Smartphones are becoming indispensable to individuals, catering to their work, entertainment, travel, and telecommunication needs, among others. And it’s even more convenient when all these needs are integrated into one single app.

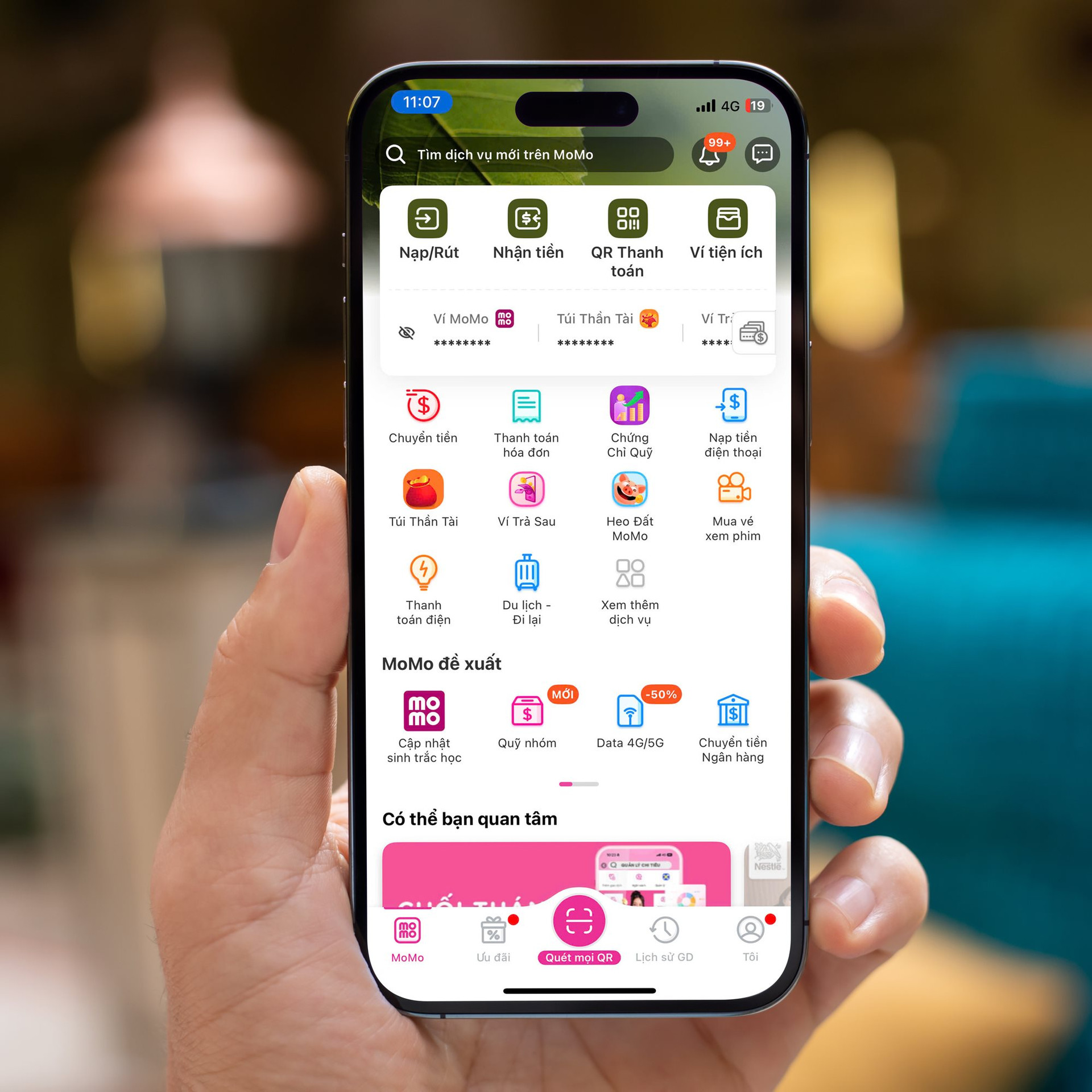

MoMo has turned this desire into reality by building an ecosystem that fulfills all the needs of Vietnamese users, from money transfer and receipt to shopping, entertainment, travel, e-commerce, e-government services, and even philanthropy. Notably, MoMo also provides financial services such as lending, savings, and investment with quick, safe, and accurate processing.

One of MoMo’s standout features is its use of AI, Big Data, and advanced security technologies to optimize the user experience, ensuring fast transactions and secure personal information.

