In the midst of the lackluster VN-Index performance, HPG shares of Hoa Phat Group have witnessed a streak of losses over three consecutive sessions, falling to 24,850 VND per share, the lowest level in eight months since January 2024.

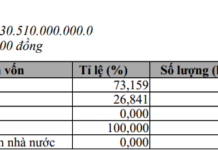

If we consider the past four months, this leading steel stock has lost 16% of its market value. Market capitalization also evaporated by more than VND 30,000 billion (~USD 1.2 billion), leaving just under VND 159,000 billion.

The recent sharp decline in HPG stock prices followed unfavorable news that two subsidiaries of Hoa Phat were found dumping steel wire in Canada. Specifically, on September 4, the Canada Border Services Agency (CBSA) issued a final conclusion on the investigation and the application of anti-dumping measures on steel wire products originating from or exported from China, Egypt, and Vietnam.

Consequently, two subsidiaries of Hoa Phat Group, Hoa Phat Dung Quat Steel Joint Stock Company and Hoa Phat Hai Duong Steel Joint Stock Company, were named in the list with dumping margins of 17.7% and 13.5%, respectively.

Currently, the Canadian International Trade Tribunal (CITT) is assessing the damage to the domestic manufacturing industry and is expected to announce its decision on October 4, 2024.

Previously, on March 8, the CBSA initiated an investigation and applied anti-dumping measures on steel wire products originating from or exported from China, Egypt, and Vietnam, following a request from Ivaco Rolling Mills 2004 LP, a hot-rolled steel coil and steel billet manufacturer based in Ontario, Canada. On June 6, the CBSA issued a preliminary conclusion on the case.

Gross profit margin expected to increase in the second half of 2024

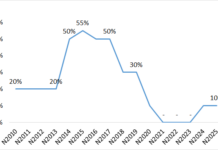

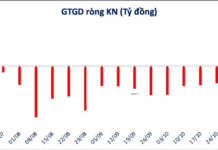

Nonetheless, Vietcap Securities (VCI) believes that HPG will continue to lead the recovery of domestic steel sales in the second half of 2024. In the first seven months of 2024, HPG’s construction steel sales volume increased by 34% year-over-year, significantly outpacing the industry’s growth rate of 13%, and pushing its market share to a record high of 37.9%. Although the growth in HPG’s hot-rolled steel (HRC) sales volume during this period was lower than that of construction steel, it still achieved a robust growth rate of 17%.

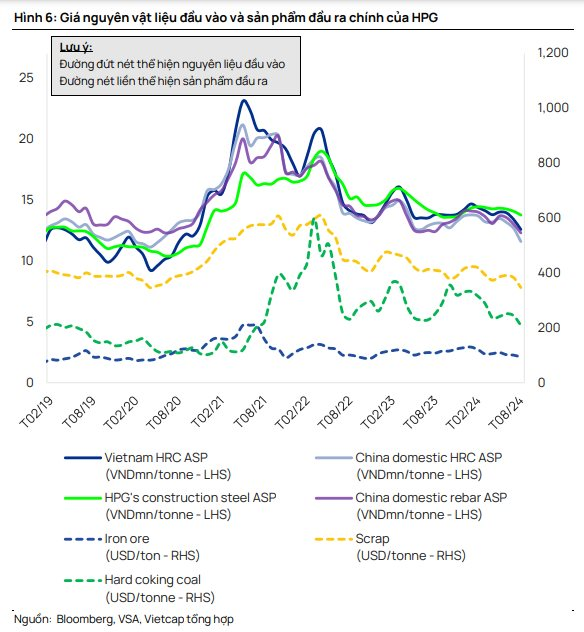

The analyst team also expects gross profit margin to increase in the second half of 2024 due to higher sales volume and input-output differential . So far this year, low demand from China has pushed down steel prices, but input costs have declined faster than output prices.

While Vietcap lowers its assumptions about average selling prices and profit margins for HPG’s steel products, it anticipates that lower input costs (iron ore and coke) will boost gross profit margin in the second half to a level higher than that achieved in the first half of 2024.

As a result, the securities firm expects the gross profit margin in the second half of 2024 to increase from 13.4% in the first half to 15.5%.

According to Vietcap, cheap steel exports from China are causing prices of export-oriented products like HRC and coated steel to fall more sharply. Since the beginning of the year, Vietnam’s HRC prices have dropped by 19% (matching the 19% decline in Chinese HRC prices). The average selling price of HPG’s construction steel, protected by tariffs of 16.3%-21.3% on imported steel, has only decreased by 4% since the beginning of the year, lower than the 16% decline in Chinese steel bar prices.

Vietcap has adjusted its profit forecast for Hoa Phat’s profit after tax and minority interests in 2024 to VND 12,315 billion, representing a 58% increase compared to the 2023 performance but a 19% decrease compared to the previous forecast (profit of VND 15,223 billion).

Regarding the progress of the Dung Quat 2 Integrated Steel Mill Project, as of the end of Q2/2024, HPG has disbursed VND 42,400 billion out of the total investment of VND 70,000 billion in fixed assets for DQ2. Vietcap believes that the project is on track to complete construction by the end of 2024 and commence operations in Q1/2025. Phase 2 (the second blast furnace) is expected to be completed in 2025.

Canada Concludes Final Anti-Dumping Probe on Steel Wire from Vietnam

The dumping margins for Vietnamese enterprises have been determined as follows: Hoa Phat Dung Quat Joint Stock Company is 17.7%, and Hoa Phat Hai Duong Steel Company is 13.5%.