VN-Index Loses Over 22 Points

The stock market entered a downward trend this week, with 4 out of 5 trading sessions ending in losses. Starting from below 1,270 points, the VN-Index fell towards the 1,250-point level. There was a session where the index dropped below this important support level but managed to recover by the closing bell.

Faced with the market’s volatile performance, many investors chose to stay on the sidelines, resulting in low liquidity throughout the week.

At the end of the week (September 13th), the VN-Index decreased by 4.64 points, closing at 1,251.71 points. In contrast, the HNX-Index rose by 0.51 points to 232.42 points, and the UPCoM-Index also increased by 0.23 points to 92.95 points.

Thus, within just one week, the VN-Index lost more than 22 points.

Read more here

Novaland Shares Plunge Over 10% Following Margin Cut News

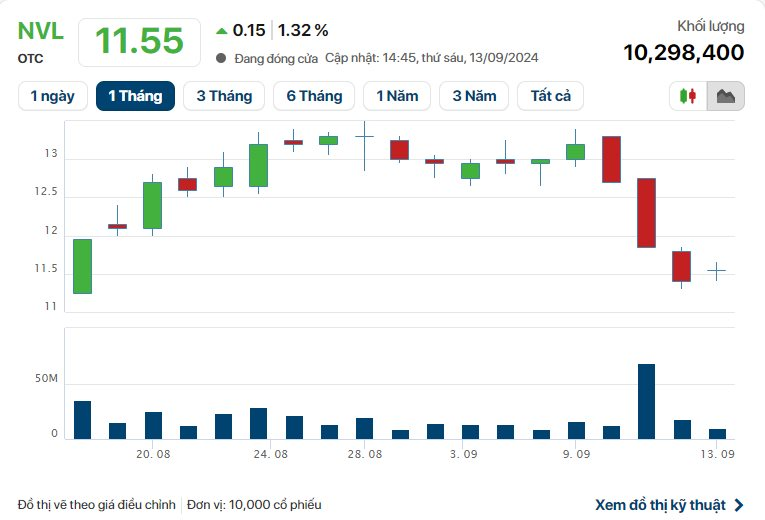

NVL shares of Novaland Investment Joint Stock Company (Novaland) experienced a sell-off by investors after the HoSE cut margin due to a delay in publishing its semi-annual audited financial statement for 2024.

This week, NVL shares dropped in 3 out of 5 sessions, with a weekly loss of over 10%.

Source: Cafef

Specifically, NVL shares started the week with a 1.54% gain, trading at 13,200 VND per share. However, following the news of the HoSE margin cut, NVL witnessed three consecutive losing sessions, with its price plunging by more than 14%. During these three sessions, liquidity surged, with nearly 100 million shares traded via matching orders.

Nonetheless, in the last session of the week (September 13th), NVL shares were aggressively bought back by investors, rising by 1.32% to 11,550 VND per share, with a matching volume of nearly 10.3 million units.

Read more here

DRH Shares of Chairman Phan Tan Dat Surge Back to the Ceiling Price

Following the announcement from the Ho Chi Minh Stock Exchange (HoSE) that it would transfer DRH Holdings Joint Stock Company (HoSE: DRH) shares from restricted trading to suspended trading due to a delay in publishing its semi-annual audited financial statement for 2024, DRH shares witnessed a sharp decline.

Source: Cafef

This development caused DRH’s share price to plummet. At the close of September 9th, DRH’s share price stood at 2,160 VND, a 6.9% decrease compared to the previous session, with a matching volume of over 2.3 million units – nearly eight times higher than the average of the previous ten sessions.

The downward trend continued in the following two sessions on September 10th and 11th, with DRH hitting its daily lower limit. On September 12th, the real estate code decreased by 4.81% to 1,780 VND per share, marking its tenth consecutive losing session.

