Samsung Electronics Group has released its detailed financial report for Q2 2024. The company’s revenue for the quarter stood at $54.9 billion, with a net profit of $7.29 billion, marking a significant increase of 23.4% and 471%, respectively, from the previous year.

This brings the total revenue for the first half of the year to $108.2 billion, with a net profit of $12.3 billion, reflecting an 18% and 403% growth compared to the same period in 2023.

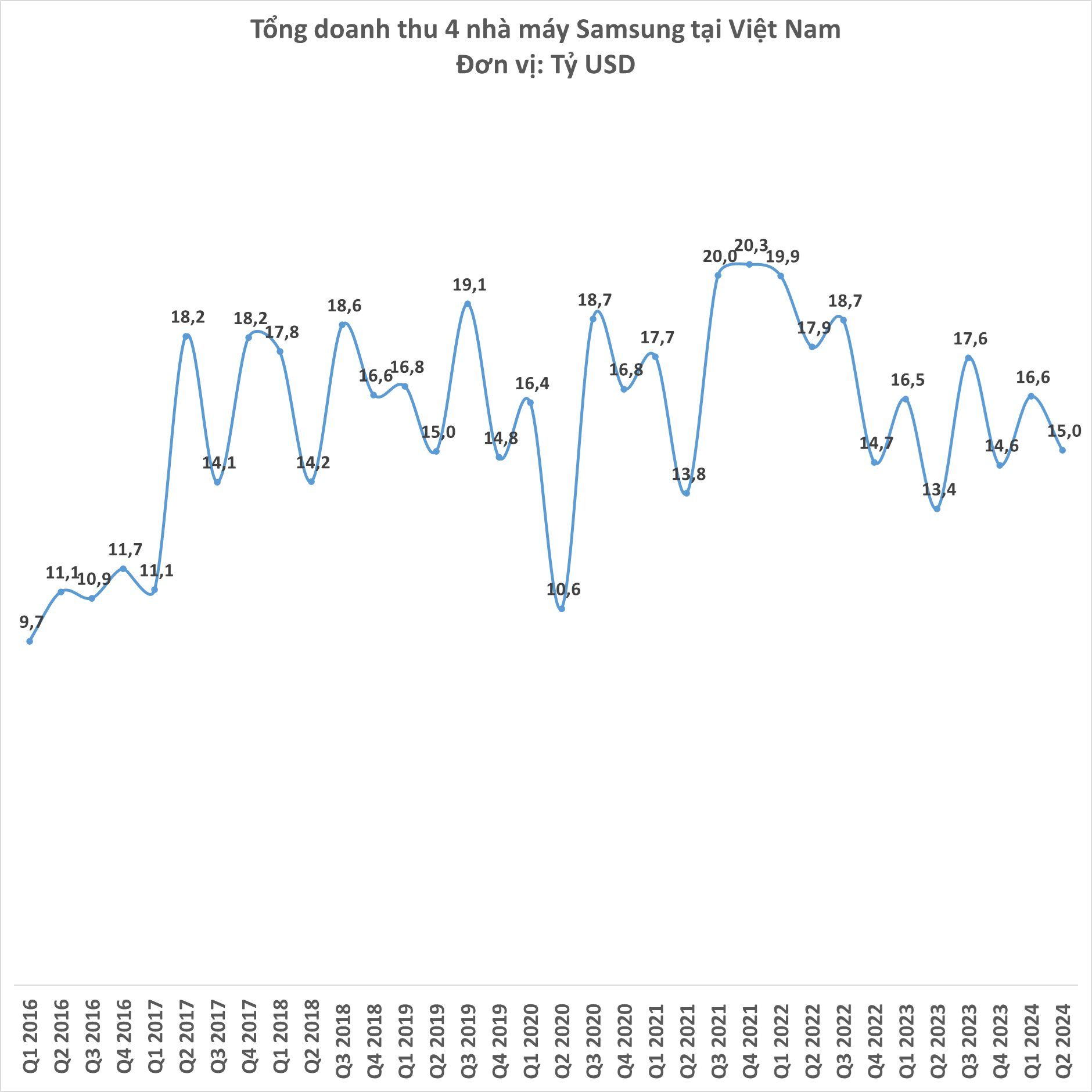

In Vietnam, Samsung reported increased business performance year-over-year. The combined revenue of its four factories, including Samsung Thai Nguyen, Samsung Bac Ninh, Samsung Display Vietnam, and Samsung HCMC CE Complex, reached $15 billion, a nearly 12% increase year-over-year. However, this figure represents a 10% decrease compared to Q1 2024.

Breaking down the revenue contribution, Samsung Thai Nguyen remained the largest contributor with $5.6 billion, followed by Samsung Display Vietnam at $4.16 billion, Samsung Bac Ninh at $3.97 billion, and Samsung HCMC CE Complex at $1.3 billion.

Samsung’s Revenue Breakdown by Factory in Vietnam for Q2 2024 (in USD)

