Impressive Growth Figures

The General Statistics Office’s report on the socio-economic situation reveals that the picture of export goods in the first eight months of 2024 has shown many positive signals. This is creating a strong momentum for businesses, associations, and industries to continue to closely monitor market developments and boost exports.

Accordingly, the total import and export turnover in July and August both exceeded $70 billion. In August alone, the preliminary total import-export turnover of goods reached $70.65 billion, up 0.8% compared to the previous month and up 13.5% over the same period last year.

Compared to 2022, a record year for imports and exports, although import and export turnover reached $732 billion, there was no month in that year with import and export turnover reaching $70 billion (the highest month only reached $67.1 billion).

In the first eight months of 2024, the preliminary total import and export turnover of goods reached $511.11 billion, up 16.7% over the same period last year, of which exports increased by 15.8%, and imports increased by 17.7%. The trade balance of goods surplus was $19.07 billion.

The report explains that the recovery of Vietnam’s main export markets has pushed August exports to a record high of $37.59 billion, the highest ever, exceeding the July figure of $36.24 billion by more than $1 billion.

In the first eight months of 2024, the preliminary export turnover of goods reached $265.09 billion, up 15.8% over the same period in 2023. Of this, the domestic economic sector reached $73.88 billion, up 21% and accounting for 27.9% of total export turnover; the foreign-invested sector (including crude oil) reached $191.21 billion, up 13.9%, accounting for 72.1%.

Notably, export turnover in recent months has continuously reached high levels, averaging $33.1 billion per month in the first eight months of 2024, while the average export turnover in the last six months of 2023 was only $31.7 billion per month.

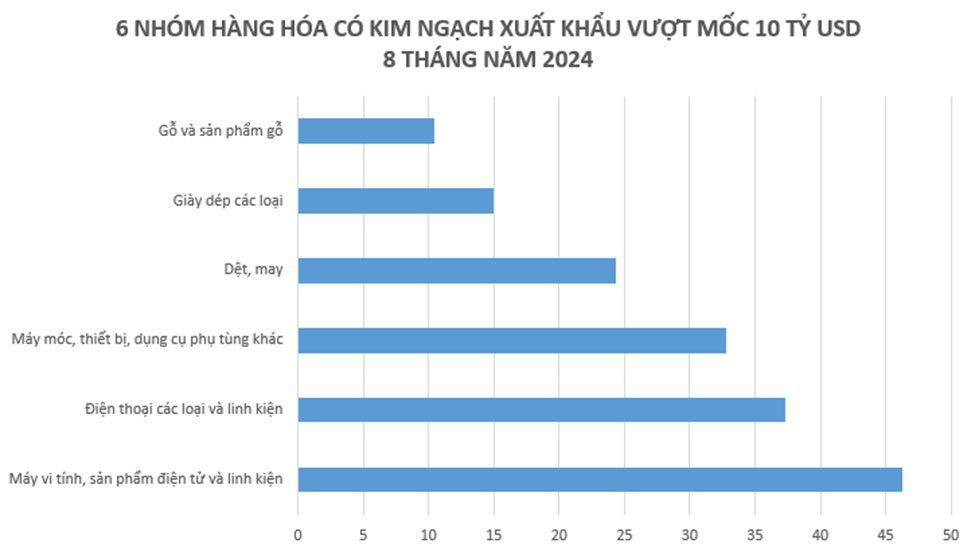

As of the end of August 2024, there were 30 export commodities with a turnover of over $1 billion, accounting for 92.3% of total export turnover (including six commodities with an export turnover of over $10 billion, accounting for 62.6%).

In the first eight months, the processed industrial product group had the largest export value of $233.3 billion, accounting for 88% of the total export turnover, up 15.4% over the same period last year. The fuel and mineral group reached $2.92 billion, accounting for 1.1%; the agricultural and forestry product group reached $22.53 billion, accounting for 8.5%; and the seafood group reached $6.31 billion, accounting for 2.4%.

