The sudden surge in market excitement during the afternoon session, despite a lack of surprising news, caught many traders off guard. With low selling volume, persistent buying pressure from investors caused the entire market to shift, propelling the VN-Index to a continuous climb and a strong close above the crucial psychological threshold of 1,250 points. Foreign investors also surprised the market with a substantial net buy of nearly 525 billion VND, the highest in 22 sessions.

The trading volume on the two listed exchanges witnessed a 65.4% increase in the afternoon compared to the morning session, reaching 7,102 billion VND. While this absolute figure is not exceptionally high, the buying side held a clear advantage, as the selling side showed signs of weakening, allowing for a smooth price push. The VN-Index breadth, which indicates the number of advancing and declining stocks, improved significantly from the morning session, with 180 stocks advancing and 178 declining around 2 pm, ultimately closing with a dominant 312 advancing stocks versus 88 declining ones.

This breadth dynamic suggests that the VN-Index’s ascent was not solely reliant on a few large-cap stocks but rather a collective effort of numerous stocks experiencing price increases. Specifically, while only 35 stocks on the HoSE had gained over 1% in the morning session, with a combined trading volume of less than 600 billion VND, the afternoon session witnessed a remarkable improvement, with 138 stocks gaining over 1% and a total trading volume of over 8,422 billion VND, accounting for 80% of the exchange’s total trading value.

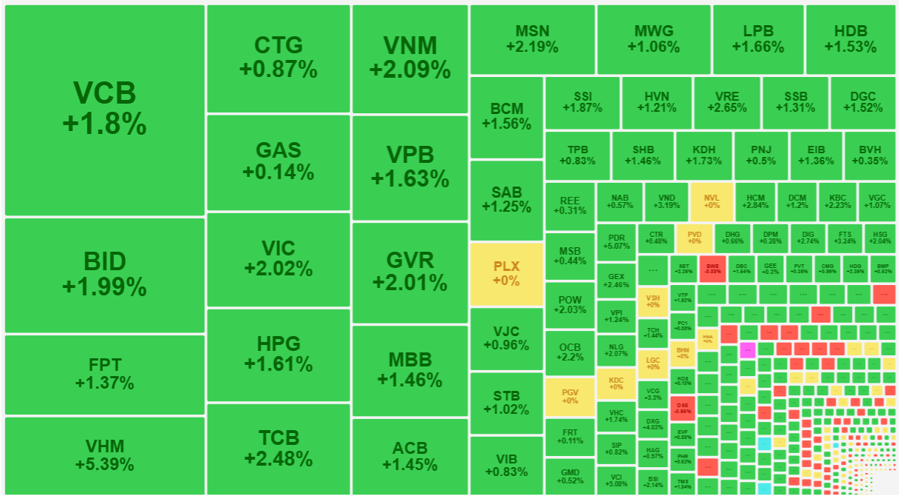

While the overall sentiment among stocks was positive, the blue-chip group, or large-cap stocks, undeniably led today’s rally. The VN30-Index, which tracks the performance of the 30 largest stocks by market capitalization, outperformed the broader VN-Index and the mid-cap and small-cap segments, posting a gain of 1.74%. VHM, a prominent large-cap stock, stood out despite already recording a solid gain of 2.16% in the morning session. It staged an impressive rally in the first 30 minutes of the afternoon session, adding approximately 3% to its morning gains and ending the day 5.39% higher. Another key large-cap stock, TCB, rose 2.48% in the afternoon, recovering from its morning stagnation at the reference price. BID, the second-largest stock by market capitalization after VCB, also witnessed a remarkable turnaround, climbing nearly 2.31% in the afternoon session to close 1.99% higher. In total, 8 stocks in the VN30 r

osier advanced over 2%, while 15 others posted gains between 1% and 2%.

The robust performance of the blue-chip group contributed significantly to the VN-Index’s impressive gain of 19.69 points at the close, the highest in 20 sessions. The index reclaimed the 1,258.95 level, firmly surpassing the critical 1,250-point mark it had lost the previous day. In fact, today’s gains effectively erased the losses incurred in the previous four consecutive down sessions.

While the majority of the VN30 stocks performed exceptionally well, several mid-cap and small-cap stocks also stood out with notable gains. Stocks in the securities and real estate sectors dominated this category, with DPG surging 5.19% on a trading volume of 122.8 billion VND, VCI climbing 5.08% with a volume of 208.5 billion VND, PDR advancing 5.07% on a volume of 259.6 billion VND, DXG rising 4.03% with a volume of 167.6 billion VND, FTS gaining 3.24% on a volume of 154.8 billion VND, HCM increasing 2.84% with a volume of 264.3 billion VND, and DIG appreciating by 2.74% on a volume of 285.1 billion VND. Additionally, mid-cap stocks with above-average trading volume, including CTS, HHV, VCG, TDC, SCR, VND, and AGR, all posted gains exceeding 3%.

Foreign investors also contributed to the afternoon’s price push, registering a net buy of 393.2 billion VND on the HoSE. This follows their net buy of 131.7 billion VND in the morning session. Today’s total net buy of nearly 525 billion VND marks the highest level of foreign investment in 22 sessions, especially after a prolonged period of consistent net selling over the past month. Notable stocks that attracted foreign investment included VHM, with a net buy of 193.2 billion VND, FPT with 188.6 billion VND, SSI with 45.6 billion VND, NVL with 44.9 billion VND, and DIG with 40.3 billion VND. On the selling side, foreign investors offloaded MWG, KDH, and VPB, with net sells of 144 billion VND, 34.4 billion VND, and 26.7 billion VND, respectively.

The resurgence of foreign capital inflows over the past two sessions coincides with the upcoming Federal Reserve’s interest rate decision, where a rate cut is highly anticipated. This policy shift has become increasingly certain, and its impact on the strengthening of the US dollar is inevitable. Consequently, foreign exchange rates in Vietnam have already shown significant improvement.

Today’s powerful reversal occurred despite relatively low trading volume. While the afternoon session witnessed robust trading activity, the combined trading value of the HoSE and HNX exchanges for the full day fell short of 11,400 billion VND. This dynamic can be viewed as a positive sign, indicating that many investors remain cautious and have not fully engaged in the market, even as stock prices recover sharply. This skeptical sentiment is characteristic of the early stages of a market turnaround, which is a healthy sign for the sustainability of the rebound.

The Stock Market Tomorrow, September 17: Catalysts to Inspire Stock Buying

For the September 16 stock market session, foreign investors increased their buying as the market turned red. This move could encourage other investors to hold on to their stocks for the upcoming session.