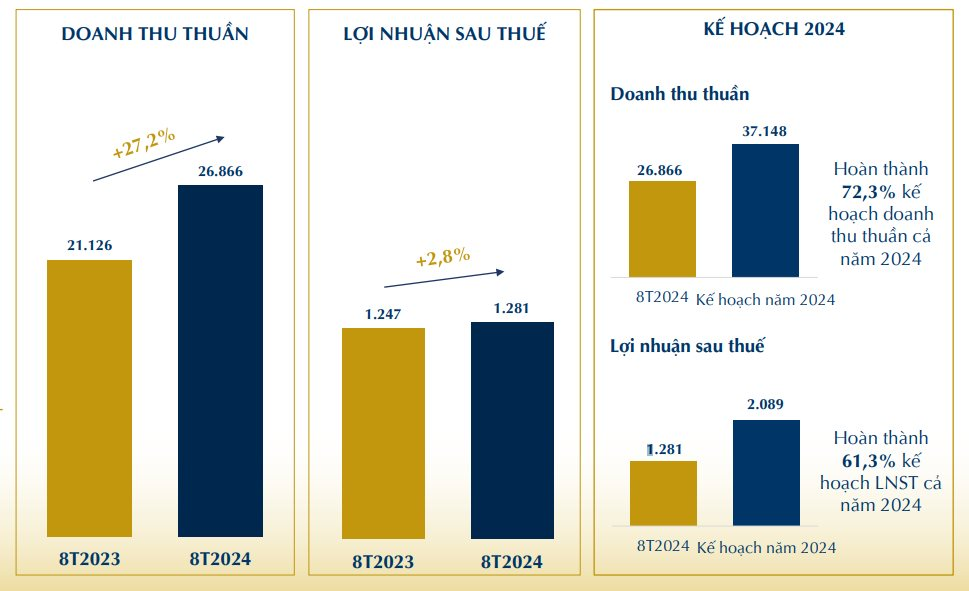

The latest operation report of Phu Nhuan Jewelry Joint Stock Company (PNJ: VN) shows that, in the first eight months of the year, the company recorded VND 26,866 billion in net revenue, up over 27% compared to the same period last year, completing 72% of the full-year plan.

After-tax profit for the first eight months reached VND 1,281 billion, up nearly 3% compared to the same period, completing 61% of the target set for 2024.

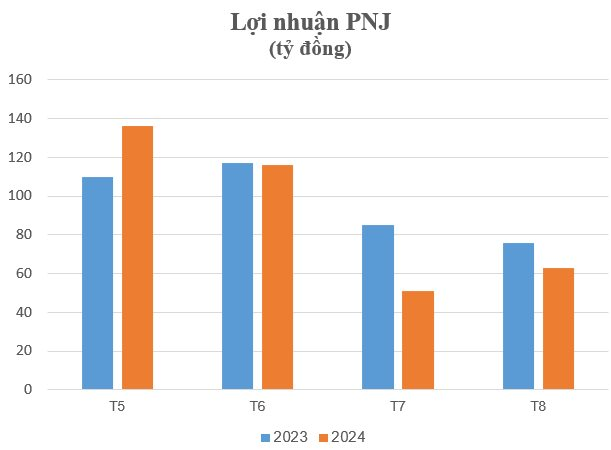

In August alone, PNJ’s revenue is estimated at VND 2,245 billion. PNJ’s after-tax profit reached approximately VND 63 billion, down 17% compared to the same period last year. This is also the third consecutive month that PNJ has seen negative profit growth compared to the previous year.

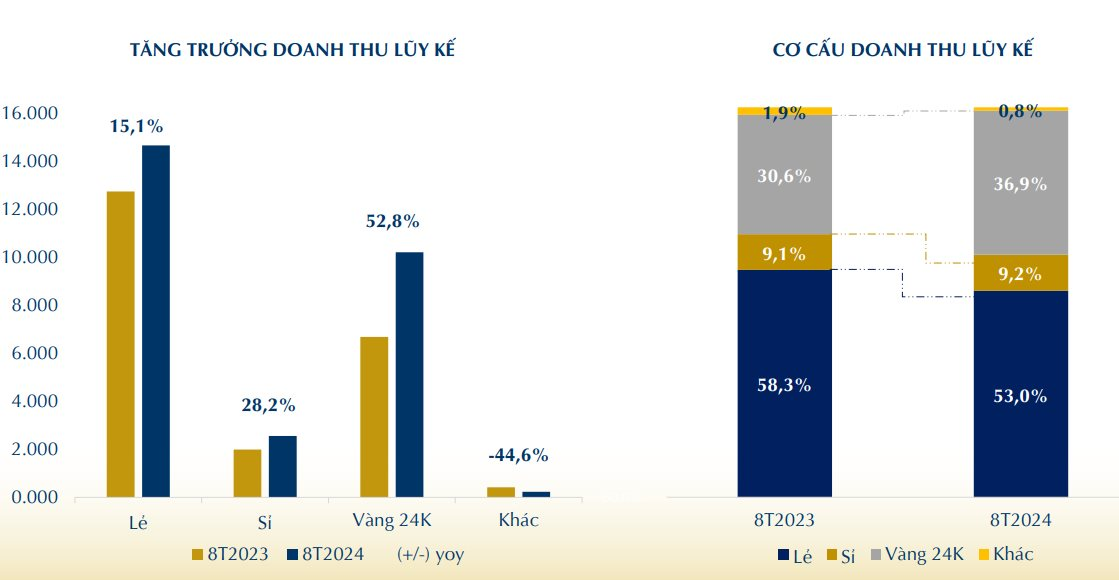

In the revenue structure for the first eight months of PNJ, retail jewelry revenue reached approximately VND 14,239 billion, up 15% over the same period last year due to the expansion of the store network as well as the launch of various jewelry products that cater to customer preferences. Revenue from 24K gold ranked second in the revenue structure, estimated at nearly VND 9,914 billion.

