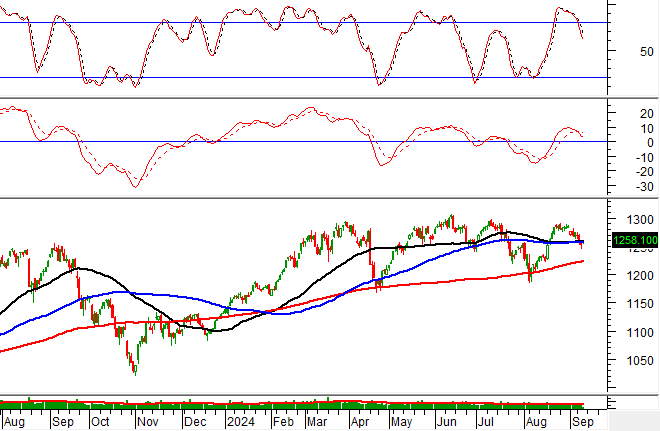

The VN-Index witnessed a trading volume of nearly 299 million units in the morning session, equivalent to a value of over 7 trillion VND. The HNX-Index recorded a trading volume of more than 26 million units, with a value of nearly 520 billion VND.

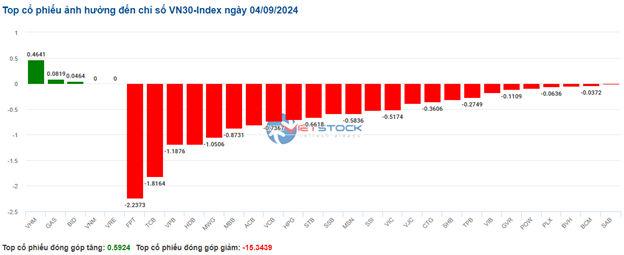

Large-cap stocks exerted significant pressure on the market, with the VN30-Index dropping by over 17 points, or 1.3%, to 1,314.19. Several stocks are currently experiencing declines of more than 2%, including GVR, SSB, HDB, PLX, FPT, and TPB. The top 10 stocks negatively impacting the VN-Index are all from this group, costing the index over 7 points. On the other hand, VHM, GAS, BID, and VNM remain positive, albeit with a modest contribution.

Source: VietstockFinance

|

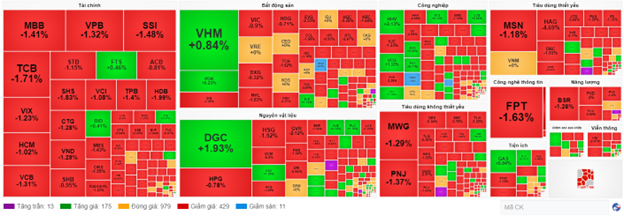

Most sectors were engulfed in red, with telecommunications and energy plunging the most, down by over 2%. This decline was mainly driven by large-cap stocks in the sectors, such as VGI (-2.51%), FOX (-1.61%), VNZ (-1.1%), CTR (-1.09%); BSR (-2.09%), PVS (-1.47%), PVD (-2.91%), and so forth.

The financial sector, which holds a substantial weight in the market capitalization, also exerted considerable pressure on the index, falling by 1.23%. Numerous stocks declined by over 1%, including VCB, CTG, TCB, VPB, MBB, ACB, STB, and HDB, to name a few.

In contrast, the healthcare sector stood out as the sole bright spot in the market, climbing by 0.84%. This rally was spearheaded by stocks like IMP (+6.61%), DTP (+3.88%), DMC (+5.25%), and MKP (+6.67%). Nevertheless, several stocks within this sector remained under the grip of bearish sentiment, including DHG (-0.46%), TNH (-1.04%), DBD (-0.73%), OPC (-1.26%), and others.

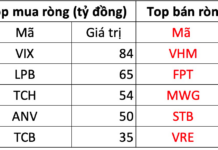

Foreign investors net sold on the HOSE with a value of nearly 564 billion VND in the morning session, focusing their sales on DGC (over 102 billion) and HPG (nearly 77 billion). On the HNX, they net sold nearly 22 billion VND, mainly offloading SHS.

10:30 am: Financial Sector Drags VN-Index into the Red

A wave of selling pressure emerged at the beginning of the session, pushing the major indices below the reference levels. While buying interest resurfaced, sellers maintained their dominance. As of 10:30 am, the VN-Index dropped by over 10 points, hovering around 1,273. The HNX-Index lost 1.73 points, trading at around 235.

The majority of stocks in the VN30 basket faced intense selling pressure. Specifically, FPT, TCB, VPB, and HDB shaved off 2.23 points, 1.82 points, 1.19 points, and 1.18 points from the overall index, respectively. Conversely, VHM, GAS, and BID were the rare gainers, but their contribution was relatively modest.

Source: VietstockFinance

|

The information technology sector witnessed a sharp decline in the market. FPT and CMG experienced the brunt of the selling, falling by 1.63% and 1.57%, respectively.

Although the financial sector’s decline was not as steep, it exerted the most negative influence on the index due to its over 34% weight in the total market capitalization. Most stocks in this sector traded in negative territory, including MBB, VPB, SSI, TCB, and others. Only a handful of stocks, such as FTS, BID, CSI, and VNR, managed to stay in the green, but their gains were insignificant.

On the flip side, the healthcare sector shone brightly, extending its gains from the previous three sessions. However, the sector remained somewhat polarized, with nearly 30 stocks trading flat. Stocks like IMP (+4.67%), DCL (+0.39%), DHT (+0.58%), and AMV (+3.33%) led the rally. Conversely, DHG (-0.56%), OPC (-3.35%), TNH (-1.04%), and DVM (-1.96%) struggled under selling pressure.

Compared to the opening, sellers held the upper hand. There were 429 declining stocks (including 11 at their lower limits) and 175 advancing stocks (including 13 at their upper limits).

Source: VietstockFinance

|

Market Open: VN-Index Dips amid Pressure from VN30 Constituents

The morning session commenced on a negative note, with most sectors drowning in a sea of red. The VN30 index bore the brunt of the selling, with its constituents predominantly in the red.

A plethora of VN30 stocks suffered sharp declines, including GVR, BCM, MWG, VRE, TCB, SSI, MSN, FPT, MBB, VPB, and CTG, among others.

The energy sector mirrored this sentiment, with stocks unanimously dipping into negative territory from the get-go. Notable losers included BSR (-1.67%), PVD (-1.64%), PVS (-0.98%), PVC (-1.5%), PVB (-1.71%), and POS (-4.55%), to name a few.

The telecommunications services sector followed suit, weighed down by its leading stocks: VGI (-2.51%), CTR (-1.25%), VNZ (-1.1%), and FOX (-0.86%). Stocks with smaller market caps, such as FOC (-1.51%), YEG (-0.55%), and ELC (-1.46%), also contributed to the sector’s decline.