2024 has been a year of recovery for Vietnam’s steel industry, which faced significant challenges in 2023 due to declining domestic demand and exports. However, building on the momentum from the latter part of the previous year, the industry has witnessed a remarkable rebound in exports, achieving impressive growth figures in 2024.

According to preliminary statistics from the General Department of Vietnam Customs, in August 2024, Vietnam exported over 1.3 million tons of iron and steel, generating revenues of $941 million. This represents a 32% increase in volume and a 21% surge in value compared to the previous month.

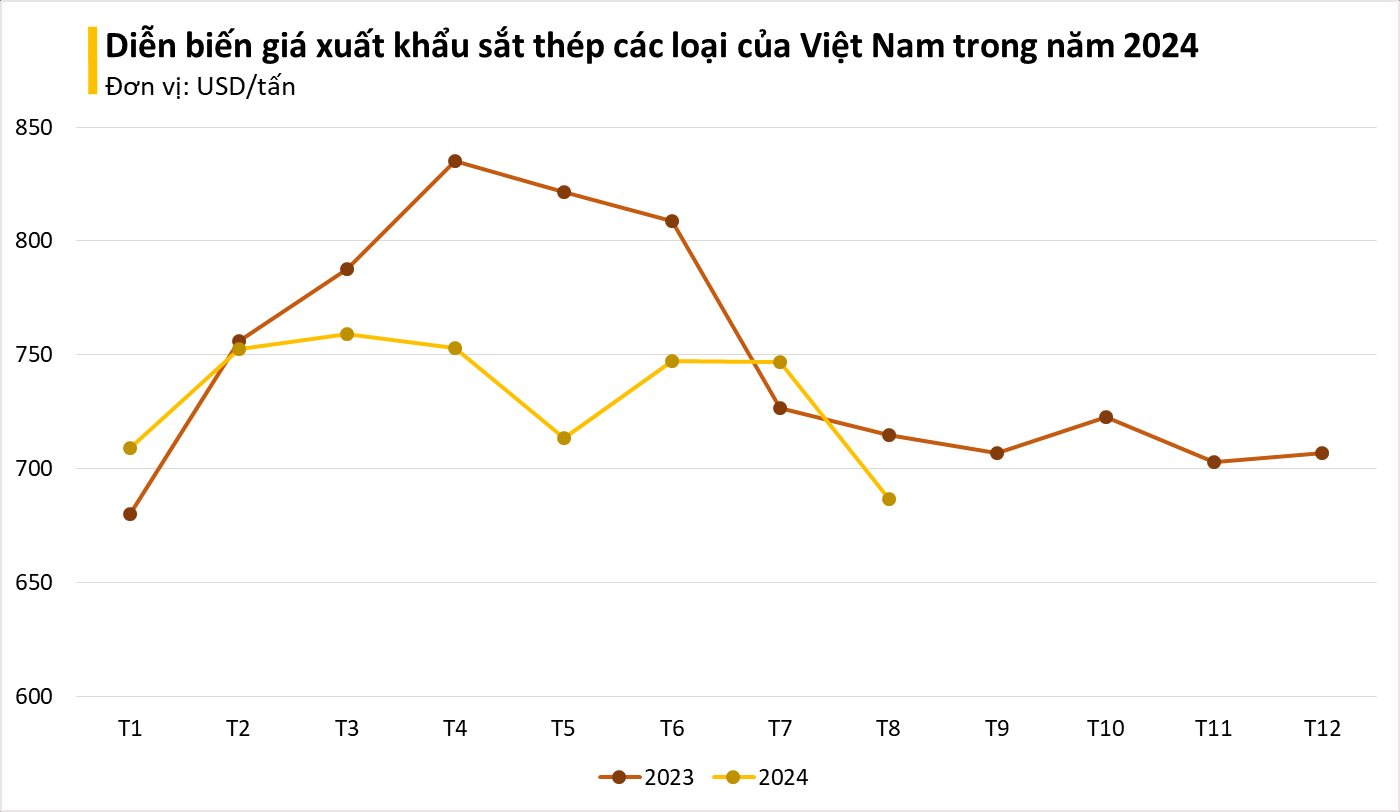

Cumulatively, during the first eight months of 2024, exports of various iron and steel products increased by 21% in volume and 14% in value compared to the same period last year. The average export price stood at $730 per ton, reflecting a 5.5% decrease from the corresponding period in 2023.

Overall, the initial months of 2024 witnessed consistently high export volumes for Vietnamese iron and steel, except for February and June. All other months recorded exports exceeding one million tons.

