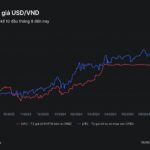

The State Bank of Vietnam has announced today’s central exchange rate of the Vietnamese Dong against the US Dollar at 24,151 VND per USD, a 10-dong increase from yesterday’s session.

With a permitted 5% margin, commercial banks can trade the USD within a range of 22,943 to 25,359 VND per USD.

The State Bank of Vietnam’s Trading Centre maintains the reference buying rate at 23,400 VND per USD. Meanwhile, the selling rate has been adjusted to 25,308 VND per USD, a 10-dong increase from yesterday.

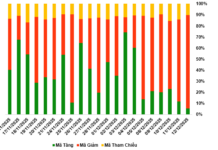

Commercial banks have also made significant adjustments to their USD/VND exchange rates.

Commercial banks have increased their USD rates. Photo: Nam Khanh |

At 2:47 pm on September 18, Vietcombank listed its buying and selling rates for cash USD at 24,480 VND and 24,850 VND, respectively, an increase of 130 dong from the previous morning (September 17).

Similarly, other banks have also witnessed substantial increases in their USD rates, with some banks raising their rates by over 100 dong compared to the previous day.

BIDV has increased its USD rates by 120 dong for both buying and selling, now trading at 24,500-24,840 VND per USD.

VietinBank has adjusted its buying and selling rates to 24,509-24,849 VND per USD, an increase of 119 dong for both.

Techcombank has increased its cash USD buying rate to 24,473 VND per USD and its selling rate to 24,864 VND per USD, a 78-dong and 75-dong increase, respectively.

Sacombank’s USD rates now stand at 24,520-24,850 VND per USD (buying-selling), a 130-dong increase in buying and a 100-dong increase in selling.

In contrast, the USD rates in the free market have been adjusted downwards.

Today, currency exchange points are buying USD at around 24,850 VND per USD and selling at 24,950 VND per USD. Compared to the previous session, the free market USD rates have decreased by 50 dong for both buying and selling.

The gap between free market and bank USD rates has narrowed. The buying rate in the free market is now only 300 dong higher, while the selling rate is about 100 dong more expensive than bank rates.

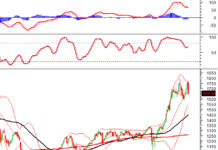

In the global market, the US Dollar Index, which measures the strength of the greenback against a basket of major currencies, stood at 100.83 points at 3:30 pm on September 18 (Vietnam time), a 0.07% decrease from the previous session.

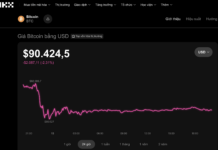

The world’s financial markets are eagerly awaiting the Federal Reserve’s policy decision, with expectations of an interest rate cut for the first time in over four years.

The Fed began its two-day meeting on the evening of September 17 (Vietnam time). Based on signals from the Fed and the market, the central bank is likely to cut its benchmark interest rate for the first time since March 2020. Prior to this, the Fed had raised interest rates 11 times, bringing the rate to the current level of 5.25-5.5%.

Hanh Nguyen

The Greenback Takes a Tumble: Will the State Bank Step In to Buy?

The recent loosening of monetary policy by the State Bank of Vietnam (SBV) in the context of a sharp decline in exchange rates has led to speculation that the central bank may buy USD at a higher price at the Trading Center to boost foreign exchange reserves. This move is expected to enhance the liquidity of VND in the commercial banking system, ensuring a more stable and robust financial environment.