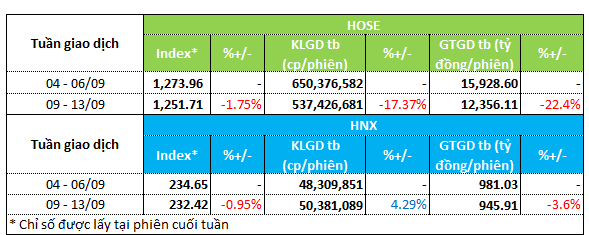

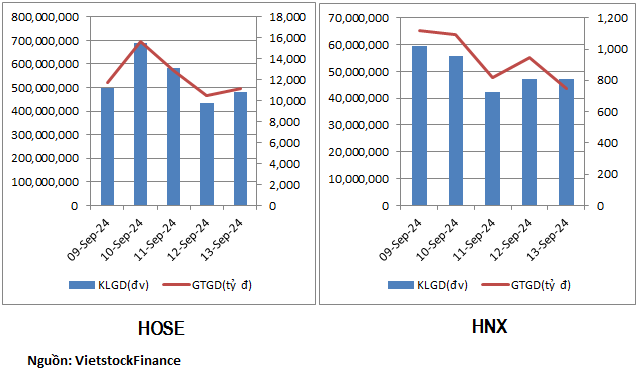

The stock market remained subdued during the week of September 9-13, with both indices and liquidity witnessing significant declines.

On the [HOSE] (https://hose.com.vn/) exchange, the VN-Index dipped by nearly 2%, settling at 1,251.7 points. Simultaneously, trading volume plummeted by over 17% to 537 million units per session, while transaction values shrunk by more than 22% to VND12.3 trillion per session.

Turning to the [HNX] (https://hnx.vn/) exchange, its index slipped by 1% to 232.42 points. Hanoi’s liquidity showed a slight weakness, with the average transaction value decreasing by 4% to VND946 billion per session. Conversely, trading volume rose by over 4% to 50.3 million units per session.

[Table: Market Liquidity Overview for the Week of September 9-13]

[Chart: Market Liquidity for the Week of September 9-13]

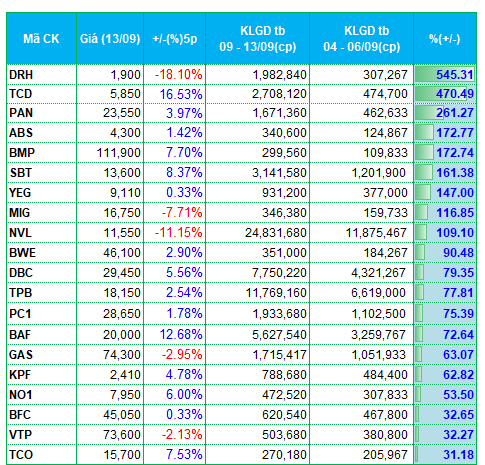

With weak liquidity, there weren’t many standout sectors attracting funds. The agriculture and livestock sectors were favored by investors last week. Agricultural stocks (PAN, CTP) and livestock companies (DBC, BAF) joined hands with agricultural suppliers (ABS, BFC) to rank among the top liquidity gainers on both the HOSE and HNX exchanges.

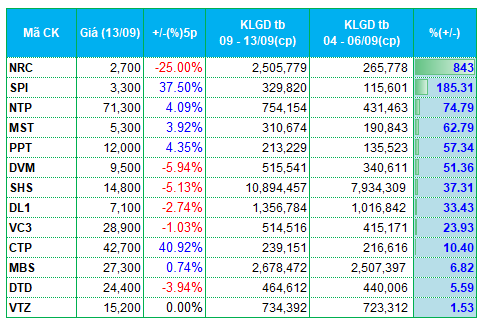

The plastics sector also drew some attention, with a handful of plastic manufacturers like BMP, NTP, and VTZ making their way into the liquidity gainers’ group. Notably, BMP witnessed a staggering 170% surge in trading volume compared to the previous week.

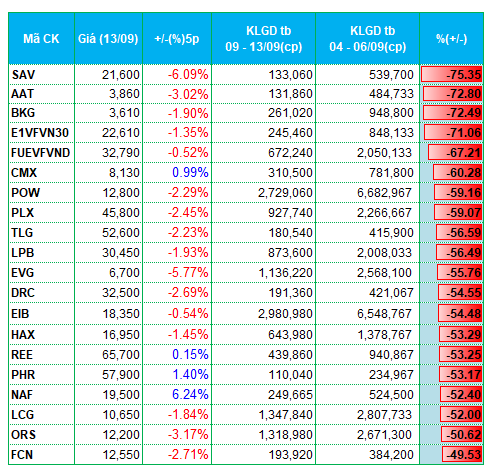

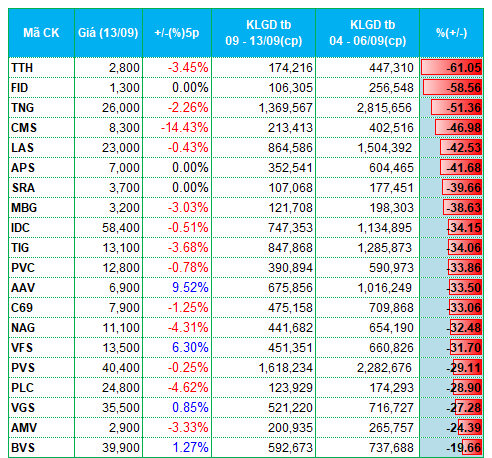

In the face of a sharp decline in overall liquidity, money outflow was widespread across various sectors. Real estate and securities were two sectors that stood out in terms of fund outflows. Within real estate, EVG, IDC, TIG, and AAV experienced decreases in liquidity. In the securities sector, ORS, APS, VFS, and BVS faced money outflows.

Additionally, the oil and gas (PVC, PVS) and construction (REE, LCG, FCN, CMS, C69) sectors also failed to attract investment funds.

[Table: Top 20 Stocks with Highest Liquidity Increase/Decrease on HOSE]

[Chart: HOSE Liquidity for the Week of September 9-13]

[Table: Top 20 Stocks with Highest Liquidity Increase/Decrease on HNX]

[Chart: HNX Liquidity for the Week of September 9-13]

*Note: The lists of stocks with the highest liquidity increases/decreases are based on a minimum average trading volume of 100,000 units per session.*

[Chí Kiên]