These results are thanks to increased export orders in key sectors such as textiles and footwear, along with continued foreign investment inflows and an impressive recovery in the processing and manufacturing industry. Notably, agricultural exports have also benefited from both high yields and favorable prices.

Regarding imports, data from the General Statistics Office indicates that the preliminary import turnover of goods in the first eight months of 2024 reached $246.02 billion, up 17.7% over the same period last year, of which the domestic economic sector reached $89.58 billion, up 19.7%; the foreign-invested sector reached $156.44 billion, up 16.5%.

In the first eight months of 2024, there were 38 import commodities with a value of over $1 billion, accounting for 90.8% of the total import turnover (including two commodities with an import turnover of over $10 billion, accounting for 40.7%). The group of production inputs accounted for the largest proportion, at 93.9%, reaching $230.95 billion.

The General Statistics Office assesses that imports have increased in most input goods serving production and exports, contributing to promoting the recovery of domestic production.

Expecting Total Import and Export Turnover to Reach $800 Billion in 2024

According to calculations, to achieve the export turnover target of $800 billion, the growth rate in 2024 compared to 2023 needs to reach a minimum of 17.5% (in 2023, the total import and export turnover reached $681.1 billion), with the total import and export turnover for the first four months being $290 billion, averaging $72.5 billion per month.

The report of the General Statistics Office evaluates that, based on the law of many years, import and export activities often take place vigorously and increase strongly in the last months of the year. The proportion of import and export turnover in the fourth quarter is often higher than in the other quarters.

With a growth rate of 16.7% in the first eight months of 2024 compared to the same period last year, the total import and export turnover in the last two months both exceeded $70 billion, along with the law of import and export activities in the last months of the year, so it is expected that the total import and export turnover in 2024 will increase by 17.5% compared to 2023 and simultaneously reach the milestone of $800 billion.

Although the export market is recovering with many orders, the exports of key industries are facing challenges due to labor shortages, high production costs, stringent requirements, and trade remedies applied by export markets.

The latest Goods Trade Barometer of the World Trade Organization (WTO) released on September 5 shows that the growth of global goods trade volume is likely to remain favorable in the third quarter of this year. There are four months left until the end of 2024. Now is the peak time for domestic manufacturers to finalize year-end orders, and for businesses with sufficient orders to worry about materials and labor to coordinate production and deliver on time.

“Dabaco (DBC) Achieves Impressive $83.2 Million in Revenue for August 2024”

The August 2024 revenue of Dabaco surpassed 2.024 trillion VND, an impressive 11% increase from the previous month. The company’s feed and pig farming sectors remain the key drivers of this remarkable growth, showcasing their unwavering commitment to excellence and sustainable progress.

“Nissan Almera Discounted at Dealerships Ahead of New Model Launch: Massive Discounts of up to 130 Million VND, Fully-Loaded Version Now at 465 Million VND, Rivaling i10 Prices”

According to the dealership consultant, there are only a handful of the 2023 Nissan Almera models left in stock. This sought-after vehicle is flying off the lot, with its sleek design and impressive performance capturing the attention of car enthusiasts nationwide. With such limited availability, potential buyers must act fast to secure their very own Almera and experience the thrill of owning one of Nissan’s most coveted models.

The Art of IR: A Market Tier Upgrade Tale

IR (Investor Relations) is a critical function for publicly listed companies or those seeking to trade on stock exchanges. Fostering strong relationships with shareholders brings numerous benefits, including enhanced capital-raising abilities and future growth opportunities. Of paramount importance is transparency – the cornerstone of effective IR practices – which also serves as a key criterion for attracting investors in the context of Vietnam’s evolving stock market landscape.

The Next Chapter: Unveiling the $70 Billion Mega-Project Traversing 20 Vietnamese Provinces

This key transport infrastructure project in Vietnam is set to have its investment proposal reviewed next month. A promising development, this review will be a pivotal moment for the country’s transport network.