According to the report of the Shareholder Qualification Board, as of 9:00 AM, the number of participating shareholders accounted for 77.63% of the total voting shares. Therefore, the General Meeting is eligible to proceed.

Profit target increases by 17%

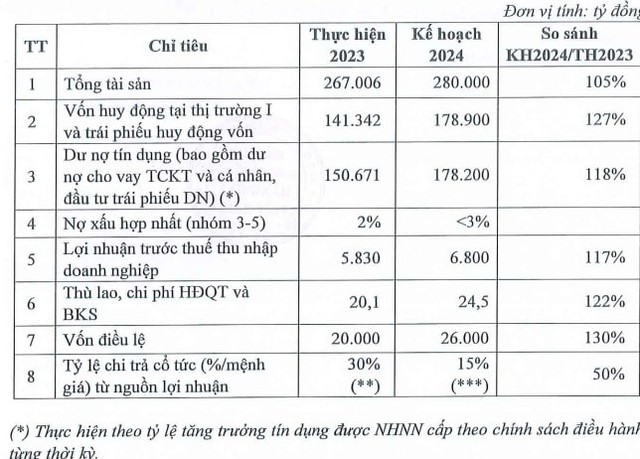

At the General Meeting, the Board of Directors (BOD) of MSB submitted to shareholders the business plan for 2024 with the target of total assets reaching VND 280,000 billion, an increase of 5% compared to 2023; mobilized capital in I market and mobilized bonds capital of VND 178,900 billion, an increase of 27% compared to the previous year. Credit balance growth in accordance with the limit granted by the State Bank according to the monetary policy of each period, it is estimated that by 2024 it could reach about VND 178,200 billion.

Pre-tax profit is expected to increase by 17% compared to 2023, reaching VND 6,800 billion. Consolidated bad debt (group 3-5) is maintained below 3% as prescribed.

Nguyen Hoang Linh, General Director of MSB, shared on the sidelines of the event that in the second quarter, the bank could record an additional 2 extraordinary income, worth about VND 700 billion from debts that have been resolved.

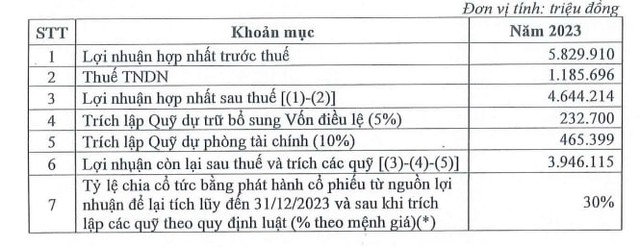

Leave the option to pay cash dividends open

At the General Meeting of Shareholders, MSB also asked shareholders for their opinions on the plan to increase the charter capital from VND 20,000 billion to VND 26,000 billion by distributing stock dividends at a ratio of 30% from retained earnings as of December 31, 2023 according to the audited financial statements and after deducting funds as prescribed by law.

In addition, the profit generated in 2024 and the profit remaining after the completion of the charter capital increase is expected to be MSB submitted to the General Meeting of Shareholders for approval of a plan to distribute dividends from the profit source that can be used to pay this dividend with a ratio of ≤15% in cash or/and stock dividends, the time of dividend advance payment depends on the market situation and MSB’s business activities.

Sharing with the writer, an MSB representative said that if approved by shareholders and business results meet expectations, the bank will pay an interim cash dividend in the fourth quarter of this year.

“We have had a plan to pay cash dividends in advance, but it needs to be approved in principle by the General Meeting of Shareholders with a maximum of 15%”, he added.

Elect a replacement for 1 member of the BOD

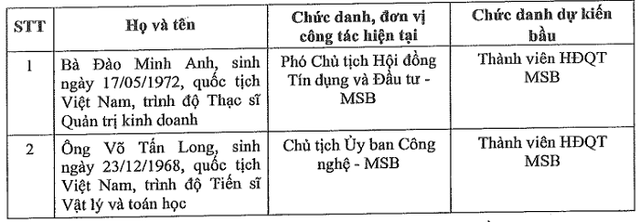

Another content that the Bank’s Board of Directors requested the approval of the shareholders is the election to replace members of the Board of Directors for term VII (2022 – 2026) in order to complete the senior staff.

