Services

According to the State Bank of Vietnam, statistics from 20 localities show that the total affected debt from Typhoon Yagi is approximately VND 80,000 billion. The heaviest losses were incurred in Quang Ninh and Hai Phong, with 11,700 affected customers and a debt balance of about VND 23,100 billion.

Immediate reduction in lending rates

As a bank with a 29-year history of accompanying customers across the country, KienlongBank understands the difficulties and urgent financial needs at this time, especially in the fields of agriculture and fisheries. Therefore, the bank has decided to directly reduce the interest rate by 2% per year on credit contracts for existing customers affected by Typhoon No. 3, hoping to help people overcome the aftermath of the storm.

In addition to reducing lending rates, KienlongBank also offers a preferential interest rate program for all new loan packages for: supplementary working capital; loan for construction, repair of houses, consumption… with flexible loan terms from 1 to 18 months, along with preferential interest rates from 0%, the total package disbursement scale of VND 3,000 billion.

According to KienlongBank’s representative: “After Typhoon No. 3, although many of KienlongBank’s transaction points were affected and assets were damaged, the bank proactively followed and updated information in each locality; compiled a list of customers affected by the storm; coordinated with customers to review and assess the current situation and damage incurred… On that basis, the bank has researched and implemented synchronous solutions and support packages such as: considering exemption/reduction of loan interest; developing preferential loan packages according to the actual situation of customers; speeding up the approval and credit granting process… to soon bring capital to customers after the storm and flood.”

Enact policies and solutions for quick capital access

KienlongBank understands that the losses and sorrows are irreparable. Moreover, life and business activities must be revived faster than ever. Accordingly, the bank has introduced various solutions and lending policies to enable people to access credit sources with not only preferential interest rates but also simplified procedures.

To achieve this, KienlongBank promotes digital transformation solutions and vigorously implements and applies technology in loan appraisal, helping to shorten the processing time for customers’ loan applications. The bank also continuously optimizes its internal processes, simultaneously issuing products that make it easier for customers to access information and reduce procedures while accurately meeting their capital needs.

|

Along with the policies urgently implemented for customers following the direction of the State Bank of Vietnam, KienlongBank also promptly joined hands with the Government to help people overcome the post-storm situation. The bank donated VND 500 million to the Vietnam Fatherland Front Central Committee, and the bank’s trade union also called on employees to support the northern compatriots with a spirit of mutual love, receiving the response of a large number of officers and employees with a total amount of over VND 1 billion. The bank will coordinate with the Central Committee of the Vietnam Farmers’ Union to use this amount to build houses for households affected by Typhoon No. 3 in Yen Bai and Lao Cai, as well as provide additional equipment and appliances to help people quickly overcome the post-storm situation and stabilize their lives.

With the simultaneous implementation of multiple preferential credit solutions, KienlongBank hopes to motivate and support customers in solving capital problems, creating a necessary foundation for them to revive their business, thereby contributing to economic development and meeting the needs of life. This is also one of the practical actions demonstrating KienlongBank’s role and responsibility in implementing the Government’s and State Bank of Vietnam’s policies on sustainable credit growth in 2024.

“Government-Backed 2000 Billion VND Loan Scheme to Aid Post-Disaster Reconstruction”

Military Commercial Joint Stock Bank (MB) is offering a special loan package of up to 2000 billion VND with a 1% reduced interest rate for individuals and households affected by the floods. This initiative aims to support those impacted by the natural disaster to rebuild their lives and get back on their feet with ease.

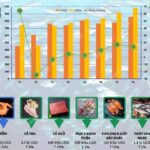

The Seafood Industry is Rocked by Storm Yagi

The recent Typhoon No. 3 (Yagi) has wreaked havoc on aquaculture, resulting in a severe shortage of raw materials for seafood processing businesses. The storm’s impact has been far-reaching, with many shipments delayed and left in prolonged storage, potentially affecting product quality and increasing the risk of financial losses for these businesses.

“Resolute in the Pursuit of 7% Growth, Despite the Super Typhoon’s Challenges”

The outlook for Vietnam’s economy remains positive, with forecasts from both domestic and international economic organizations predicting high-growth scenarios that could even surpass the upper target of the 2024 GDP goal. Despite the potential setbacks caused by Super Typhoon Yagi, Prime Minister Pham Minh Chinh remains steadfast in his ambition to achieve a remarkable 7% growth rate for the year.