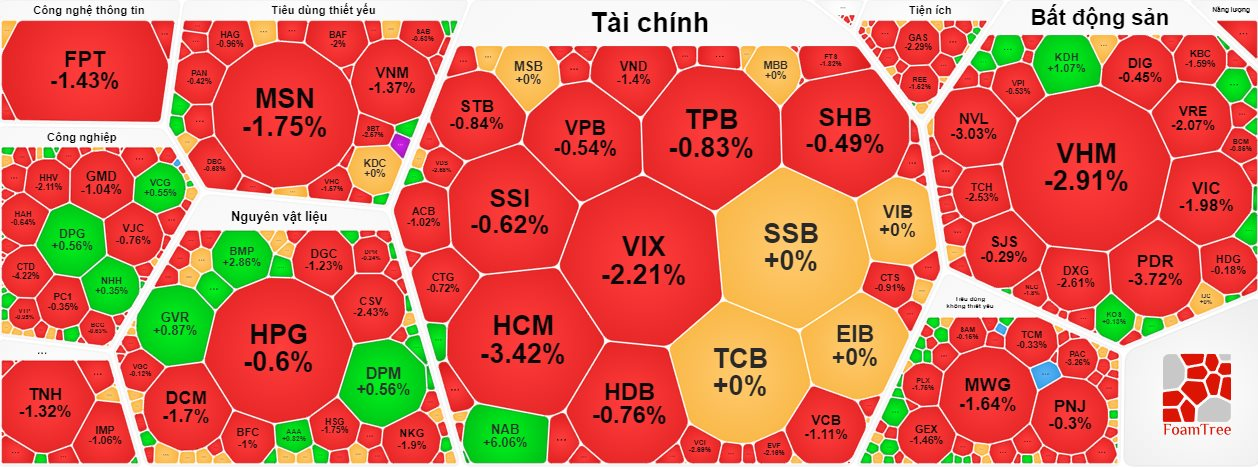

The VN-Index witnessed a gloomy trading week, with the index consistently declining and liquidity falling to low levels. As investors adopted a cautious trading approach, the VN-Index gradually lost ground towards the end of the session, slipping below the 1,240-point mark and eventually closing at 1,239.26, a loss of 12.45 points.

The two remaining markets also traded in a subdued manner, with the HNX-Index falling 1.58 to 230.84 and the UPCoM-Index dropping 0.38 points to 92.57.

Low liquidity hindered any potential recovery for the indexes. On the HoSE floor, there were 312 declining stocks, 62 stocks that stood at reference prices, and 97 rising ones. Today’s trading liquidity remained low, with 608 million shares matched, equivalent to a matching value of VND13,485 billion. Across all three markets, the total trading value did not even reach VND14,800 billion.

The market was on fire, with the VN-Index breaking below the 1,240-point level.

Meanwhile, among the VN30 basket of large caps, only GVR of the Vietnam Rubber Group stood out with a slight gain of less than 1%. On the other hand, the two mega-cap stocks, VCB and VHM, dragged the main index down by nearly 3 points each, followed by GAS, VIC, FPT, BID, VNM, and others, which had the most negative impact.

On the brighter side, NAB, GVR, KDH, and BMP were the most positively influential stocks, although their impact was negligible. NAB led the gainers with a substantial increase of over 6%, while the others rose by less than 1%.

Regarding sector performance, most sectors in the market were in negative territory. Telecommunications experienced the sharpest decline of -2.45%, mainly driven by VGI (-2.09%), VNZ (-14.99%), CTR (-0.8%), and ELC (-0.83%). This was followed by the real estate and information technology sectors, which fell by 1.48% and 1.42%, respectively.

The strong selling pressure from domestic investors caused the VN-Index to plunge during today’s session. However, foreign investors viewed this as an opportunity to scoop up bargains. On the HoSE exchange, foreign investors net bought over VND 217 billion.

Among the stocks, foreign investors net bought the most in TCB (VND 70 billion), NAB (VND 54 billion), FPT (VND 53 billion), VNM (VND 50 billion), CTG (VND 40 billion), and others.

On the opposite side, foreign investors net sold HSG, MWG, VCI, PDR, and HPG. The additional selling pressure from foreign investors contributed to the decline in the prices of these stocks during today’s session.

On the HNX exchange, foreign investors net bought up to VND 344 billion, focusing on two main stocks, PVS (VND 30 billion) and TNG (VND 10 billion). On the UPCoM exchange, foreign investors net bought VND 2.5 billion.