While banks have maintained low deposit and lending rates for an extended period, margin loan interest rates at many securities companies have remained high, typically ranging from 10% to 14% annually. However, recently, several companies have introduced promotional offers to attract investors.

VPS Securities Joint Stock Company, for instance, has launched a promotional package offering a preferential interest rate of just 4.5% per year for the first five days and 8% for the first seven days of margin lending. Previously, existing clients trading through VPS accounts paid an average interest rate of about 14% per year.

VPBank Securities Joint Stock Company (VPBankS) provides loans for stock purchases at an interest rate of 8.6% per annum, with a credit limit of up to VND 5 billion per account. Yuanta Vietnam Securities Company offers margin loans at an interest rate of 6.8% per annum for the first VND 1 billion in debt.

SSI Securities Company will refund 20% of the actual monthly interest received to customers who open new accounts or existing customers who have not used margin from July 1, 2023, to January 19, 2024. The maximum interest refund is VND 5 million per month and VND 50 million per year. SSI’s current lending rate is approximately 13.5% per annum.

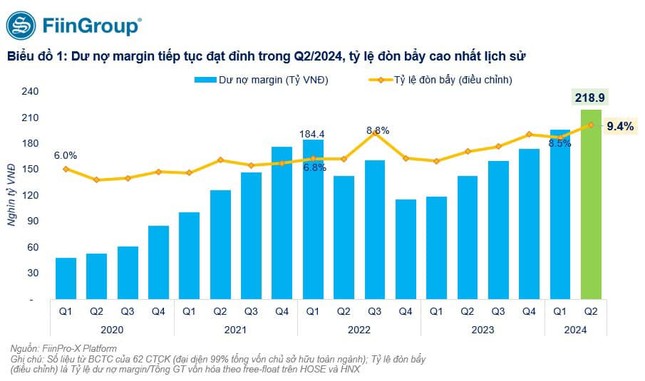

Margin debt of securities companies was estimated at nearly VND 220 trillion at the end of the second quarter. Source: FiinGroup

According to data from FiinGroup, the margin debt of securities companies at the end of the second quarter was estimated at nearly VND 220 trillion, an increase of 11.5% compared to the first quarter.

As of June 30, the total equity of the group of securities companies reached approximately VND 248 trillion. The margin/equity ratio is estimated at about 88%, continuously increasing over the past six quarters.

As per regulations, the margin/equity ratio is limited to 200%. This implies that the lending capacity of securities companies is approximately VND 280 trillion, and this room is even expanding as many companies have successfully raised capital recently.

Racing to Lower Margin Loan Interest Rates

The brokerage firms are in a race to offer the most competitive interest rates, empowering investors with greater access to affordable capital.