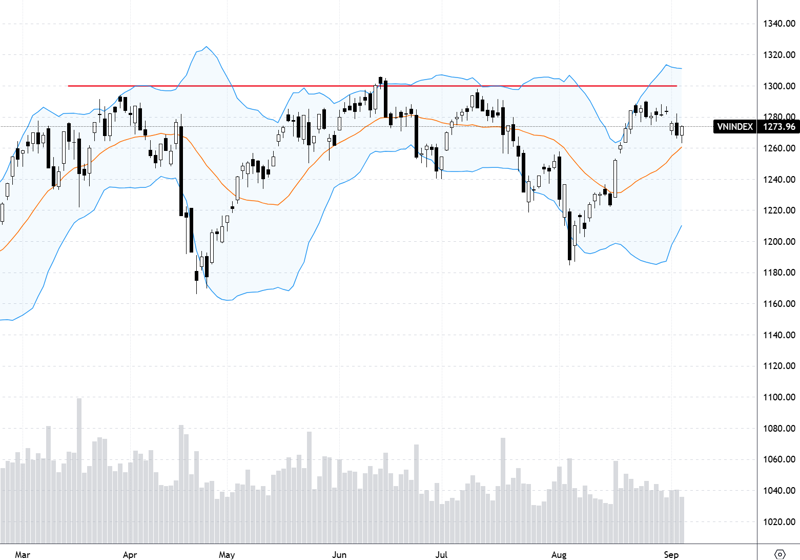

VN-Index has reacted quite well to the 1250-point mark that you expected last week, and liquidity in this area has dropped to a very low level. Is that a good sign? What signals are you waiting for to confirm that this correction phase is over?

In this area, I am waiting for the index to adjust a little more to the support zone of 1220-1240 points and have good demand participation again, then it is possible to signal the end of the correction phase.

Nguyen Thi My Lien

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

Looking at the 1-hour chart, the VN-Index is forming a 5-wave structure and is currently likely to have ended wave 4 in the 50% fibo area, creating a Three Bar reversal cluster of candles; thus, the probability is very high that the index has entered wave 5 and will head towards the area around 1300 points or 1320 points.

In terms of daily candles, the VN-Index has slowed down the downward momentum with low liquidity and has continuously created pulling feet candles, which is also a signal for us to expect a reversal. In addition, on Friday, the leading stocks from the bottom were Securities and Real Estate, which performed very well. To confirm the end of the correction phase, I need more signals from daily reversal candles and better participation of cash flow.

Nghiem Sy Tien – Investment Strategy Specialist, KBSV Securities

The index rebounded after touching the 124x threshold, indicating that active bottom-fishing cash flow is still waiting for a good buying opportunity. However, liquidity has continuously been maintained at a low level and has been moving sideways with a narrow amplitude, reflecting a lack of information and a lack of basis for trading. Therefore, at least until events with a large impact such as the Fed meeting, the announcement of Q3 business results, I expect signals from large-cap and large-volume stocks to bottom out first and lead the rebound.

Nguyen Huy Phuong – Senior Head of Analysis Center, Rong Viet Securities

The VN-Index has reacted quite well to the 1250-point mark, with a quick move back above this level in the sessions of 11/09 and 13/09. The decline in liquidity shows that cash flow is still quite hesitant due to the downward impact after the 2/9 holiday. However, low liquidity also recorded a cooling-down supply and did not cause much pressure when the index fell back to the support area after the previous profit-taking sessions. Therefore, the current situation has mixed signals.

To conclude that the correction phase is over, I think we need to see the 1250-point support area maintained and more decisive cash flow, especially a quick move up to the 1260-point area.

Money flow trend: More supportive information, will Vietnamese stocks go against the world?

Storm No. 3 devastates the North

Nguyen Thi My Lien – Head of Analysis Department, Phu Hung Securities Company

The market continued to fall last week. Although there was a session of decline with an increase in volatility, overall, for the nearly 3-week correction phase, I see that the correction signal is not too bad when the candle volatility comes with a decrease in volume, indicating a weakening selling pressure.