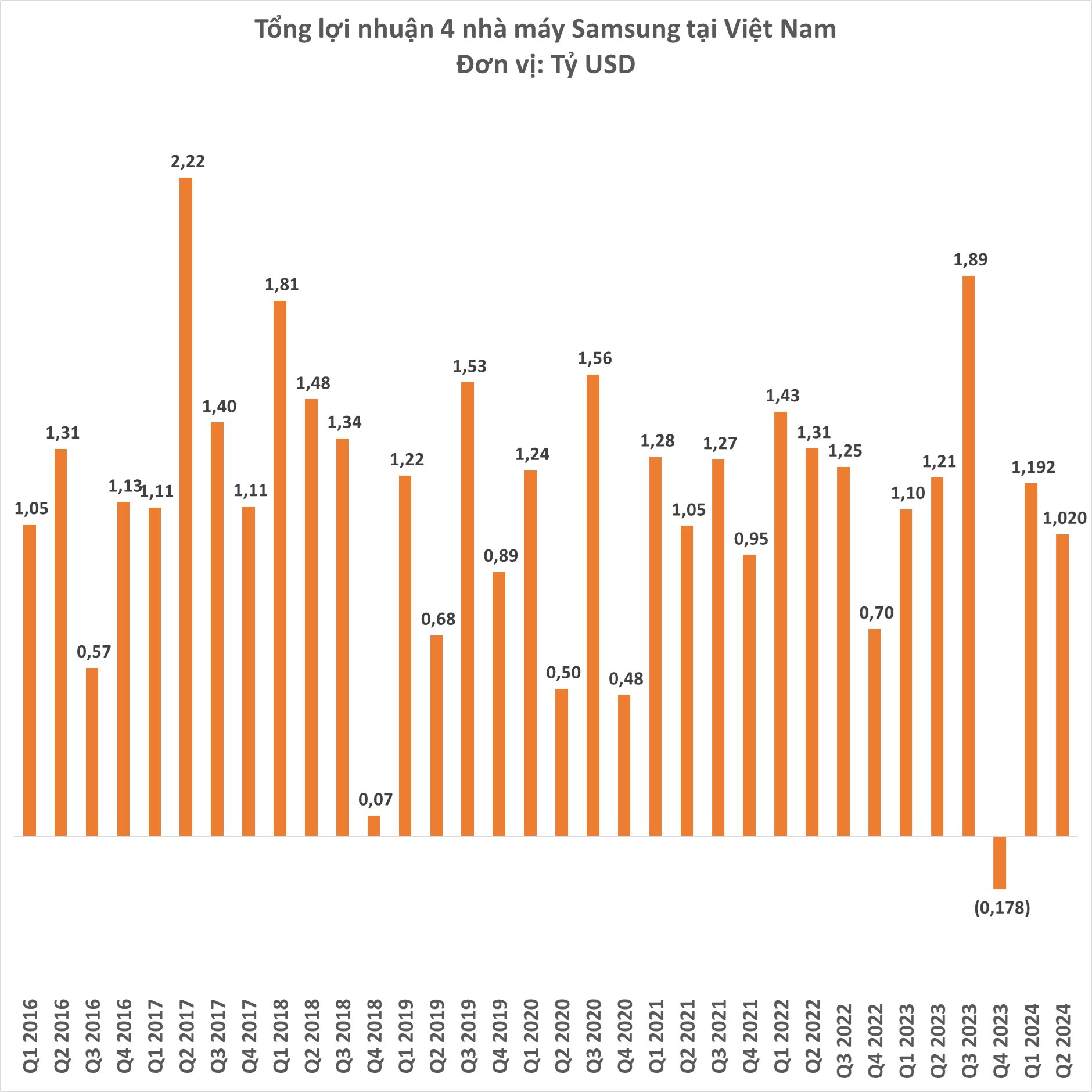

While revenue grew year-over-year, the combined profit of the four Samsung factories decreased to $1.02 billion, a 15.7% decline. This also represents a 14% decrease compared to Q1 2024.

The main reason for the profit decline is attributed to Samsung Thai Nguyen, which contributed only $0.42 billion in profit, compared to $0.67 billion in the previous year and $0.72 billion in Q1 2024.

Profit Comparison of Samsung Thai Nguyen Factory (in USD)

In other news, Reuters has reported that Samsung Electronics has instructed its subsidiaries worldwide to reduce their sales and marketing staff by 15% and administrative staff by 30%.

This plan is set to be implemented by the end of this year and will impact Samsung employees globally.

The exact number of layoffs in each country remains unclear, and it is yet to be determined which business units will be most affected by this decision.

Reuters attributed Samsung’s massive job cuts to the company’s struggles in its core business areas.

The company’s semiconductor business, a key division, has been recovering at a slower pace than its competitors since hitting a 15-year low in profits in 2023.

This is largely due to Samsung lagging in the artificial intelligence (AI) sector.

The situation prompted Samsung to replace the head of its semiconductor division in May 2024, aiming to overcome the “chip crisis” and catch up with rival SK Hynix, which has a head start in the race for AI chips.

In the smartphone market, Samsung faces intense competition from Apple and Huawei, among others.

In a separate statement, Samsung stated that the workforce adjustments made in foreign countries are regular activities aimed at improving business efficiency.

The company further asserted that these adjustments do not have specific targets and do not affect the company’s production team.

[Insert suggested article: “Unraveling the Guilt Trip Phenomenon: Spotting the Signs and Strategies to Navigate This Emotional Pitfall”]

The First 100% Autonomous Robot in Vietnam: Samsung Electronics Factory and Ho Xuan Nang’s Tech Investment

“With an unwavering commitment to innovation, Mr. Le Anh Son, CEO of Phenikaa-X, revealed that his team successfully developed an advanced robot AMR Pallet Mover solution for Samsung Electronics Thai Nguyen (SEVT)’s warehouse within a remarkable four-month timeframe. This achievement showcases Phenikaa-X’s exceptional ability to deliver tailored, time-efficient solutions to meet the evolving needs of industry leaders like Samsung.”

Unlocking Record-Breaking Revenue: Hòa Phát’s Stellar Performance in Q2 Nears Historic Peak with a Skyrocketing 120% Profit Surge, Yet HRC Remains a “Dark Spot”.

As of the six-month cumulative period, Hoa Phat reported a remarkable performance with a total revenue of VND 71,028 billion and an after-tax profit of VND 6,188 billion. These impressive figures mark a significant surge of 26.6% and an astounding 238% respectively, when compared to the same period in the previous year.