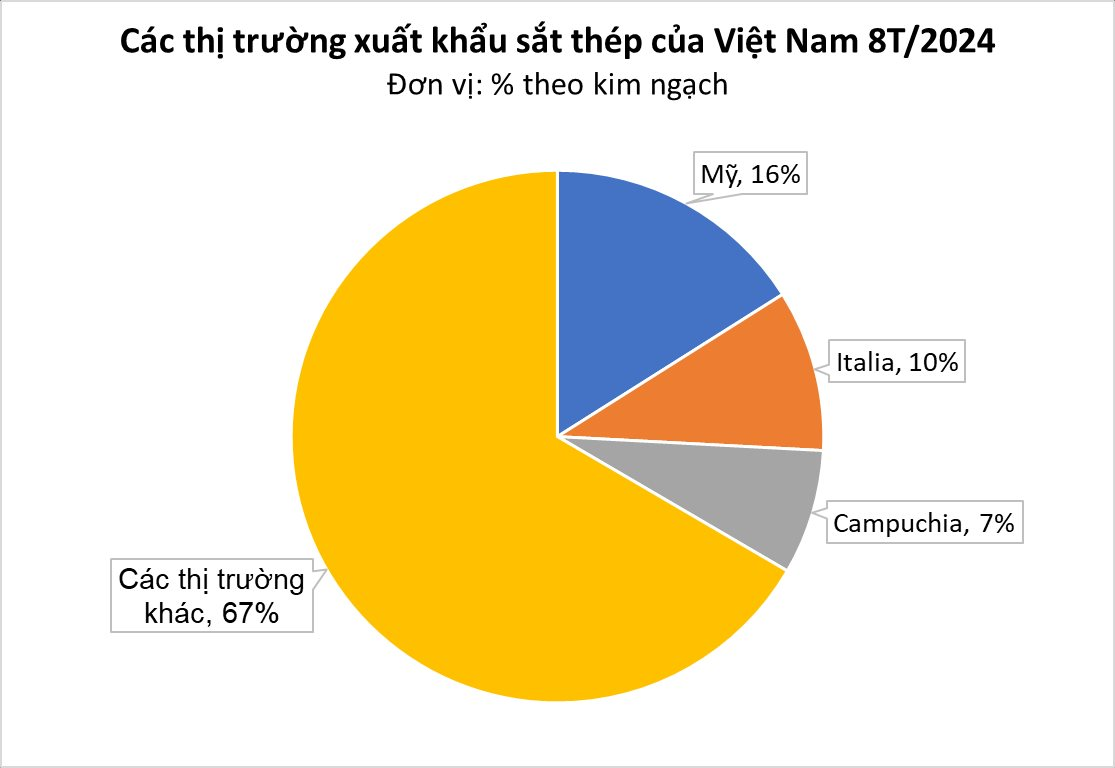

Analyzing the export markets, the United States maintained its top position as the largest consumer of Vietnamese iron and steel products during the first eight months of 2024. Exports to the US surpassed 1.26 million tons, equating to over $1.04 billion, with an average price of $822 per ton. This marked a substantial increase of 16% in volume, 38% in value, and 3.8% in price compared to the same period in 2023.

Italy, the second-largest market, witnessed a decrease of 14.8% in volume, 24.7% in value, and 11.5% in price compared to the first four months of 2023.

Cambodia secured its position as the third-largest market, with exports totaling 781 tons, valued at $492 million, and an average export price of $628 per ton during the same period.

Beyond the top three markets, several other countries demonstrated remarkable growth. Notably, exports to Russia, Saudi Arabia, and Spain registered impressive double-digit increases.

The Vietnam Steel Association (VSA) forecasts improved export performance due to the widening price gap between steel prices in North America, Europe, and Vietnam. This price differential gives Vietnamese steel a competitive edge in the global market.

Additionally, Europe’s tighter control over the import of semi-finished steel products from Russia in 2024 presents an opportunity for Vietnamese steel exports to gain a stronger foothold in the European market.

The VSA remains optimistic about the industry’s prospects, attributing the positive outlook to favorable conditions and opportunities arising from export markets. By 2030, the average steel consumption is expected to reach 290-300 kg per person, a significant increase from the current level of 240 kg per person. This bodes well for the next cycle of development and growth for Vietnam’s steel industry and will likely contribute to the recovery of profits for businesses in the sector.

However, the industry also faces certain risks and challenges, including policies enacted by China and the EU, as well as the transition to greener practices, emission reduction targets, and trade protectionism.

According to the World Steel Association (WSA), global steel prices in 2024 are projected to increase slightly by 3.5% compared to 2023, driven by recovering demand and tightening supply. In contrast, the World Bank forecasts a slight decrease in iron ore prices for 2024, expected to reach $108 per ton, representing a 2.8% decline from 2023.

Regarding domestic steel prices, the end of the third quarter typically coincides with the rainy season, which may hinder significant breakthroughs in construction activities. Additionally, while the real estate sector has shown signs of improvement, a substantial upturn is yet to materialize.