Vietcap Securities (Vietcap, code: VCI) announced that it has signed a syndicated loan agreement worth $119 million (equivalent to VND 2,975 billion) with the option to increase the credit commitment limit by up to $81 million (equivalent to VND 2,025 billion).

The loan was arranged by Maybank Securities Pte. Ltd., Malayan Banking Berhad (Singapore Branch), Maybank Philippines, Inc., Maybank International (Labuan Branch), and Taishin International Bank Co., Ltd. (Singapore Branch).

With this loan, Vietcap has successfully raised capital following its previous fundraising round in January 2024.

Previously, Vietcap had the following international syndicated loans:

In January 2024, Vietcap raised $34 million with an option to increase to $100 million arranged by Bank SinoPac Co., Ltd., and Bank of Kaohsiung – Offshore Banking Branch.

In August 2023, the company raised $100 million, arranged by Mega International Commercial Bank through its Offshore Banking Branch.

In July 2023, Vietcap secured a $45 million loan arranged by Shanghai Commercial and Savings Bank, Ltd. through its Offshore Banking Branch.

In October 2022, Vietcap raised $105 million, with a Greenshoe option for a loan of up to $150 million, arranged by Maybank Securities Pte. and O-Bank Co., Ltd., with Malayan Banking Berhad, Singapore Branch as one of the lenders.

In May 2022, they secured $100 million arranged by Mega International Commercial Bank through its Offshore Banking Branch.

In November 2021, the securities firm also obtained $100 million, with a Greenshoe option for a loan of up to $150 million, from a banking group arranged by Maybank Kim Eng Securities Pte Ltd (now Maybank Securities Pte Ltd), with Malayan Banking Berhad, Singapore Branch as one of the lenders.

In May 2020, they secured an unsecured syndicated loan of $40 million from a banking group led by Sinopac Bank.

In late August, VCI announced that it would issue shares to increase its charter capital from equity (bonus shares). The record date for allocating rights is September 13, with the ex-rights date being September 12.

The entitlement ratio is 30% (shareholders owning 10 shares will receive 3 new shares), expecting to issue an additional 132.57 million new shares, thereby increasing its charter capital to nearly VND 5,745 billion.

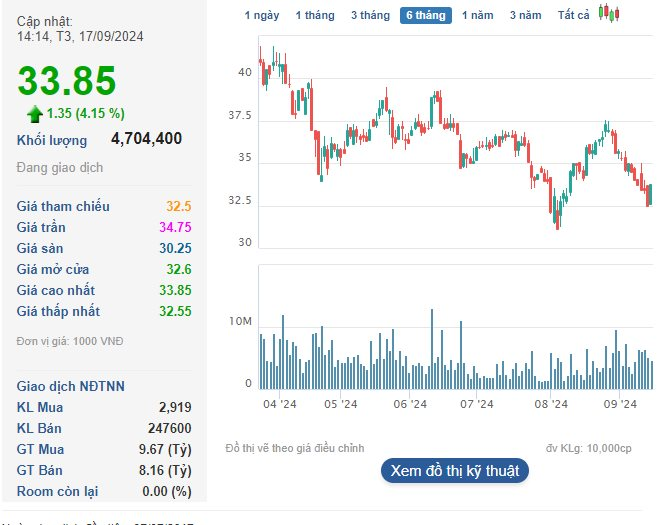

In terms of business performance for Q2 2024, Vietcap reported operating revenue of VND 919 billion, up 83% over the same period last year; after-tax profit of over VND 279 billion, up 138% over the same period last year. For the first six months, VCI reported a profit of nearly VND 477 billion, 2.5 times higher than the first half of 2023.

In the market, VCI shares are currently up more than 4% from the previous session, thereby advancing to VND 33,850/share.

The Billionaire’s Bet: VinFast’s Endless Funding Assurance.

Beyond the philanthropic donation, billionaire Pham Nhat Vuong also orchestrated a subsidiary share transfer deal worth over VND 1,800 billion.