Interest rates continue to fall

This figure is higher than the 6.9% growth rate at the end of September last year. This indicates that capital is also being pushed by banks into production and business, in line with the Government’s directive.

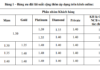

Credit growth is promising, given the economic challenges, according to industry experts, due to the flexible and aggressive policy implementation by the SBV. Allocating the entire 15% credit growth target as early as the end of 2023 has created favorable conditions for commercial banks to take the initiative in credit granting. In addition, the SBV has implemented appropriate solutions through market tools to gradually lower interest rates. According to current data, the deposit interest rate is at 3.84%/year, up 0.23%/year. However, the lending interest rate for new loans is 6.23%/year, down 0.86%/year compared to the end of 2023. In addition to lowering lending rates, banks have continuously offered preferential credit packages “tailor-made” for different customer segments.

OCB has just launched a preferential loan package with an interest rate of only 5.2%/year, a loan term of 24 months, and a loan limit of up to VND 10 billion to support customers in developing and doing business and preparing for the end of 2024. This is an opportunity for businesses and households to reduce interest rate burdens and efficiently utilize capital for investment projects, expand production, or upgrade technology.

ABBANK has launched a series of special promotions for individual customers seeking capital to expand their business before the year-end peak season. Specifically, the bank’s business loan package has an interest rate of only 4.99%/year, with a loan term of up to 24 months. In addition, the bank will also deploy “superfast” disbursement within three days, helping customers seize business opportunities promptly.

Mr. Khuong Duc Tiep, Permanent Deputy General Director of ABBANK, shared that, in 2024, the bank has been and is continuing to strongly deploy many promotional programs for individual customers. ABBANK’s preferential packages aim to diversify fields and purposes, maximizing customers’ choices, bringing many benefits, and meeting their needs and financial situations.

Notably, Agribank has just allocated an additional VND 100,000 billion in preferential capital to serve individual customers investing in production and business with an interest rate of only 3.5%/year for short-term loans and only 6.0%/year for medium and long-term loans. These interest rates are 1.5%/year lower than Agribank’s current lending rate and are among the lowest in the market.

The increase in deposit interest rates and the decrease in lending interest rates also mean that banks have shared a lot with enterprises. “Although banks have to pay higher interest rates to depositors, the lending rates have decreased, narrowing the input-output gap. This shows that banks are willing to sacrifice profits to share with businesses and people,” emphasized Mr. Dao Minh Tu, Permanent Deputy Governor of the SBV.

Banks are deploying many credit packages with preferential interest rates to support enterprises

Don’t just rely on interest rates

Sharing about the move of many banks to increase deposit interest rates in the past time, the CEO of a mid-sized joint-stock commercial bank said that the slight increase in deposit interest rates ensures a positive real interest rate, which is attractive enough to channel money into banks to meet the demand for capital increase at the end of the year, especially when there is still a lot of room for credit growth.

It can be said that banks have prepared sufficient capital and are trying their best to promote credit growth in the last months of the year. However, what is important now is the capital absorption capacity of enterprises and the mechanism to stimulate loan demand. Experts believe that this requires many other macro policies, not just monetary policies or the efforts of banks to lower lending interest rates.

According to Dr. Vo Tri Thanh, a member of the Monetary and Financial Policy Advisory Council, there is still room for lowering lending interest rates, but it is very limited. This is because the deposit interest rate floor is inching up. Banks can try to cut costs in their business operations, but they cannot significantly reduce lending rates as it will strongly affect NIM in the short term and operational safety in the long run. “In the past time, banks have already sacrificed a lot of profits to share with customers. To maintain the current lending interest rate, banks have made great efforts,” said Dr. Vo Tri Thanh.

Sharing this view, Mr. Phan Dung Khanh, Investment Advisory Director of Maybank Investment Bank, said that although the Fed’s interest rate cut helps stabilize Vietnam’s interest rate trend, it is difficult to cut it further. Because low-interest rates also put pressure on exchange rates.

From a banking perspective, Mr. Ngo Quang Trung, CEO of BVBank, said that banks also have to pay interest to depositors and balance capital sources to ensure safety ratios. Therefore, with the high-interest rate capital that banks have mobilized in the past time, we must now maintain a stable interest rate or a higher trend to avoid losing the gap between mobilization and lending. Moreover, we need to meet the diverse and increasing capital needs of the economy in the last months of the year. In other words, lending rates are unlikely to fall further, after a decrease of about 0.96%/year compared to the end of 2023 by commercial banks.

Mr. Phung Xuan Minh, Chairman of Saigon Ratings, said that businesses and borrowers, in general, should not expect lending rates to fall further. This is because the bad debt ratio has been increasing significantly recently, leading to higher provisioning costs for banks.

To support economic growth in the coming time, BIDV’s research team proposes that fiscal policy should continue to play a key role, expanding in a focused and targeted manner, associated with promoting public investment disbursement. Monetary policy should be proactive and flexible, increasing capital access for businesses…

The Stock Market ‘Anticipates’ Next Week’s Key Event

The market experienced a rather dull trading week, with the last two sessions seeing the lowest liquidity since April 2023. Investor sentiment seems to be heavily impacted by the aftermath of the third storm, which disrupted the business operations of a significant number of enterprises. The market is also awaiting the response of the State Bank of Vietnam following the interest rate cut by the Federal Reserve.