The upcoming Federal Reserve (Fed) meeting, scheduled for September 18, is anticipated to be one of the most significant events of the year for international financial markets. Expectations are high that the Fed will initiate a rate cut, marking the first reduction since the rate hike cycle that began on March 17, 2022.

ABS Securities Research forecasts a 25-basis point cut by the Fed. A deeper 50-basis point cut could unnecessarily disrupt the short-term money market, especially considering that the yield curve is no longer inverted.

## HOW DO STOCK MARKETS REACT WHEN THE FED CUTS RATES?

Historical data from the S&P500 reveals varied responses to Fed rate cuts. Specifically, when measured from the date of the first rate cut, the S&P500 tends to perform better during periods of robust economic growth and declines during economic recessions.

### 2008 Cycle (2007-2008 Financial Crisis):

The Fed concluded its 2005-2006 rate hike campaign in June 2006. By early 2007, the housing bubble burst, and unemployment rates started to climb. As the economy weakened, the FOMC began cutting rates in September 2007, ultimately reducing rates by 2.75 percentage points within a year. Consequently, the S&P500 declined continuously for three years from July 2007 and only recovered to the 1500s in 2013.

### 2001 Cycle (Dot-com Bubble):

Following the dot-com bubble in the late 1990s and the bankruptcies in 2000, the Nasdaq Composite Index peaked in February 2000 but didn’t bottom out until September 2002.

During this period, the stock market crisis spilled over into the real economy, causing a slight GDP decline and higher unemployment—resulting in an eight-month recession. The 9/11 terrorist attacks further exacerbated the economic issues. The Fed slashed rates by a total of 5.25 percentage points at a steady pace throughout 2001. Similarly, the S&P500 dropped by nearly 17% over three years and continued to fall until it recovered to the 1300s in early 2006.

### 1990 Cycle:

The Gulf War recession lasted from July 1990 to March 1991. Unemployment rates rose from 5.2% in June 1990 to 7.8% two years later. The Fed began cutting rates on July 13, 1990, lasting over two years, and reduced rates by a total of 5.15 percentage points. The S&P500 declined by 15% in six months but recovered to the 360s by February 11, 1991.

For rate cuts that occurred during strong economic growth periods, like in 1980 and 1970, the markets quickly rebounded after initial dips. Most recently, in 2020, after a 17% drop in March, the S&P500 swiftly recovered and surged by 27% after one year and 45% after two years from the initial rate cut date.

## IMPACT ON VIETNAM’S ECONOMY AND STOCK MARKET

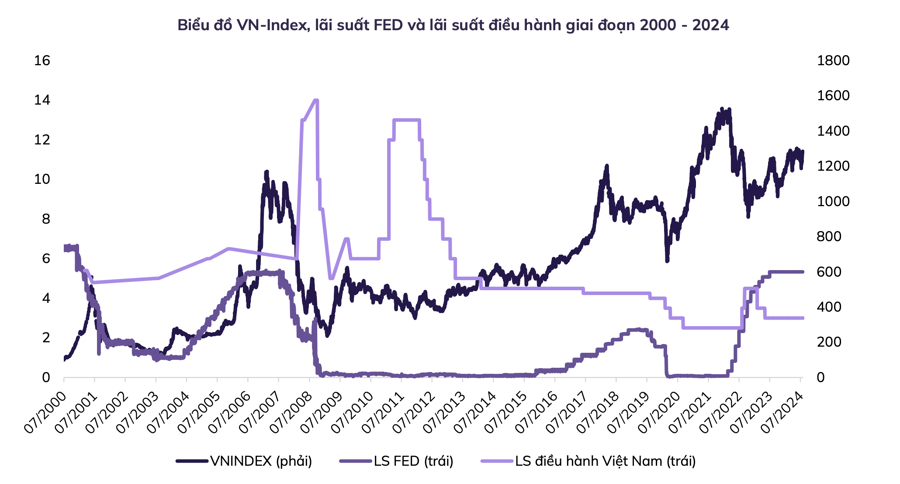

Since its establishment in July 2000, Vietnam’s stock market has witnessed a total of four rate cut cycles from the Fed, three of which were significant and linked to global economic crises in 2001, 2007, and 2020.