However, on September 13th, DRH shares of DRH Holdings unexpectedly reversed course and hit the ceiling price, ending a streak of ten consecutive losing sessions (including three floor sessions). At the close of September 13th, DRH’s share price stood at 1,900 VND per share, a 6.74% increase compared to the previous session, with a matching volume of nearly 2.7 million units.

Read more here

Danh Khoi (NRC) Shares of Chairman Le Thong Nhat Continue to be Sold Off

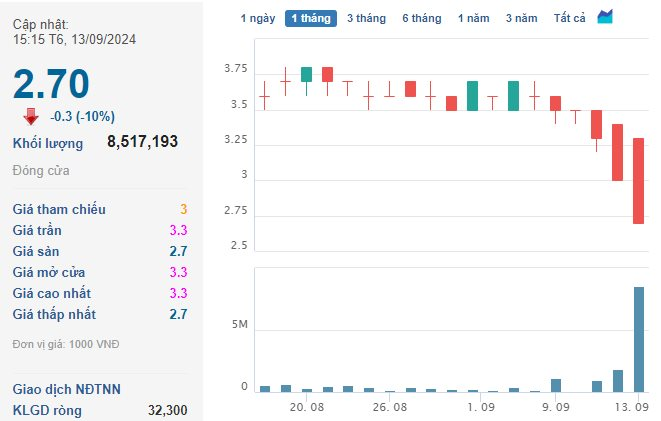

At the close of September 13th, NRC shares of Danh Khoi Group Joint Stock Company stood at 2,700 VND per share, a 10% decrease compared to the previous session, with a matching volume of over 8.5 million units – approximately fifteen times higher than the average matching volume of the past ten sessions.

Source: Cafef

This was the second consecutive session that NRC shares hit the floor price. In the previous session (September 12th), this real estate code fell by the daily limit of 9.09% to 3,000 VND per share, with a matching volume of nearly 1.9 million units.

Looking at the broader picture, NRC shares have declined in 7 out of the last 10 sessions (including 2 floor sessions), with a loss of 33.3%, equivalent to a decrease of 900 VND per share.

Currently, NRC shares are trading at their all-time low since their market debut in 2018.

Read more here

VNG, the “Tech Unicorn,” Experiences Volatility

Following news of changes in the company’s top management last weekend, VNZ shares of VNG Corporation plummeted in the first two sessions of the week, with its share price plunging by nearly 30% in just two days.

However, a subsequent statement from VNG confirmed that founder Le Hong Minh remains the CEO and legal representative of the company, which helped the “tech unicorn” rebound strongly.

Source: Cafef

In the middle of the week, VNG shares surged to the ceiling price for two consecutive sessions, recovering nearly 30% in just two trading days.

In the last session of the week (September 13th), VNZ started to lose momentum, rising by only 2.08% to 418,100 VND per share, with a matching volume of nearly 20,000 units.

Read more here

A Company Prepares to Pay Out 70% Cash Dividends, and Its Share Price Soars to Near All-Time High

After hitting the ceiling price in the previous session, SAC shares of Saigon Port and Services Joint Stock Company continued their upward momentum, climbing by 3.57% to 29,000 VND per share (closing price on September 13th). Thus, within just one month, SAC shares have surged by 32% to approach their all-time high set in late June 2024. Liquidity also spiked, with over 200,000 matching units, far exceeding the average volume of just a few thousand units.

The share price soared following the announcement that September 30th would be the record date for a 70.65% cash dividend payout, equivalent to 7,065 VND per share. With over 3.9 million shares in circulation, the company expects to distribute nearly 28 billion VND in dividends for this period. The expected payment date is October 15th.

Among the shareholders, Saigon Port Joint Stock Company (SGP – a subsidiary of VIMC) is the largest, holding 52.72% of the capital and expected to receive 15 billion VND in dividends. Following closely are Vietnam Prosperity Trading and Investment Joint Stock Company (holding 7.8% capital) and Agricultural Commodities Joint Stock Company (holding 5% capital), which are expected to receive 2 billion VND and 1.4 billion VND in dividends, respectively.

Read more here