The deadline for finalizing the bondholder list is September 10th, and the deadline for bondholders to submit their responses to the opinion poll is 9 am on September 18th. The ballots will then be checked and the results announced on September 19th.

According to data from HNX, this is the only bond currently in circulation from GKM. It was issued on September 20, 2021, with a value of VND 100 billion, to supplement working capital for production and business activities, financial investment, and investment in the Khang Minh Aluminum Factory project in Ha Nam province.

The bonds were allocated to professional securities investors, with an initial term of 36 months until September 20, 2024, at an interest rate of 12.6% per annum, payable quarterly. The bonds are non-convertible, do not include warrants, and are guaranteed by 7 million GKM shares.

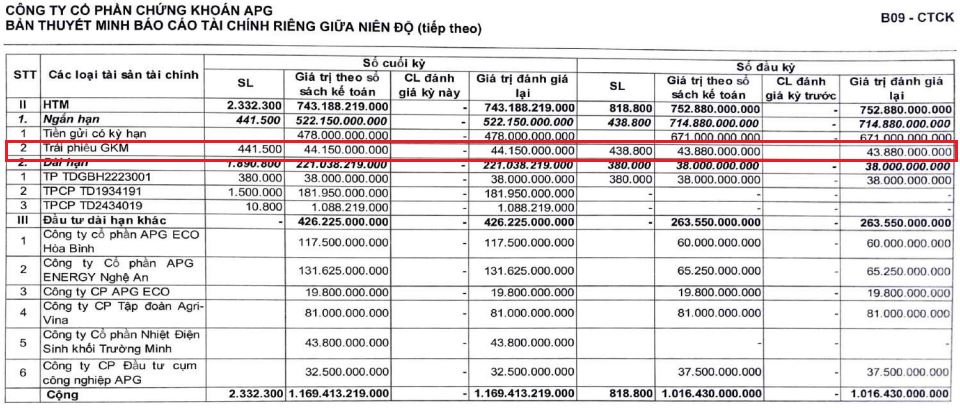

APG Securities Joint Stock Company (HOSE: APG) acted as the issuance advisor, issuance agent, registrar, depository, transfer manager, and asset manager for these bonds. APG is also a major shareholder, owning more than 5 million GKM shares, equivalent to a 16.08% stake.

Currently, there are 4,490 bonds, or VND 44.9 billion, still in circulation. Additionally, APG’s semi-annual report for 2024 noted an investment of nearly VND 44.2 billion in GKM bonds.

|

Earlier, in June 2024, the GKM Board of Directors approved the issuance of new bonds, GKMH2427001, with a maximum value of VND 44.9 billion, equivalent to the remaining value of the GKMH2124001 bonds.

The new bond issue aims to restructure debt, including payment of principal and interest on bonds due or early redemption, with the familiar partner APG acting as the advisory organization, issuance agent, and bondholder representative.

The bonds have a term of 36 months, a fixed interest rate of 11% per annum, payable annually, are non-convertible, do not include certificates, and are unsecured.

However, as of the end of the third quarter, GKM has not announced the results of this issuance. This could be a reason why GKM was unable to raise enough capital to meet the maturity of the existing bonds, leading to a request for a 24-month extension.

In the first half of 2024, GKM recorded revenue of more than VND 133 billion, an increase of more than 86 times compared to the same period last year. The surge in revenue is attributed to the expansion of business operations to include trading in construction materials and rice, in line with the new orientation of the General Meeting of Shareholders and the Board of Directors. Net profit reached nearly VND 6.3 billion, almost double that of the previous year, mainly due to the divestment of Khang Minh Quartz Stone Joint Stock Company.

| GKM’s net profit for the first half of 2024 showed a significant increase compared to the same period last year |