Wrapping up the week, the VN-Index declined by 1.75% from the previous week to 1,251 points. Foreign investors net sold VND 1,132 billion on all three exchanges.

Several sectors performed negatively compared to the overall market. Insurance stocks, for instance, fell simultaneously amid concerns over rising compensation costs due to Typhoon No. 3. Two other large-cap sectors, Banking and Real Estate, also witnessed declines. NVL hit the floor due to unfavorable information regarding potential restrictions on margin trading.

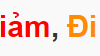

Most industry groups underwent adjustments in the past trading week. Statistics: SHS.

Analysts attributed the subdued trading activities last week to various factors, including prevailing cautious sentiment ahead of significant macroeconomic events. The market is also awaiting the State Bank of Vietnam’s response following the Fed’s rate cut decision. Furthermore, the strongest typhoon in decades disrupted the production and business operations of a portion of enterprises in the northern region.

Looking ahead, according to Bao Viet Securities Company (BVSC), global stock markets will focus on the monetary policy meetings of several major central banks, including the US, UK, and China. The Fed is expected to initiate a rate cut cycle starting from this meeting.

The Fed’s rate reduction is anticipated to support the long-term growth of global stock markets and positively influence Vietnam’s stock market.

From a cautious perspective, experts from Saigon-Hanoi Securities Company (SHS) suggested waiting for improved market liquidity before considering expanding investment portfolios. The recommended investment strategy focuses on leading stocks with solid fundamentals, strong second-quarter financial results, and positive growth prospects for the third quarter.

In the short term, SHS believes that the current price range is relatively reasonable given the market’s growth prospects. Investors can consider increasing or expanding their portfolios when the VN-Index firmly tests the lower bound of 1,250 – 1,255 points in the medium-term accumulation channel, with expectations for improved market conditions.

Liquidity may pick up again after the Fed’s potential rate cut decision next week.

In September, Yuanta Securities anticipates a Fed rate cut and a stabilization of the USD/VND exchange rate, creating conditions for the State Bank of Vietnam to maintain low-interest rates to support the economy.

The growth momentum of enterprises remains strong, although it may slow down due to the slow recovery of major economies and natural calamities. Typhoon No. 3 could impact the projected P/E ratio for this year, but not significantly.

The Stock Market Plunge: NVL, DRH, NRC, and VNZ Take Center Stage as the Market Sheds Over 22 Points

The stock market witnessed a downward trend last week, with the VN-Index shedding over 22 points. Novaland (NVL), DRH Holdings (DRH), and Danh Khoi (NRC) stocks, along with tech “unicorn” VNG (VNZ), saw a surge in trading. Meanwhile, a company’s announcement of a 70% cash dividend caused its stock to soar towards its historical peak.