In this area, I am waiting for the index to adjust a little more to the support zone of 1220-1240 points and have good demand participation again, then it is possible to signal the end of this correction phase.

Le Duc Khanh – Director of Analysis, VPS Securities

Storm Yagi has caused great damage to the economy – Instead of bouncing back, the stock market continued to accumulate more on the strong support area of 1250 points. The Fed will soon announce a rate cut next week, Vietnam’s macro-economy is favorable… The only thing is that investors are still cautious and not really excited about bottom-fishing. I think that a few sessions of strong recovery with high liquidity will be the good signal that many investors are expecting, especially in the coming trading week.

Nguyen Hoang – VnEconomy

The main concern that caused the market to adjust last week was the flood situation, which caused great damage. The market is concerned that these impacts will adversely affect production and business activities and growth opportunities in the remaining months of the year. How do you assess this risk?

Nghiem Sy Tien – Investment Strategy Specialist, KBSV Securities

The recent developments of Storm Yagi and its aftermath have caused great damage to infrastructure and production and business activities. However, I think that the impact of the storm and flood is only localized or clearly affects certain sectors such as agriculture. In the short term, the supply of pork in the North will decrease and may be in short supply when repopulation continues to be interrupted by floods and African swine fever. Therefore, hog prices are expected to continue to rise, and businesses that can maintain production will benefit. Next is the rice industry, but it is difficult to quantify the impact as the main rice bowl of Vietnam is still in the Mekong Delta region.

Nguyen Huy Phuong – Senior Head of Analysis Center, Rong Viet Securities

Storm Yagi and its impacts are currently the focus of the whole country. It has not only caused loss of life but also great damage to infrastructure, trade, and production in many key economic provinces and cities of the country.

Typically: The storm has seriously affected crops and disrupted supply chains, leading to increased costs in the coming crop. Prolonged heavy rains caused flooding and disrupted projects, forcing contractors to temporarily stop construction, increasing costs due to prolonged progress. In addition, trade activities were also interrupted as some seaports in the North may have to close…

These issues directly affect production and business activities and pose great challenges to the economy. However, in my personal opinion, these impacts may only be short-term in September and early Q4/2024.

During the recovery from the storm and its aftermath, areas that are less or not affected by the storm may increase production to make up for the shortage in affected areas.

After efforts to cope with the storm and its aftermath, the Government is expected to issue support policies to help the affected areas recover quickly. At the same time, the risk of tight money will be low, and it is likely that the State Bank will maintain a loose monetary policy in the coming time to support the economy. In addition, reconstruction activities will also create opportunities for some sectors.

Therefore, in my personal opinion, the impact of Storm Yagi on the Vietnamese stock market is short-term. In addition, investors may also be cautious to have time to evaluate and consider the negative or positive impacts on each sector and each enterprise. This leads to the poor liquidity of securities in the current period.

There is a basis for strong credit growth at the end of the year, as credit growth for the whole industry as of August 15 has only reached 6.11%, far from the target of 14% by the end of 2024.

Nghiem Sy Tien

Nguyen Thi My Lien – Head of Analysis Department, Phu Hung Securities Company

Storm Yagi will definitely affect the economy because its impacts are still occurring in the northern provinces of our country. There are two points that we note. One is the surge in the prices of goods, especially food, after the storm, thereby inflation may increase slightly in the short term, although gasoline prices have been adjusted down deeply.

Second is the impact on production and business activities as well as import and export of Vietnam when factories and machinery in the northern regions are heavily affected, including both FDI and domestic enterprises. That is, the storm and flood will affect both important indices of the economy, which are inflation and economic growth.

However, I think that these impacts will only be short-term as the Government is currently making great efforts to overcome the consequences of the storm, including both actions and policies. The deep drop in the exchange rate at the moment also creates conditions for the State Bank to be more confident in implementing a “loose” monetary policy. We believe that in the future, the Government and the State Bank will implement stronger support policies to restore the economy, thereby helping economic growth to maintain a good growth momentum.