### 2001 Cycle:

Following the Fed’s initial rate cut announcement, the VN-Index showed no signs of decline and instead rose by 49 points within a month, eventually doubling to 571 points by June 2001.

A stock market bubble began to form as the market grew too quickly in a short period, leading to the risk of a sharp corrective downturn. By the end of 2001, the VN-Index plummeted by over 300 points from its previous peak, settling at 235.4 points.

### 2007-2008 Cycle:

The rapid growth in the real estate market prompted the Fed to decide on a 50-basis point rate cut on September 18, 2007, as the real estate bubble began to burst, and unemployment rates started to climb.

The VN-Index dropped in the month before the rate cut decision but then rose by 14.39% to 1069 points within a month after the cut before continuously falling to the 260s region. The global economic crisis significantly impacted Vietnam’s economy, and it took the VN-Index two years to recover and start rising again.

### 2019 Cycle:

The Fed cut rates three times in 2019, each by a quarter of a percentage point, in what Chairman Powell termed a “mid-cycle adjustment.” The VN-Index dipped slightly before and after the rate cut announcements but then rebounded to the 1010s in early November 2019.

### 2020 Cycle:

The Fed slashed rates significantly due to the Covid-19 pandemic, causing panic in the market and heavy selling pressure from investors. The VN-Index hit a bottom on March 30 at 662.26 points, a 27% drop from January 22, 2020. However, the market regained momentum, and one year later, it climbed by 31.2%.

## HOW WILL THE FED RATE CUT AFFECT VIETNAM’S ECONOMY?

For the Vietnamese economy, the Fed’s rate cut has several implications:

– Lower USD interest rates reduce borrowing costs for USD-denominated loans taken by governments, businesses, and individuals in the US and worldwide.

– Lower USD interest rates allow central banks globally to follow suit and implement more accommodative monetary policies, stimulating income and consumption among Americans, which, in turn, boosts demand for Vietnam’s exports, as the US is a key export market for Vietnam.

– Reduced USD interest rates ease pressure on the VND/USD exchange rate and VND interest rates, lowering borrowing costs for foreign currency loans in Vietnam.

– It helps curb inflation caused by rising exchange rates, as Vietnam still relies on imports for essential goods like fuel and manufacturing raw materials.

– The State Bank of Vietnam (SBV) gains more room to maneuver its monetary policy flexibly. In anticipation of the Fed’s rate cut in September, the SBV lowered the OMO lending rate for the first time since late 2023, from 4.5% to 4.25% on August 5 and further to 4.00% on September 16. The OMO rate cut indicates the SBV’s intention to support the banking system’s liquidity and establish a lower interbank lending rate in the coming period.

– The rate cut’s impact on the stock market includes the potential for banks to boost credit growth, enhancing the economy’s and stock market’s liquidity.

– Lower USD interest rates attract international investment to developing countries, which offer significant interest rate differentials for local currency deposits compared to USD deposits. This is a reversal from the recent trend, where high USD interest rates drew investment away from emerging/frontier markets back to the US.

– Data shows that in the past two weeks, foreign investors have been net buyers in some ASEAN markets, including Indonesia and Malaysia. While they continue to sell in Vietnam, the net selling pace has slowed significantly in the past two and a half months, and net buying sessions have reappeared.

“In the short term, the Fed’s rate cut has more positive effects on Vietnam’s economy and stock market than negative ones. The specific actions from the Fed’s upcoming accommodative policies and the hard or soft landing scenario for the US economy will also significantly impact Vietnam. We will need to closely monitor developments to provide timely assessments and forecasts,” ABS experts emphasized.