Hanoi Stock Exchange (HNX) recently published the financial report for the first half of 2024 of Kita Invest Joint Stock Company.

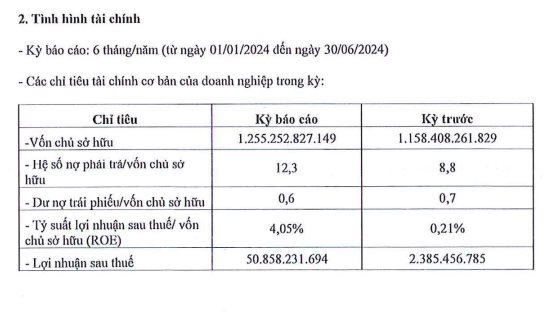

Accordingly, for the first six months of this year, Kita Invest recorded a net profit of nearly VND 51 billion, more than 21 times higher than the same period last year. Kita Invest’s equity increased by 8.4%, from VND 1,158 billion to VND 1,255 billion.

Notably, the bond debt amounted to approximately VND 2,000 billion, bringing the bond debt-to-equity ratio down from 0.7 to 0.6.

Source: HNX

It is known that Kita Invest currently has three bond lots, KITA.BOND2020.03, KITA.BOND2020.07, and KITA.BOND2020.08, traded in the market. All three bond lots were issued in 2020.

KITA.BOND2020.03 has an issue value of VND 500 billion; the circulating value as of June 30, 2024, was VND 400 billion. With a five-year term, this bond lot is expected to mature on May 5, 2025.

The remaining two lots, KITA.BOND2020.07 and KITA.BOND2020.08, have had their terms changed from 48 months to 60 months and are expected to mature on July 30, 2025. The issue value of the two lots, KITA.BOND2020.07 and KITA.BOND2020.08, is VND 200 billion each, and the circulating value (as of June 30, 2024) is VND 200 billion and VND 195.629 billion, respectively.

Thus, the total bond debt of Kita Invest as of June 30, 2024, is only about VND 795.629 billion, a significant decrease compared to the previous period.

KITA Airport City, a 150-hectare urban area project in the center of Binh Thuy District, Can Tho City.

In the real estate market, Kita Invest is known as the investor of the KITA Airport City project, a 150-hectare urban area project in the center of Binh Thuy District, Can Tho City. The project offers 5,000 land plots, ranging from 80 to 170 square meters, including terraced houses, shophouses, villas, and apartments. The total investment capital in this project is VND 8,000 billion.

It is known that Kita Invest belongs to Kita Group Joint Stock Company. In the past two years, KITA Group has expanded into the North with a series of projects in prime locations. Notably, KITA Capital is located within the Nam Thang Long – Ciputra urban area, offering high-end real estate such as detached villas, twin villas, terraced houses, luxury apartments, a 5-star hotel, and a modern financial tower.

KITA Group’s expansion into the North also includes the Stella project in Quoc Oai, Hanoi; the premium Sukura Golf project in Hai Phong; the 58-hectare TAX Resort project in Hanoi; and the 8.2-hectare Hoa Lac urban area project.

Beyond residential real estate, KITA Group is embracing a comprehensive development strategy by venturing into resort projects such as the high-end urban area within the vast Golden Hills project (in Hoa Vang district and Lien Chieu district, the northwestern gateway of Da Nang city). This will be followed by Stella Ocean Park in Phan Thiet.

According to KITA Group’s leadership, these two projects will be the inaugural ventures for the corporation’s luxury real estate brand, which it aims to develop in many beautiful coastal areas nationwide.

Mobilizing Over 45 Trillion VND in Government Bond Auctions in August

In August 2024, the Hanoi Stock Exchange organized 16 auctions of government bonds issued by the State Treasury, raising VND 45,283 billion, a 24% increase compared to July. The State Treasury offered 5-year, 10-year, 15-year, 20-year, and 30-year maturities, with the 10-year maturity maintaining the highest issuance volume, accounting for 63% of the total successful bids.