The stock market unexpectedly turned around and shone brightly in today’s trading session, with just one more day to go until the Fed meets to decide on an interest rate cut. The index fluctuated throughout the morning session, but strong buying pressure from foreign investors triggered a flood of capital into stocks, propelling the VN-Index to a 19.69-point gain towards the 1,258-point region.

The breadth was overwhelmingly positive, with 312 gainers and 88 losers. Most sectors regained some of their losses from last week, with Real Estate and Securities leading the gains, rising 2.4% and 2.46%, respectively. The Vin family shone with VHM up 5.39%, VIC up 2.02%, and VRE up 2.5%. These three stocks alone contributed more than three points to the overall market.

Banks rose 1.57%, with standout performers such as VCB up 1.8%, BID up 1.99%, and TCB up 2.48%. This group alone pulled more than four points for the VN-Index. Other sectors also posted decent gains, including Materials up 1.14%, Software up 1.35%, Oil & Gas up 1.37%, and Food & Beverage up 1.36%.

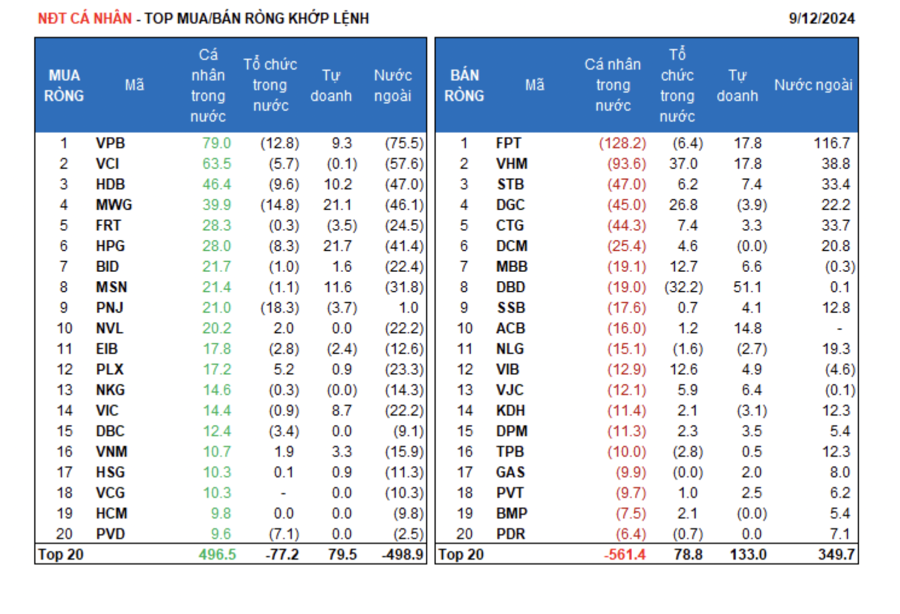

However, liquidity across the three exchanges rose marginally, with matched orders reaching 15,000 billion VND in the context of widespread price increases, indicating that stockholders were holding firm. Foreign investors net bought strongly, with a net purchase value of 524 billion VND, mainly accumulating VHM and FPT while dumping MWG.

Foreign investors net bought 522.5 billion VND. Excluding block deals, they net bought 555.8 billion VND.

The sectors that foreign investors net bought on the matched orders were Real Estate and Information Technology. The top stocks that foreign investors net bought were VHM, FPT, SSI, NVL, DIG, PDR, VRE, VJC, VNM, and TPB.

On the selling side, the sector that foreign investors net sold on the matched orders was Retail. The top stocks that foreign investors net sold were MWG, KDH, VPB, DCM, STB, VCG, HPG, TVS, and DPG.

Individual investors net sold 692.1 billion VND, of which 475.2 billion VND was net sold on the matched orders.

Excluding block deals, individual investors net bought 9 out of 18 sectors, mainly the Retail sector. The top stocks that individual investors net bought were MWG, HPG, KDH, REE, STB, VPB, GEX, DCM, MSN, and BID.

On the net selling side, excluding block deals, individual investors net sold 9 out of 18 sectors, mainly the Real Estate and Information Technology sectors. The top stocks that they net sold were VHM, FPT, NVL, EIB, DIG, PDR, VRE, HDB, and NAB.

Proprietary trading arms of securities firms net bought 63.5 billion VND, and excluding block deals, they net bought 115.8 billion VND.

Excluding block deals, proprietary trading arms of securities firms net bought 8 out of 18 sectors. The sectors with the strongest net buying were Banks and Real Estate. The top stocks that proprietary trading arms of securities firms net bought today were VHM, ACB, TCB, VPB, STB, LPB, GAS, HDB, VND, and VCB. The sector with the strongest net selling was Food & Beverage. The top stocks that they net sold were MSN, VNM, KDH, FPT, TPB, HPG, VJC, FRT, FUEVN100, and MWG.

Domestic institutional investors net bought 103.3 billion VND. Excluding block deals, they net sold 196.4 billion VND.

Excluding block deals, domestic institutional investors net sold 12 out of 18 sectors, with the highest value in the Power, Water & Gas sector. The top stocks that domestic institutional investors net sold were HPG, REE, GEX, STB, NLG, FPT, BID, PVD, SHB, and SSI. The sector with the highest net buying value was Real Estate. The top stocks that domestic institutional investors net bought were VHM, HDB, EIB, MBB, KDH, VIX, CTG, DCM, HDG, and DPG.

Block deals today reached 3,341.8 billion VND, up 6.1% from the previous session, contributing 22.1% of the total trading value.

Today, there was a notable transaction in SSB stock, with more than 62.2 million units, equivalent to 883.3 billion VND, changing hands among individual investors.

Individual investors continued to trade in the Banking sector (EIB, VIB, NAB, STB, TCB) and large-cap stocks (FPT, VIC, MWG).

The allocation of trading value increased in Real Estate, Retail, Software, Waterborne Transport, Oil & Gas Production and Services, Building Materials & Interior, while decreasing in Banks, Securities, Steel, Chemicals, Agricultural & Marine Products, Food, Warehousing, and Logistics.

Excluding block deals, the allocation of trading value increased in the mid-cap sector (VNMID), while it decreased in the large-cap (VN30) and small-cap (VNSML) sectors.

The Stock Market Tomorrow, September 17: Catalysts to Inspire Stock Buying

For the September 16 stock market session, foreign investors increased their buying as the market turned red. This move could encourage other investors to hold on to their stocks for the upcoming session.