On the other hand, revenue from wholesale jewelry recorded about VND 2,472 billion, up 28% over the same period last year due to the shift in wholesale customer demand towards established and professional manufacturers.

In the first eight months, PNJ’s average gross profit margin reached 16.6%, down from 18.6% in the same period in 2023 due to changes in the revenue structure of each business segment.

The company believes that, in the context of the “headwind” of the market, the average gross profit margin is still maintained at a decent level thanks to factors such as the stable profit margin of the retail and wholesale channels. In addition, PNJ has implemented measures to optimize resources and improve operational efficiency in production, offsetting the decrease in gross profit due to the increase in the proportion of 24K gold in revenue structure.

In terms of system development, in the first eight months of the year, PNJ opened 24 new stores and closed 10, bringing the total number of stores to 414. Specifically, there are 405 PNJ stores, 5 Style by PNJ outlets, 3 CAO Fine Jewellery locations, and 1 wholesale center.

Will gold bars no longer contribute significantly to PNJ’s revenue from 2025?

According to a new analysis report by Rong Viet Securities (VDSC) on PNJ, the gold bar business segment is expected to shrink significantly from the second half of 2024 due to tight policies in this market. In the base case scenario, VDSC projects that this business segment will no longer contribute significantly to revenue.

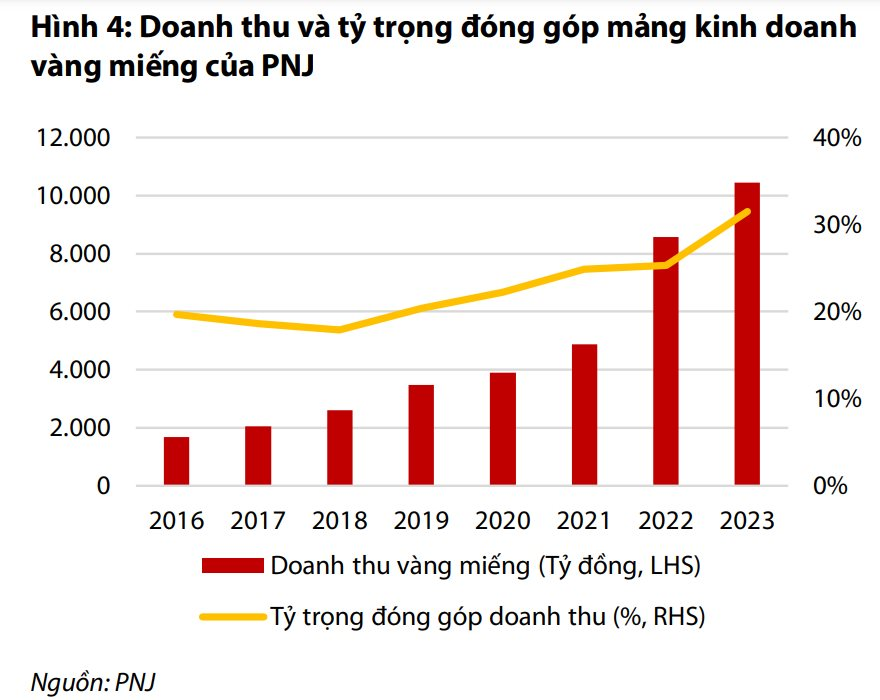

The gold bar segment is the second-highest revenue contributor for PNJ, accounting for 31.5% in 2023. The gross profit margin for this segment is very low, at about 1.0%. However, PNJ has retained this segment because it is a basic need for Vietnamese people and it serves as a gateway for customers to discover other PNJ products such as jewelry, watches, etc.

VDSC has not observed any change in the tight management policy from the authorities as the overarching management goal remains unchanged. Therefore, VDSC projects that the shortage of gold bar supply will continue in the following years. This leads to the conclusion that PNJ’s revenue from the gold bar segment will cease from 2025 onwards.

The Profit Plunge Persists: BKAV Pro’s Dismal Performance Continues with a Meager 2.7 Billion VND Six-Month Profit

As per the financial report submitted to the Hanoi Stock Exchange (HNX), BKAV Corporation, a leading Vietnamese cybersecurity firm, reported a modest profit of VND 2.7 billion for the first half of 2024. The company, helmed by entrepreneur Nguyen Tu Quang, is known for its flagship product, BKAV Pro, a robust antivirus software solution.

The Art of Refining Gold: An Interview with SJC’s CEO

“Due to unforeseen circumstances, our company, SJC, had temporarily paused the purchase of damaged gold. However, we are pleased to announce that we have now allocated the necessary resources to resume the acquisition of distorted SJC gold. With our advanced capabilities, we can skillfully refine and restore this precious metal to its former glory.”