With the goal of democratizing financial services, the purely Vietnamese financial app, MoMo, has built a platform that is not only convenient but also highly secure, contributing to the sustainable development of the digital economy.

Pioneering AI Usage to Bring Difference to Consumers

Creating a distinctive impression is key to winning over users. That’s why MoMo has utilized its superior AI technology to offer a significant difference compared to similar products in the market.

MoMo’s AI focuses not only on process automation but also on optimizing the user experience through the analysis of Big Data and Machine Learning. MoMo’s AI solutions can learn and adjust based on real-time user behavior, catering to the diverse and complex needs of each customer.

The AI technology used by MoMo is flexible and scalable, allowing business partners to easily adopt AI solutions regardless of their scale.

MoMo prioritizes safety and security. Its AI technology integrates advanced security measures, including biometric identification and user data protection, enabling the system to automatically and effectively detect and prevent financial fraud.

These improvements have helped MoMo become one of the pioneering brands, asserting its unique mark over competitors and driving the digitalization of financial consumption in Vietnam.

Superior Financial Solutions with Advanced AI Technology

MoMo’s advanced AI technology has created optimal and convenient features to address the needs of not only individual customers but also small and medium-sized organizations and businesses.

Time is a critical factor for consumers. Understanding this, MoMo has integrated AI into its eKYC feature, allowing users to complete the process of opening a bank account directly on the MoMo app within 2-3 minutes. Additionally, partner banks offering online account opening services through MoMo can reduce their operating costs by up to 50% compared to traditional account opening methods.

By integrating AI, MoMo, along with banks and financial institutions, has shortened processing times, enabling consumers to access loans 10-30 times faster than traditional methods.

MoMo has recently introduced a new feature called “Spend Management,” which uses AI to automatically categorize expenses, making expense management easier and more efficient than traditional recording methods. Previously, during the Lunar New Year 2024, MoMo launched the “Create QR with AI Image” feature, thanks to Generative AI technology, providing a creative, elegant, and civilized experience of receiving lucky money.

In addition to superior features for individual customers, AI in MoMo’s Sales 4.0 solution helps small and medium-sized enterprises (SMEs) and micro-enterprises (MSMEs) in Vietnam to digitize effectively. This technology provides analytical insights into customer behavior and suggests appropriate business campaigns, assisting managers in implementing more effective customer care and promotional programs.

MoMo also utilizes AI chatbots to automatically support customers, quickly resolving common issues and reducing customer support response times by over 60%, ensuring timely and efficient assistance.

Sustainability Wins User Trust

With a long-term vision, MoMo’s AI technology and solutions ensure maintainability and sustainable development in the future. MoMo’s AI system can adapt flexibly to changes in customer and market demands. MoMo also continuously updates the latest security standards and applies AI to detect risks early on, ensuring safety and reliability for both users and partners.

Combining these factors, MoMo’s AI solution not only maintains its pioneering position but also has the potential for continuous development, meeting the increasingly complex needs of users and the market in the years to come.

For MoMo, AI plays a crucial role. Artificial Intelligence has directly boosted MoMo’s revenue growth by optimizing business processes and personalizing user experiences, helping them easily access financial services without having to visit traditional banks.

AI provides MoMo with valuable insights to predict market trends and suggest effective business strategies to keep up with consumers’ needs.

It is evident that MoMo’s AI-integrated products and services have improved the lives of many users, especially in providing easier access to financial services for the community. Through AI, users gain additional knowledge about personal financial management, fostering a wiser, more sustainable, and safer society.

Better Choice Awards honor and celebrate “Innovative Values” in products, services, and achievements that bring practical benefits to consumers, creating a difference by not seeking the “best in segment” but instead focusing on the actual needs of users to help them find the most suitable brands and products.

The awards opened for public voting on September 9, 2024, after a press conference at the headquarters of the Ministry of Planning and Investment, 6B Hoang Dieu. The voting will close on September 24, 2024. Cast your vote for your favorite brands to win the nominations at Better Choice Awards 2024 via the website: https://betterchoice.vn/

Gen Z and Their ‘Full-Service’ Payment Methods: How MoMo Became a Pioneer in Digital Finance

As a pioneering financial platform, MoMo is at the forefront of driving digital transformation in Vietnam. With a range of innovative financial services and products, MoMo is empowering people to live smarter and more fulfilling lives. By harnessing the power of technology, MoMo is revolutionizing the way people manage their finances, making it easier and more accessible than ever before. With its user-friendly interface and secure platform, MoMo is the trusted choice for millions of Vietnamese, enabling them to take control of their financial future.