Accordingly, the MSB General Meeting of Shareholders will carry out the procedure to elect a replacement for 1 member of the BOD for term VII (2022 – 2026), after Ms. Nguyen Thi Thien Huong submitted her resignation.

The two candidates expected to be elected to the Board of Directors are Ms. Dao Minh Anh, Vice Chairman of MSB Credit and Investment Council and Mr. Vo Tan Long, Chairman of MSB Technology Committee.

According to MSB’s announcement, Ms. Minh Anh was born in 1972, with a BA in Economics, National Economics University, and an MBA from Asian Institute of Technology (AIT) – Thailand. She has worked in the financial – banking sector since 1998 at BIDV, VIB, OCB and MSB.

Mr. Vo Tan Long was born in 1968, with a degree in Electrical Engineering from the Leningrad Electrical Engineering University, a PhD in Physics and Mathematics from Saint Petersburg State Electrical Engineering University. He started working in the financial – banking sector since 2013 and has worked for companies such as IBM, VPBank, PWC, MSB, ROX …

Answering shareholder questions

Shareholder: Ask the bank’s leaders to share the business results in the first quarter and the business prospects for 2024?

General Director Nguyen Hoang Linh: As of the end of the first quarter, the total assets of the bank reached over VND 280,000 billion, an increase of over 4%. In the context of the general credit growth in the banking industry slowing down, MSB’s credit growth in Q1/2024 is estimated to reach over 5%. Customer lending reached VND 158,000 billion, an increase of 4.7%. Deposits reached VND 138,000 billion, an increase of 4.1%.

MSB said that at the end of the first quarter of 2024, the bank recorded a profit of over VND 550 billion from foreign exchange trading, equivalent to 54% of the net interest income of this activity in the whole of 2023.

Pre-tax profit in the first quarter reached over VND 1,500 billion, a slight increase compared to last year. CIR decreased to 33%, overall NIM 3.87%; Casa increased by 14.64% and accounted for 29% of total deposits, a growth compared to the same period last year.

Mr. Linh assessed that the difficult situation of the economy could last until at least the first 6 months of the year. However, with its ability to control and optimize capital sources, MSB can achieve the targets of the business plan set out in 2024.

Shareholder: Ask the bank to share information on the recent deposit incident

General Director Nguyen Hoang Linh: Regarding retail customers, genuine customers participating in MSB’s activities are always guaranteed their rights by the bank. The recent incident was because MSB proactively detected it and submitted it to the authorities to clarify the incident. MSB always respects the decisions of the competent authorities to ensure the interests of customers, if they are genuine customers.

“Losing money on the banking system is not simple. If all the checking and monitoring steps are carried out, we can avoid the risks involved in depositing money”, said Mr. Linh.

Sharing the impact of the recent incident on the bank’s operations, Mr. Linh said that MSB’s customers are all very intelligent and capable of evaluating information. Therefore, the deposit balance is not affected.

“Every year, MSB sets aside thousands of billions to provision for risks for its operations, so the above incident cannot affect the bank’s operations”, Mr. Linh emphasized.

Adding more on this issue, Nguyen Hoang An, Deputy Chairman of MSB’s Board of Directors, said: When the bank becomes more modern, the subjects take advantage to seize control, seize customer money. In fact, it is not only MSB, but also the crime of exploiting money, seizing control is very common.

According to Mr. An, the recent incident has been reported by MSB to the police, if it is due to degraded officials and the procedure is carried out correctly, customers will be paid in full. The case has been filed since October last year and is awaiting the conclusion of the agency.

Shareholder: Ask the management to share the NIM outlook for 2