The VN-Index closed the 37th trading week of 2024 at 1,251.71 points, a decrease of 22.25 points or 1.75% from the previous week, with significantly lower liquidity.

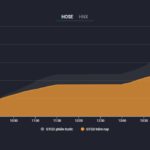

The average trading value of the three exchanges during the past week reached VND 13,766 billion. Specifically, for matched orders, the average trading value was VND 12,964 billion, down 20.4% from week 36 and 24.8% lower than the 5-week average. This is the lowest weekly liquidity in the past 38 weeks (since the end of December 2023).

Selling pressure did not change much compared to the previous two weeks. In fact, the highest selling volume last week (recorded in the afternoon session of September 10) was even lower than the peak of the previous three weeks.

Foreign investors sold a net amount of VND 1,122.2 billion, and for matched orders, they sold a net amount of VND 850.9 billion.

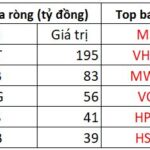

The main sectors that foreign investors bought on a net basis were Information Technology and Real Estate. The top stocks that foreign investors bought on a net basis were FPT, VHM, CTG, VNM, STB, DGC, TPB, DXG, DGW, and FTS.

On the selling side, foreign investors focused on Basic Resources. The top stocks sold by foreign investors were MSN, HPG, VPB, MWG, HDB, VIC, HSG, VCB, and BID.

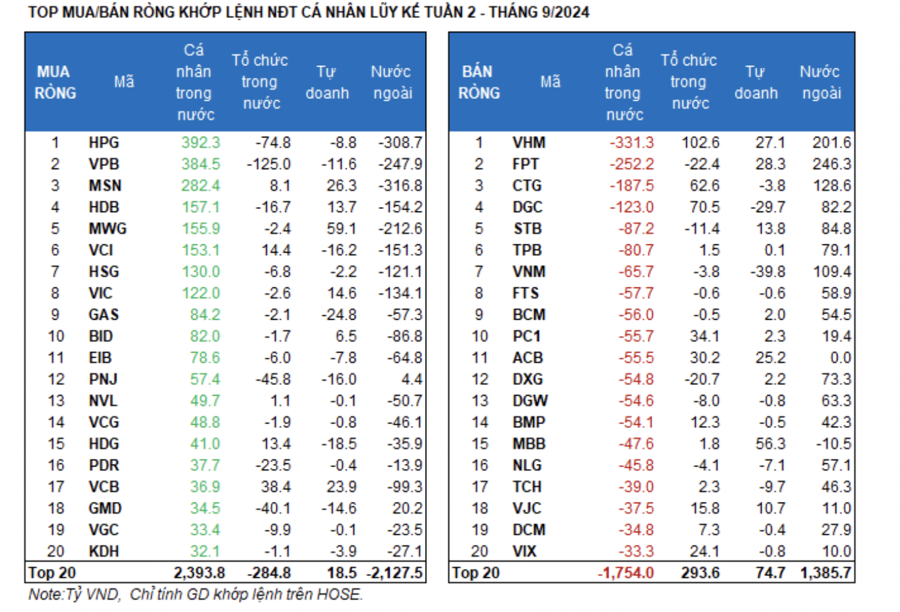

Individual investors bought a net amount of VND 1,318.3 billion, of which VND 731.8 billion was from matched orders. For matched orders, they were net buyers in 11 out of 18 sectors, mainly in Basic Resources. The top stocks bought by individual investors included HPG, VPB, MSN, HDB, MWG, VCI, HSG, VIC, GAS, and BID.

On the selling side, they sold on a net basis in 7 out of 18 sectors, mainly in Information Technology and Real Estate. The top stocks they sold included VHM, FPT, CTG, DGC, STB, TPB, FTS, BCM, and PC1.

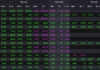

Proprietary trading bought a net amount of VND 329.4 billion, and for matched orders, they bought a net amount of VND 238.9 billion. For matched orders, proprietary trading was net buyers in 11 out of 18 sectors. The sectors with the highest net buying were Banks and Retail. The top stocks bought by proprietary traders this week included MWG, MBB, TCB, DBD, TCD, FPT, VHM, MSN, ACB, and GVR.

The top stocks they sold were in the Financial Services sector. The top stocks sold by proprietary traders included VNM, DGC, GAS, HDG, E1VFVN30, SAB, VCI, PNJ, GMD, and TLG.

Domestic institutional investors sold a net amount of VND 525.5 billion, and for matched orders, they sold a net amount of VND 119.8 billion. For matched orders, domestic institutions were net sellers in 10 out of 18 sectors, with the highest value in Banks. The top stocks sold by domestic institutions were VPB, TCB, HPG, PNJ, GMD, DBD, PDR, FPT, DXG, and TCD.

The sectors with the highest net buying were Financial Services. The top stocks bought by domestic institutions included VHM, DGC, CTG, FUEVFVND, VCB, VIB, PC1, ACB, VIX, and VJC.

Looking at the weekly allocation of funds, the weight continued to decrease in Real Estate, Banks, Steel, and Information Technology, while it increased in Securities, Food, Retail, Chemicals, Gas, Agriculture & Seafood, and Building Materials.

In the group with an increased fund allocation weight, Agriculture & Seafood and Building Materials gained, while the other sectors declined.

In the group with a decreased fund allocation weight, Information Technology stood out as the market index went against the overall market trend and slightly increased by 0.67% for the week (thanks to FPT). The other sectors fell.

Money Flow Strength: Looking at the weekly fund allocation, the large-cap VN30 group saw a decrease in fund allocation, while the mid-cap VNMID and small-cap VNSML groups experienced an increase.

In week 37, the fund allocation to the large-cap VN30 group decreased to 49% from 54.1% in week 36 (a short trading week due to the September 2 holiday). In contrast, the mid-cap VNMID and small-cap VNSM groups saw increases in fund allocation.

In terms of trading value, the average trading value per session decreased for all three groups, with the largest decrease in VN30 (-VND 1,584 billion). This was followed by VNMID (-VND 913 billion) and VNSML (-VND 172 billion).

Regarding price movements, the large-cap VN30 group saw the biggest decline (-1.6%), followed by VNMID (-1.43%) and VNSML (-1.23%).

The Foreign Sell-Off Continues: Over 300 Billion Dong Dumped on Two Blue-Chip Stocks in the Latest Trading Session

The foreign investors continued to net sell with a value of about VND 66 billion on the entire market.

“A Brutal Sell-Off: Investors Abandon Chairman Le Thong Nhat’s NRC Stock”

“Shares of Danh Khoi (NRC), helmed by Chairman Le Thong Nhat, have been on a downward spiral, plummeting to historic lows as investors continue to offload their holdings. The stock’s free fall has sparked concerns among market participants, raising questions about the company’s future prospects and the impact on shareholder value.”