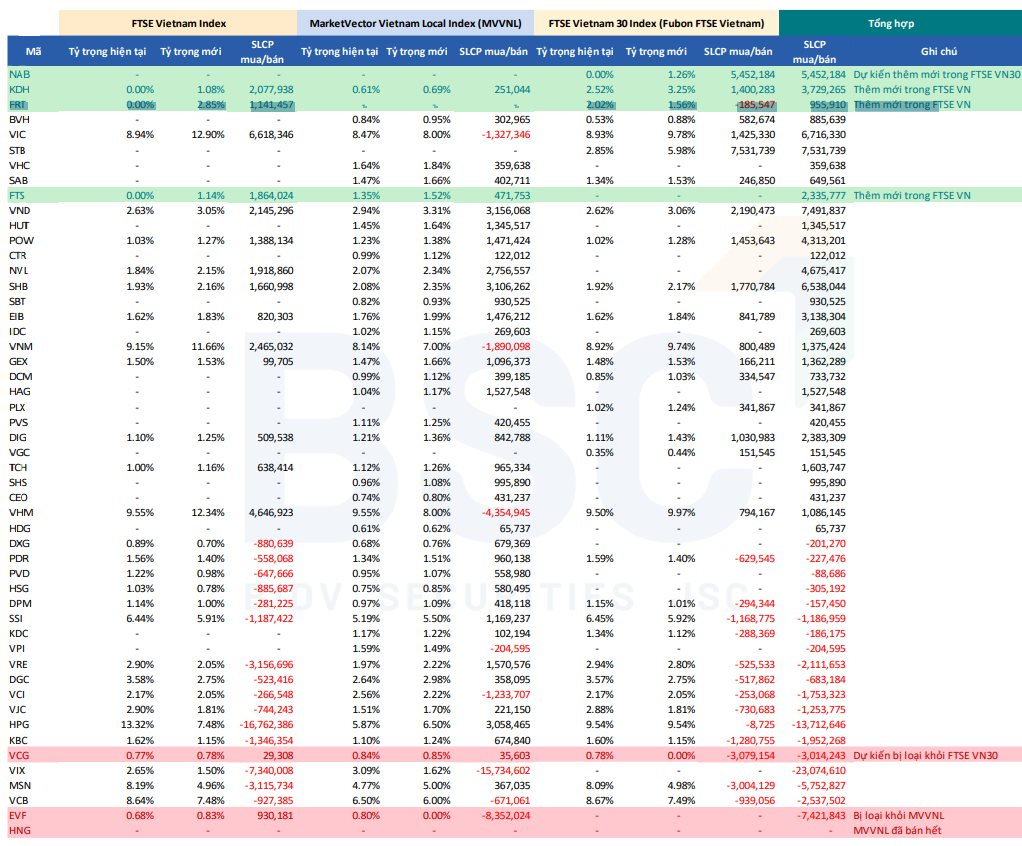

On September 6, 2024, FTSE announced the constituent stock portfolio of the FTSE Vietnam Index (referenced by ETF FTSE), adding three new stocks: FRT, FTS, and KDH, while removing none. .

As of September 13, 2024, MarketVector announced the MarketVector Vietnam Local Index (VNM ETF reference) by removing the EVF code.

Notably, during this review period, the FTSE Vietnam 30 Index (referenced by Fubon ETF) will also review its portfolio, but will not publicly announce the official results. The referenced ETF will restructure its portfolio on the last implementation day. BSC Research predicts that the FTSE Vietnam 30 portfolio may remove VCG stock and add NAB stock instead.

The current scale of FTSE Vietnam ETF is 298 million USD (7.200 billion VND), VNM ETF is 493 million USD (12.100 billion VND), and Fubon ETF is 647 million USD (15.900 billion VND). The total scale reaches 35.2 trillion VND (~1.4 billion USD).

The above indexes will perform the final restructuring on September 20, 2024. BSC has predicted the number of stocks to be bought/sold for the referenced ETFs according to the indexes.

Specifically, some codes that may be heavily purchased include NAB (over 5.4 million shares), KDH (3.8 million shares), VIC (6.7 million shares), STB (7.5 million shares), VND (7.5 million shares), SHB (6.5 million shares), KDH (3.7 million shares), NVL (4.7 million shares),…

Conversely, ETFs may sell large amounts of stocks in codes such as VIX (23 million shares), HPG (13.7 million shares), EVF (7.4 million shares), MSN (5.8 million shares), and VRE (2.1 million shares),…

The Greenback Takes a Tumble: Will the State Bank Step In to Buy?

The recent loosening of monetary policy by the State Bank of Vietnam (SBV) in the context of a sharp decline in exchange rates has led to speculation that the central bank may buy USD at a higher price at the Trading Center to boost foreign exchange reserves. This move is expected to enhance the liquidity of VND in the commercial banking system, ensuring a more stable and robust financial environment.

Will MWG Stock Return to the Nearly VND 13,000 Billion ETF Portfolio with the VNDiamond 3.0 Update?

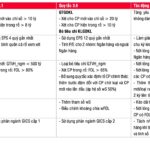

SSI Research has reported that the VNDiamond Index’s rules have been revised to tighten liquidity conditions for stocks while relaxing FOL conditions. The new rules also amend the P/E filter criteria, introduce a formal stock basket determination rule, and add a wS parameter to curb volatility in the index.