Le Duc Khanh – Director of Analysis, VPS Securities

This is the recovery phase – The stock market also needs more time to accumulate and recover, even though the upward trend from now to the end of the year is still considered the main trend. The market’s adjustment and accumulation also partly reflect a cautious mentality, waiting for a consensus signal to increase – the securities group has shown signs of improvement. The recovery of production and business in the last months of the year supports the general trend of securities.

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

According to statistics of the past 5 years, the movement of the VN-Index after the storm, in 4 out of 5 years, the market increased well after the storm, only the Noru storm in September 2022, the market adjusted down. Thus, in history, the index is rarely negatively affected by storms.

In the short term, the VN-Index has had correction sessions due to concerns about the negative impact of the storm while the world is moving quite positively.

Nguyen Hoang – VnEconomy

The market expects credit supply to be stronger at the end of the year, especially when the impact of Storm No. 3 is a new variable and credit growth at this point is still very low, the favorable exchange rate trend. Will this create more momentum for the stock market?

According to statistics of the past 5 years, the movement of the VN-Index after the storm, in 4 out of 5 years, the market increased well after the storm, only the Noru storm in September 2022, the market adjusted down. Thus, in history, the index is rarely negatively affected by storms.

Nguyen Viet Quang

Nguyen Thi My Lien – Head of Analysis Department, Phu Hung Securities Company

Right after having a rough statistic about the impact of Storm Yagi, I saw that the State Bank asked the banking system to assess and come up with measures and credit packages to support businesses and people to overcome the consequences of the storm, even to reduce interest rates, restructure repayment terms, consider interest exemption…

What is important is that the monetary policy view will tend to support the economy and, along with the favorable condition of the exchange rate as I mentioned above, I believe that the interest rate level will be stable at a low level and there will be more supportive policies, and credit will also be pushed stronger. These policies will positively affect the operations of enterprises, although it is undeniable that production and business activities will be at risk and affected in the short term, but I believe that the economy will soon recover and thereby become a driving force for the stock market.

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

I always hold the view that “In danger, there is opportunity”. The impact of Storm No. 3 will affect many businesses, but there will also be many government support policies for businesses to recover (possibly increasing credit supply with preferential interest rates, adjusting down interest rates for existing loans,…) and develop stronger than before.

Nguyen Huy Phuong – Senior Head of Analysis Center, Rong Viet Securities

In general, up to the end of June 2024, according to the State Bank, the bad debt ratio, including on-balance sheet bad debt, potential debt, and restructured debt, was at 6.9% (including debt restructured according to Circulars 02, 06). The rate of bad debt increase is faster than credit growth, and the bad debt coverage ratio (LLR) continues to decline, indicating that the worry and pressure of bad debt have been and are still present. The positive point for the on-balance sheet bad debt ratio tends to decrease slightly from 4.94% in May to 4.56% in June. At the same time, the handling progress has also improved.

Currently, Storm Yagi has also caused great damage to assets, business and consumption activities of the economy, and this will also affect the group of borrowing customers for production and business when interrupted and damaged. This group of customers also needs time to recover and return to production and business, and may have a chain impact on the value chains of this group of customers.

The impact of Storm Yagi on the Vietnamese stock market is short-term. In

The Unexpected Movement of the Stock Exchange’s ‘Most Expensive’ Shares

The VN-Index rebounded into the green today (September 12th), with the recovery’s momentum hinging on a select few stocks. Notably, VNG’s shares soared to the ceiling price after the company clarified Le Hong Minh’s current role within the organization.

“A Brutal Sell-Off: Investors Abandon Chairman Le Thong Nhat’s NRC Stock”

“Shares of Danh Khoi (NRC), helmed by Chairman Le Thong Nhat, have been on a downward spiral, plummeting to historic lows as investors continue to offload their holdings. The stock’s free fall has sparked concerns among market participants, raising questions about the company’s future prospects and the impact on shareholder value.”