VietinBank’s asset management arm has recently announced the sale of debts owed by Indochine Imex, a company operating in the heat-electricity supply industry. The collateral for these debts includes land plots in Ho Chi Minh City and Dong Nai province, as well as 2.6 million shares owned by the company’s key stakeholders.

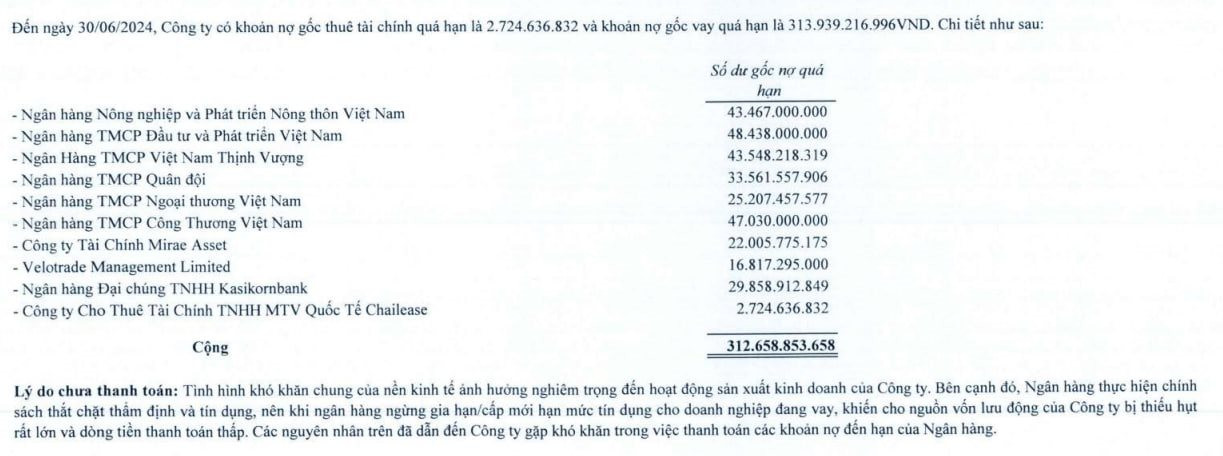

Indochine Imex’s latest financial reports reveal significant overdue loan amounts from multiple banks, totaling VND 314 billion as of June 30. The company also faces challenges with bond payments.

Source: Indochine Imex’s Q2 Financial Report

The company attributes its payment difficulties to the challenging economic climate and tighter bank lending policies, resulting in a significant shortage of working capital. These factors have hampered Indochine Imex’s ability to service its debt obligations.

Formerly known as Dong Thanh Education Investment and Development, Indochine Imex was established in 2010 with an initial charter capital of VND 50 billion. The company underwent a name change and a capital increase to VND 120 billion in 2017 and 2018, respectively, and is now traded on the HNX exchange under the symbol DDG. As of now, the company’s charter capital is nearly VND 800 billion.

Indochine Imex experienced a record loss of VND 206 billion in 2023, a stark contrast to the VND 44 billion profit recorded in the previous year. For 2024, the company targets a revenue of VND 550 billion and a modest after-tax profit of VND 4 billion, focusing on restructuring and core business activities.

In the first half of 2024, the company’s revenue plummeted by 66% year-on-year to VND 120 billion. Despite a gross profit of over VND 18 billion, Indochine Imex faced a net loss of over VND 14 billion due to substantial financial expenses. However, a surge in other income of nearly VND 21 billion helped the company report a pre-tax profit of VND 6.5 billion for the period, a significant improvement from the VND 192 billion loss in the same period last year.

DDG’s share price closed at VND 3,200 per share on September 16, with an average matched volume of over 152,000 units in the last 10 sessions. The share price has been on a downward trend since April 2023, with brief recovery attempts, amid continuous selling and forced liquidation by insiders.

Ms. Tran Kim Sa, a member of the Board of Directors and CEO of Indochine Imex, recently registered to sell 1.15 million shares from June 6 to July 5, following several unsuccessful attempts earlier in the year due to unfavorable market conditions. Her brother, Mr. Tran Kim Cuong, the company’s Vice President, also reported a forced sale of 550,000 shares by a securities company in May, reducing his stake to 250,000 shares.

Other insiders, including Mr. Nguyen Thanh Quang, the company’s Chairman, have also offloaded significant shareholdings in recent months.