Ms. My stated that the transaction was aimed at restructuring her investment portfolio. Based on the SCR share price of VND 5,380/share during the morning session of September 16, Ms. Hong Anh’s sister is expected to receive a minimum of VND 590 million after completing the divestment from TTC Land.

Ms. Đặng Huỳnh Ức My and her brother, Đặng Hồng Anh, who previously appeared on Shark Tank Vietnam Season 2 as Shark Hong Anh

|

The insider trading took place as the SCR share price had declined by nearly 33% over the past five months, from its peak of VND 8,000/share in early April to the VND 5,000/share range – the lowest since late 2022, equivalent to a near two-year low.

| SCR share price movement from December 2022 to present |

Ms. Đặng Huỳnh Ức My is the daughter of Ms. Huỳnh Bích Ngọc and Mr. Đặng Văn Thành, the founder of Thanh Thanh Cong Group (TTC Group). The businesswoman is a well-known figure in the agricultural industry and is widely recognized as the Chairwoman of Thanh Thanh Cong – Bien Hoa Joint Stock Company (TTC AgriS, HOSE: SBT).

Prior to this, Ms. My sold 70 million SBT shares from July 12-26, reducing her ownership to 75 million shares, equivalent to 9.84% capital.

Returning to TTC Land, in mid-August, the company filed a lawsuit against Hoa Binh House JSC, a subsidiary of Hoa Binh Construction Group Joint Stock Company (HOSE: HBC), to recover the site of the TTC Plaza Binh Thanh project at 26 Ung Van Khiem, Binh Thanh District, Ho Chi Minh City.

TTC Land stated that the lease contract between the two parties had terminated on August 3, and Hoa Binh House JSC was responsible for handing over the leased premises to TTC Land on August 8. However, when TTC Land’s representative arrived to accept the handover, Hoa Binh House JSC did not cooperate and failed to complete the handover.

Notably, TTC Land’s Vice Chairman, Đặng Hồng Anh, previously served as an Independent Member of the Board of Directors at HBC from 2019 to 2021.

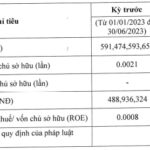

In terms of business performance, TTC Land reported a reviewed net profit of VND 1.2 billion for the first half of 2024, a decrease of nearly 81% compared to the self-prepared financial statements and a 59% drop from the same period in 2023. Excluding a loss of VND 55 billion in the first half of 2013, the net profit for the first half of 2024 was the lowest in the company’s operating history.

The company attributed the significant change to differences in tax calculations by the auditor, as well as a decline in financial revenue and other income, resulting in lower profits compared to the previous year.

| TTC Land’s net profit for the first half since the announcement |